The Fed is planning to unwind the $4.5 trillion in mortgages and bonds on its balance sheet.

Maybe you should think about unwinding yours.

The current record low interest rates resulted from unprecedented intervention in credit markets with three rounds of so-called "quantitative easing" executed through relentless buying of fixed income instruments by the central bank in the United States, paralleled by similar bond-buying by the European banking authorities.

Global public debt is estimated at about $58 trillion by the Economist, with the United States making up approximately one quarter of the total.

Source: The Economist

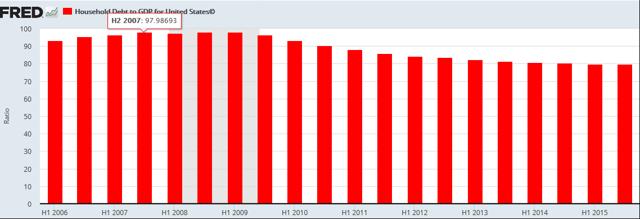

The U.S debt comprises about $50,000 of debt per person. Add household debt currently at about 80% of GDP and ask yourself "how will this debt ever be repaid?".

Source: International Monetary Fund, Household Debt to GDP for United States© [HDTGPDUSQ163N], retrieved from FRED, Federal Reserve Bank of St. Louis; April 5, 2017

A second question investors should ask is "if households are already deeply in debt and the Fed seeks to sell $4.5 trillion in fixed income securities, who will buy them?"

It seems obvious that if quantitative easing was responsible for lower interest rates, the opposite must hold true - the Fed selling bonds must lead to higher rates. Higher rates typically lead to lower multiples for equities and, failing higher earnings, to lower stock prices.

We will hear all sorts of arguments from the Fed and from sell-side firms that the process of de-levering the Fed will be a smooth one, executed over time and not disruptive. A good story, well told.

The Fed will try to sell 8% of all sovereign debt existing on earth without disrupting credit markets.

What about the European central bank? As at March 2017, its holdings amounted to over $3 trillion of fixed income securities.