The Consumer Price Index for All Urban Consumers increased 0.6% in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, 'headline' inflation has increased 2.5%, the highest number in nearly five years.

January's number came in at double the consensus estimate of 0.3%, so watch for some market turmoil today. The month-over-month increase was the highest since February 2013 and the year-over-year increase was the highest since March 2012.

The BLS says a sharp rise in gasoline prices accounted for nearly half of January's increase. Gasoline prices rose 7.8% in January and are up 20.3% from a year ago. Also notable: Apparel prices rose a sharp 1.4%, after two straight months of declines. The cost of new vehicles also rose sharply, 0.9%.

On the positive side, food prices rose only 0.1% and are down 0.2% over the last 12 months.

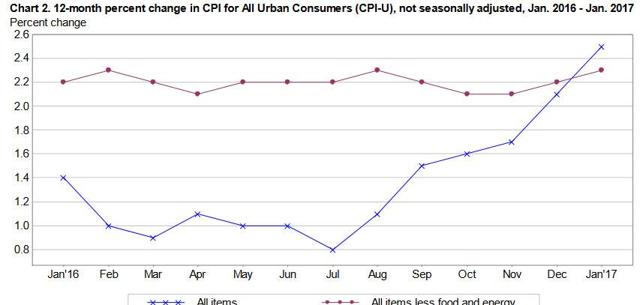

'Core inflation' - which strips out food and energy - increased 0.3% in January and is up 2.3% over the last 12 months. It's interesting to note that headline inflation is now outpacing core inflation, which has stayed in a range of 2.1% to 2.3% over the last year:

What this means for TIPS and I Bonds. Holders of I Bonds and Treasury Inflation-Protected Securities are also interested in non-seasonally adjusted inflation, which is used to set future interest rates on I Bonds and adjust principal balances of TIPS. The January inflation index was set at 242.839, an increase of 0.58% over the December number.

This means that TIPS principal balances will rise 0.58% in March, a welcome increase after essentially zero growth from December to February. Here are the March inflation indexes for all TIPS.

The January inflation report is also good news for holders of I Bonds, which will