Thesis

How the mighty have fallen applies directly to Gilead (GILD) and Bristol-Myers Squibb (BMY). Gilead is in the midst of a two year downtrend while Bristol is on the low end of some volatile price swings. There is a case for and against each company. It is up to you to decide if the rewards outweigh the risk. In my opinion, both appear to be good long term investments.

The Backstory Of Gilead

Gilead's rise to fame was a result of its Hep C drug. Surprisingly, or not, the decline of its Hep C drug is also the reason for its demise. The company is running out of people to sell to as it faces increased pressure from competitors. So is Gilead a one trick pony? I don't think so. But first, shown in Figure 1 is the five year chart for Gilead. Or, the rise and fall of Gilead as it would appear. As you can see, Gilead is at a multi-year low and nearly 50% off its all time high.

Figure 1: Gilead Five Year Chart

The Backstory Of Bristol-Myers Squibb

Bristol-Myers story has fared slightly better than poor Gilead. In August of 2016, the company's drug Opdivo posted some bad results. In combination, Merck posted positive results for a drug in a similar (but not the same) category. I'll save you the jargon of explaining why they were different. The company took a lot of heat for Opdivo's miss at becoming a first line lung cancer drug and the markets reacted poorly. The one year chart for Bristol is shown in Figure 2.

Figure 2: Bristol-Myers Squibb One Year Chart

The Case For Gilead

Well, let's take a look at value first. The company has a P/E of 6.6 with a forward P/E of 8.8. This is extremely low, especially for a pharma company. However, PEG is negative which means the company is expecting negative growth next year. This combined with an ultra low P/E implies Gilead may be a value trap. It is worth noting that Gilead trades roughly on par with its future cash flow.

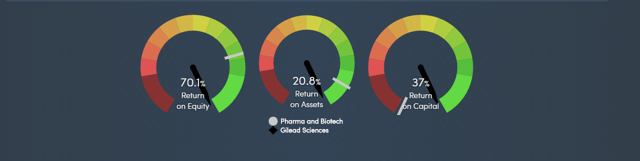

Analysts are calling for Gilead to face a 26% decrease in earnings next year with a 25% decrease over the next three years. This does mean that they believe it will bottom somewhere between now and the next three years. Past and future earnings are shown in Figure 3.

Figure 3: Gilead Past And Future Earnings

Source: Simply Wall St

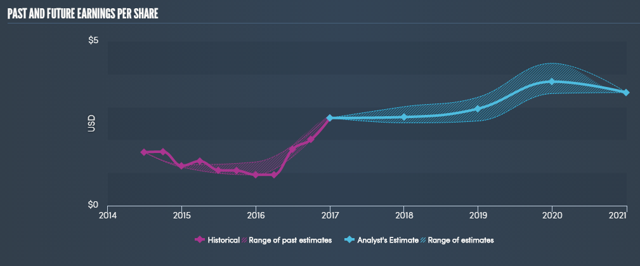

Despite all this, Gilead has some powerful performance metrics. Return on equity is a whopping 70.1% and way ahead of the pharma industry average. Return on assets is 20.8% and also ahead of the competition. Return on capital is 37% and miles ahead of the average in the pharma industry. This is shown in Figure 4.

Figure 4: Gilead Performance Metrics

Source: Simply Wall St

Gilead has a debt/equity of 136% which is arguably high. However, one of the biggest highlights for the company is its cash flow. Gilead has some $32B in cash, equivalents, and securities. Levered free cash flow covers more than half of the company's total debt so that lessens my worries. Gilead also pays a 3.12% dividend with a payout ratio of just 18.5%.

Gilead has expressed its intentions to make acquisitions as a way to boost declining sales. The company has serious cash flow so I wouldn't worry about the ability to actually perform acquisitions. Gilead also has a couple drugs in the pipeline although they are a little ways out from approval. Making an acquisition could boost earnings while the pipeline matures. It is worth noting that management talked up the company's pipeline at a recent JP Morgan conference.

The Case For Bristol-Myers Squibb

Bristol-Myers has a P/E of 20 and a trailing P/E of 17. This is still below the industry average which is good. Bristol has a PEG of 1.4 which bakes in some growth for the company.

Earnings are expected to grow a mere 1% next year but are projected to increase 41% over the next three years. Cash flow is expected to get more than a 50% boost over the next two years. Past and future earnings for Bristol-Myers is shown in Figure 5.

Figure 5: Past And Future Earnings

Source: Simply Wall St

Performance metrics for Bristol-Myers are a little less spectacular, although all are still above industry average. Return on equity, assets, and capital were 29.3%, 11.8%, and 25% respectively. These are lower than Gilead's, however, still pretty solid.

Bristol-Myers has less debt than Gilead with a debt/equity of 41%. It also has enough cash to pay off its debt. It is fair to say that it has a very strong balance sheet. The company pays out a 2.92% dividend, which is a tad less than Gilead's and has a much higher payout ratio at 57.7%. This isn't troubling or anything, just something to note.

Bristol has an easier path than Gilead does. Opdivo has still performed exceptionally well despite its miss with lung cancer. Bristol has a solid drug portfolio and pipeline. I think that the reaction over Opdivo was too much and that the company has opportunity to recover substantially.

Risks

Addressing both companies in general, drug prices have been under intense scrutiny for some time now. President Trump met with pharma execs and spoke about making deals with them to lower prices in exchange for tax cuts and other benefits. It remains to be seen how this will play out but it is definitely a risk to keep at the forefront of your mind.

There are (maybe) also changes to the healthcare market as a whole. After an unsuccessful repeal of the Affordable Care Act, there is talk of a full repeal and talk of replacement with the help of Democrats. Given the current administration, no one can know for sure what will happen. I believe that drug companies will end up alright.

Gilead may very well be a falling knife value trap. I am certain there are investors who bought halfway through the current decline thinking there was no way it could go lower. In my opinion, the company will eventually turn things around if you hold onto it long enough. A simple multiple expansion to 10 would mean a serious increase in share price. If the company can get a little momentum going, there would be serious potential reward for investors.

Bristol-Myers is exposed to the same industry wide risk as Gilead. However, I don't see too much else for them that doesn't come with the territory. The company has less debt, projected growth, and a multitude of catalysts.

Final Thoughts

I believe Gilead may be more of a long play than Bristol-Myers. I find it very hard to believe that the management at Gilead will sit back on their heels while the company faces declining sales and a young pipeline. I would look for an acquisition to be made. While waiting, I am more than happy to sit back and collect dividends.

Bristol-Myers is poised for growth in my opinion. I believe that if you can ride out some volatility you will be rewarded by an excellent portfolio of drugs and a promising pipeline. Bristol is posting revenue and earnings growth while Gilead is not. This makes them the safer play in my opinion. I believe their relatively low valuation does not take into account the growth the company will achieve. Also, its dividend is nothing to shake your head at either.

If you are investing for the long haul, like collecting dividends, and have a tolerance for risk and volatility, I would recommend buying both companies. Gilead is a cash cow and I believe they will do something to boost earnings sooner rather than later. I believe Bristol-Myers to be the quicker of the two to recover. If you believe the whole sector is facing systemic risk from drug pricing concerns, this article is not for you. I believe there is opportunity in both Gilead and Bristol-Myers going forward.