Essentially, we are interested in three things-a strong balance sheet, a record of success as a business, and the potential for a profitable future.

- Charles M. ("Chuck") Royce

This report focuses on the portfolios of Master Investor Chuck Royce of the Royce Funds. The firm was founded in 1972 and has over $30 billion in assets under management. It manages twenty-three different funds including closed-end and open-end mutual funds. Most are focused on relatively small companies - companies under $3 billion in market cap. Over the last fifteen years the funds have slightly outperformed the Russell 2000, the key benchmark for small cap funds (8.8% versus 8.5% annualized).

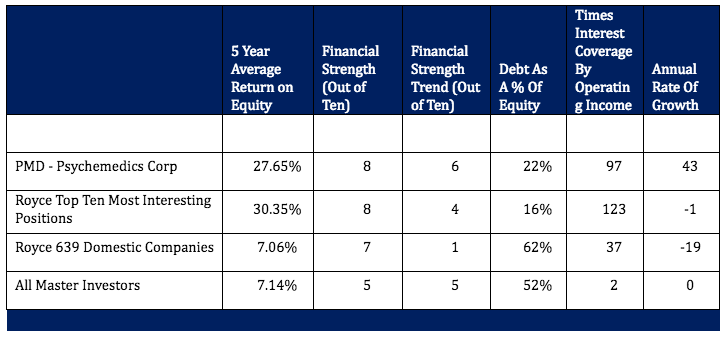

I looked at 639 companies of the total of 795 companies in Royce portfolios, eliminating those that lacked the long series of financial statements that I need to do my analysis because they went public recently, are foreign-based, or had no revenues. My analysis found that the overall balance sheet strength of companies in Royce portfolios was above average, and long-term profitability about average.

Most Interesting Position In Royce Portfolios: Psychemedics Corp (PMD)

Psychemedics provides tests for the detection of drugs through the analysis of hair samples utilizing a patented technology. This technology can provide long-term historical drug use information (several months or longer depending on the length of the hair sample). It can measure alcohol use over the last three months.

From the company's 10K:

- In 2016, the Company experienced a large increase in revenues derived from Brazil due to a legal requirement that professional drivers in Brazil obtain a hair test to detect abused substances when renewing their driver's license.

- Revenue increased $12.0 million or 45% to $39.0 million in 2016 compared to $27.0 million in 2015. This increase was driven entirely from new business in Brazil. The volume and average revenue per sample for the