Thesis

Hexcel Corporation (NYSE:HXL) has a lot going for it. I believe the company presents reasonable growth at a reasonable price. This may not be the next moon shot company but I feel it is underfollowed. I think demographics are shifting in its favor. I believe Hexcel to be a good investment.

About The Company

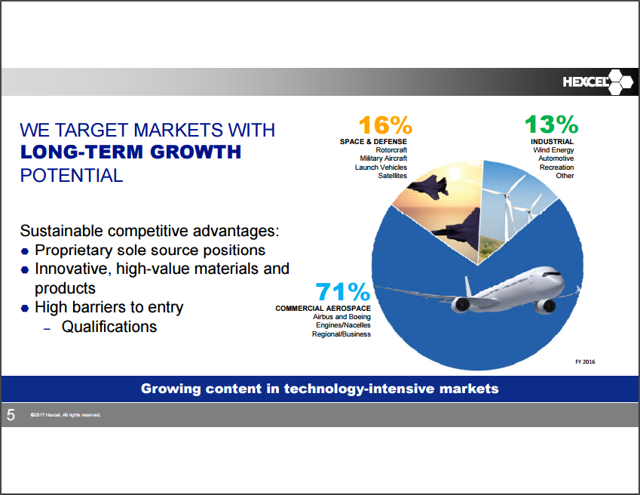

Hexcel Corporation develops, manufactures, and markets structural materials used in the aerospace, defense, and industrial markets. It operates in two segments: Composite Materials and Engineered Products. Simply put, Hexcel makes individual parts of airplanes, helicopters, and other aircraft - both military and commercial. The company does 42% of sales in the US, 41% in Europe, and 17% in the rest of the world. Its diversity by industry is equally good. This is shown in Figure 1.

Figure 1: Hexcel Corporation Industry Diversity

Source: Hexcel Investor Presentation

Hexcel is comfortably mid-cap with a market cap of $4.8B. It trades at a volume of roughly half a million shares per day. Oddly enough, 500,000 shares per day is the exact number I typically use to determine whether or not a stock is underfollowed. However, almost all of Hexcel's stock is owned by institutions. For this reason, combined with relatively low volume, I would say the company is unknown to the retail trader.

What I Like

I would say that Hexcel Corporation is a reasonable value. You are by no means buying an all-star stock on sale. You would simply be buying stock in a company for about the price it should be. If you are someone who prefers to throw companies like this on a watch list to look for a lower entry point, by all means.

That being said, Hexcel trades at a P/E of 20.1. Forward P/E for the company is 17. PEG for the company is 2 which bakes in some growth going forward. The company trades at 2.4x sales and 3.9x book value. It is worth noting that Hexcel trades on par with future cash flow.

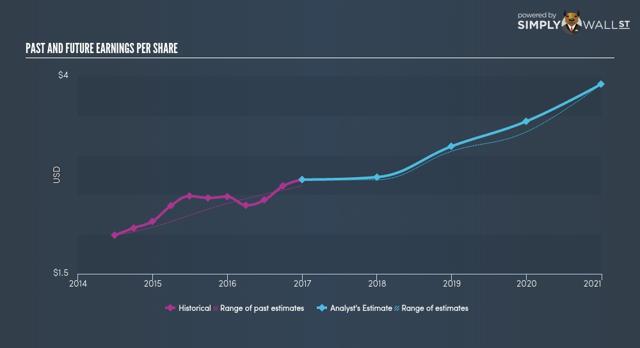

Hexcel is lightly covered by analysts. Next year earnings are expected to grow just 1%. However, earnings are predicted to increase 27% over the next three years. When looking at Hexcel's earnings history I see a slow slope up. Year-over-year, Hexcel grew quarterly revenue by 4% and quarterly earnings by 10%. The past and future earnings for the company are shown in Figure 2.

Figure 2: Hexcel Corporation Past And Future Earnings

Source: Simply Wall St

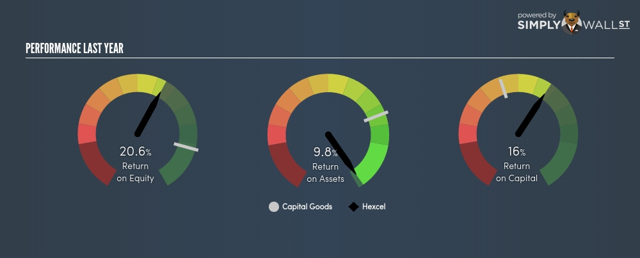

Hexcel's performance metrics are pretty good. Return on equity, assets, and capital are 20.6%, 9.8% and 16%, respectively. ROE was under the average for the capital goods industry. ROA exceeded the industry average. ROC was also ahead of the competition. Performance metrics for the company are shown in Figure 3.

Figure 3: Hexcel Corporation Performance Metrics

Source: Simply Wall St

The company's balance sheet is also pretty good. Debt/equity for Hexcel is 55%. Current ratio is a little higher than I like to see at 2.2, but I don't see anything to worry about at this point. The company does return cash to shareholders. The dividend is nothing to write home about at 0.81%. Payout ratio is 16%, so nothing to worry about there. However, in the last four years the company bought back $507m in shares with an additional authorization for $300m.

Opportunities And Drivers

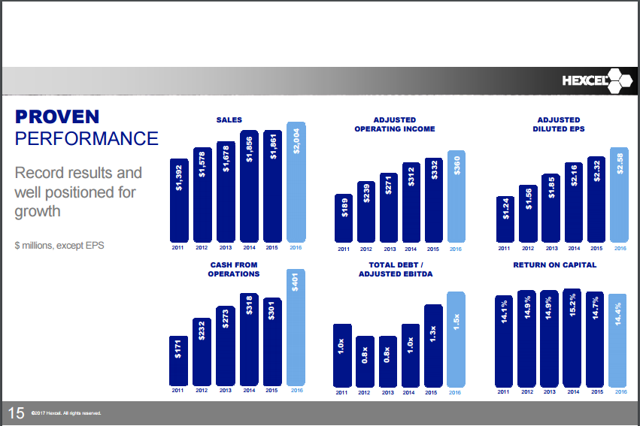

The majority of the business comes from the Commercial Aerospace division. Since 2010, this has produced a CAGR of 14.2%. The company identifies strong global demand for this sector. The current backlog is nine years primarily from Boeing (BA) and Airbus (OTCPK:EADSY). This represents $10B in sales.

Space and Defense is a hot sector, although it currently only makes up 16% of sales. The carbon fiber produced by Hexcel is the industry standard. Within the Space and Defense group, rotorcraft (helicopters) produces 50-55% of sales.

The smallest group, Industrial, also has a lot of opportunity. Wind energy comprises more than half of the sales for Industrial. I only see this growing in the future. The company also identifies an opportunity in the automotive industry as it adopts composites.

Overall, the company has thrown down some serious performance over the last six years and I see no reason why this shouldn't continue. Defense spending is going nowhere but up. A $10B backlog is never a bad thing. And the future of energy is arguably much greener than what we have now. Hexcel's performance is shown in Figure 4.

Figure 4: Hexcel Corporation Performance

Source: Hexcel Investor Presentation

Risks

There are some risks for Hexcel. The company is prone to the cyclical nature of the market it operates in. Fortunately, the company's massive backlog helps mitigate this. Hexcel is dependent on Boeing and Airbus for a substantial part of its revenue. It depends on commodities in order to do its business. This is all pretty standard stuff. Nothing in particular stands out to me from the company's 10-K, but I recommend reading up on other risk factors before making an investment decision.

Final Thoughts

Hexcel is a reasonably priced company with reasonable growth prospects. I believe that demographics are shifting to Hexcel's benefit. I believe its diversity, both geographically and by industry, will help reduce any risk posed by cyclical markets. I believe the company has rewarded and will continue to reward its shareholders.