I had a dream that one day I would be rich and I could switch out all my normal jewelry for gold jewelry to finally acquire that classy 1980s gangster look. Then it hit me: Why don't I just invest it all in gold directly? Jokes aside, this is a legitimately good question for a starting point to a gold investment because it hits the investor deep and where it matters: What exactly is a gold investment?

So, we know gold trades like a commodity, but we also see it used as a hedge. Unfortunately, gold cannot be treated as a pure commodity because it is not necessarily consumed by its buyers (except for the jewelry and electronics industries), but rather held like a stock. It is not a great hedge, either, as we will see later in this article.

Overall, the best gold investments are timely, made based on either clear macro theses or on seasonal commodity theses. The average investor holding gold as a hedge is often acting sub-optimally due to 1) the existence of better hedges, and 2) the fact that gold trades like any other commodity on the futures market.

Today, I want to dispel some myths about the gold hedge, discuss gold seasonality, and provide a superior holding strategy for those using the SPDR Gold ETF (NYSEARCA:GLD) as their gold investment.

Gold as a Hedge

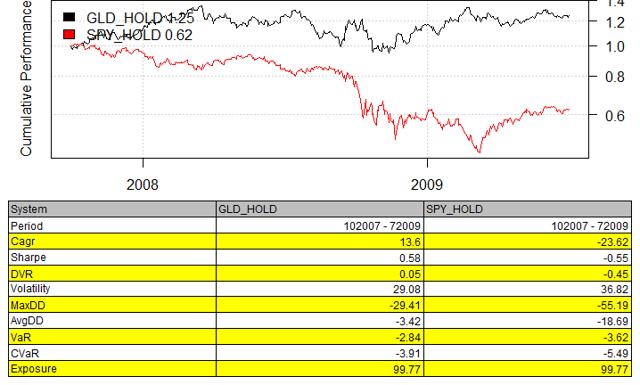

Let's start with dispelling the hedge myth because it's easiest. I prefer to use a simple chart example, one that many gold investors should remember -- if not print out and hang on the wall:

In the last market crash, GLD did well. We see this from the numbers. But from the chart one thing becomes much more apparent: GLD trended sideways during most of the market's downward trend.

With