By Brian Kehm, Financial Research Associate, The Oxford Club

The housing bubble burst in 2008...

But today, it's back in full force.

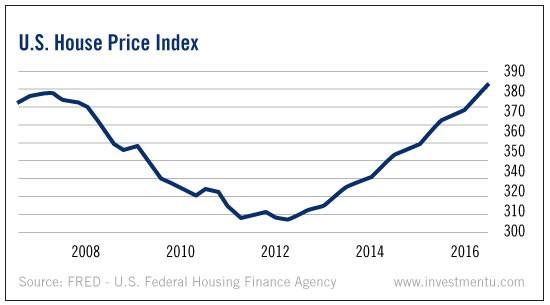

Home prices are above precrisis levels. And the force pushing them to new highs is losing strength.

The next housing collapse is on the horizon. Eventually, home prices must return to normal levels. That's why I've uncovered two ways to profit from the correction.

But first, let's take a closer look at what's behind today's housing bubble.

Borrower's Paradise

It's one of the best times in U.S. history to borrow money.

The 30-year fixed-rate mortgage topped 18% back in the '80s. But today, it's closer to 4%. So you can borrow money at a 70% discount compared to a few decades back.

The artificially low rates have prompted folks to borrow money to buy homes. And now, the fear of rising rates is pushing a final buying spree. As interest rates rise, borrowing becomes less attractive. That's why mortgage brokers are encouraging home buyers to lock in low rates today.

A rock-bottom interest rate is the main culprit behind the housing bubble resurgence. It's spurred sales and pushed home prices above precrisis levels. But now, the Fed is slowly turning off the cheap money tap.

The new housing bubble can't be sustained as cheap debt disappears. Buyer demand will fade. And this is just one reason to be cautious.

Lending standards are a little better today than they were in the early 2000s. But they're still not great. Lenders and brokers still have plenty of ways to pass the buck.

Mortgage brokers work on commission. Their job is to close sales whether or not those sales are financially sound. When a broker sells a house, the mortgage on that house is often repackaged into a security with other mortgages. Then, it's sold to