Investment thesis

Despite the recent economic shock stemming from Modi's demonetization decision, India's long-term growth trajectory is likely to remain intact. With superior earnings growth track record and profitability of the Indian stock market, India-focused ETFs represent a unique long-term investment opportunity regardless of market conditions.

India's macroeconomic snapshot

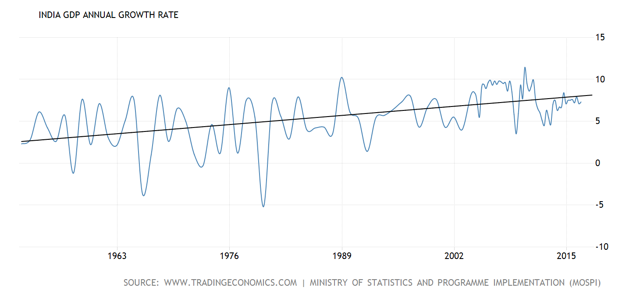

Although several international institutions decreased India's growth outlook, long-term momentum of the world's seventh largest economy is definitely not poised vanish anytime soon. Last month, the World Bank cut its forecast for this year's GDP annual growth rate to 7 percent from its previous estimate of 7.6 percent, citing a deceleration in consumption and manufacturing due to the unexpected demonetization event and an ongoing slowdown in private investment and credit financing due to the mounting bad debt issues. Shortly after, this was followed by the IMF's update, which also counts with a lower GDP growth rate compared to its original estimate (6.6% vs. 7.6% earlier). However, as pessimistic as these forecast cuts might seem at a first glimpse, India's long-term growth story is not likely to change. Most of the negative consequences of Modi's currency reform have a short lifespan and are unlikely to materialize in the long run. Actually, over time, one should expect the exact opposite - several GDP-boosting benefits should arise. As the grey economy is assumed to shrink under the new system, banks deposits are expected to rise and spur economic growth through increased lending activities.

Strong earnings growth and profitability

Since the Asian financial crisis in 1997, earnings of Indian companies have grown faster than those of their foreign peers. According to calculations performed by Dr. Andrew Stotz, CFA, the average EPS growth in India has hit 16 percent since the turn of the millennium, while the average EPS outside India has reached a mere 9