Last night, I briefly reviewed Netflix's (NASDAQ:NFLX) 1Q17 beat, stating that "not much had changed regarding Netflix's investment thesis". The company disclosed continued subscriber and revenue growth expectations along with lower op margins that I expect to remain modest (and lumpy) in the foreseeable future.

Credit: Extreme Tech

While the quarterly results were solid and bulls have pushed the stock to new all-time highs in after-hours trading, today I want to take a step back and look at Netflix beyond the results of the quarter.

Don't expect a walk in the park

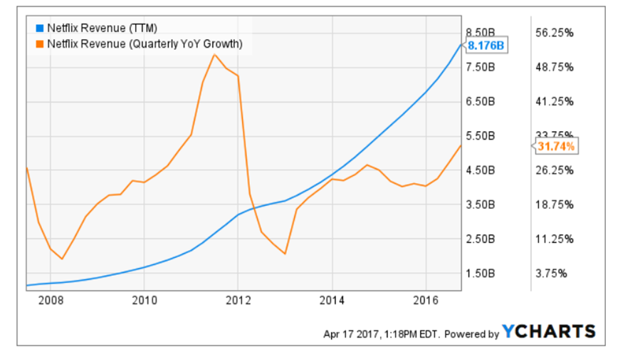

NFLX seems like an exciting stock to own, particularly for growth-biased investors looking for momentum. Since 2013, revenues have increased at a double-digit pace that has been since accelerating, as the company has continued to gain relevance in the U.S. and expanded more aggressively into international markets (see graph below).

Source: YCharts

Content creation and distribution continues to be a hot business, and Netflix is shaping up to be one of the winners in this increasingly crowded space. Management is standing behind the strategy of "leading internet TV around the world" at the cost of margin improvement in the foreseeable future, which is likely to protect NFLX's status of "growth stock" for a few quarters to come.

To make the bull case even stronger, speculation around Netflix being a takeover target, particularly by Apple (AAPL), keeps surfacing every so often. I can't help but think that a good bit of the strength priced into the stock must be associated with potential M&A activity.

But fundamentally, I find an investment in NFLX at current levels highly speculative. Trading at nearly $150 after hours, shares are currently valued at about 135x current-year EPS consensus, and over 75x next year's. Such valuation levels make Amazon (AMZN) look inexpensive.

But unlike Amazon, a one-of-a-kind online retailer and (a perhaps less differentiated) cloud service provider, Netflix is in very good company in the online content creation and distribution world. To argue my point is Netflix's own management team:

Amazon Prime Video expanded recently to match our territory footprint, while YouTube remains far larger than either of us in terms of global video enjoyment minutes. Video consumption is growing on Facebook, and Apple is rumored to be adding video to its music service. Satellite TV operators are moving to become internet MVPDs, such as ViaSat to ViaPlay in the Nordics, DISH to Sling, and DirecTV to DirecTV Now. Insurgent firms such as Molotov.tv in France and Hulu are building native-internet interfaces for TV network bundles. CBS is releasing a major original series (Star Trek) exclusively on its domestic SVOD service (with us as international partner). Finally, the BBC has become the first major linear network to announce plans to go binge-first with new seasons, favoring internet over linear viewers. We presume HBO is not far behind the BBC.

I even think that Netflix is looking at the competitive landscape a bit narrowly. Traditional media channels, including broadcast and cable stations, are likely to keep demand for content creation high and continue to push hard for an online presence (whether independently or through existing channels, like YouTube), crowding even more the Internet TV space.

Let's also not forget that Apple, whose CEO has clearly expressed an interest in the original content and online TV business, has yet to enter the stage in a more meaningful way. When it did so with music, although being pretty late to the party, Apple quickly became a meaningful player alongside market leaders like Pandora (P) and Spotify (MUSIC). The race for high-quality content and competitive pricing, it seems, has already started and is only likely to heat up.

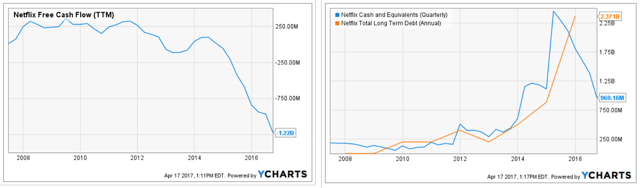

Looking closer at the financials, I note that Netflix's free cash flow has been falling off a cliff since 2014 (see graph below on the left), as cash spent on streaming content assets has grown a whopping 50% YOY to $8.7 billion in 2016. As a result, cash reserves have fallen sharply from 2015 levels while debt has shot up (see graph below on the right):

Source: YCharts

I do not expect investment in growth to subside anytime soon, which will probably indicate further cash burn, increased debt levels (as confirmed by the company yesterday) and pressured margins in the short term. If I am right, the recent increase in stock price and valuation multiples will likely meet increased risks from stronger competition, lower cash flow generation, and depleting net cash balances - not a combination of factors that make me feel very comfortable.

None of this might matter to momentum investors, nor to hard-core bulls who believe strongly in Netflix's prospects for the long term. But it certainly makes me raise an eyebrow.

In summary

Growth investors may be tempted to jump in and ride NFLX's momentum that was boosted by the release of its 1Q17 results. Top-line strength is clearly there and margin expansion is yet to come in the farther future while the psychological "positive international op margin" checkpoint is expected to be reached in 2017.

Value investors like me, however, will likely be skeptical of stretched valuation multiples and boosted optimism that might prove to be too aggressive amid an increasingly competitive landscape.

Note from the author: I invite you to follow me as I build a risk-diversified portfolio designed and back-tested to generate market-like returns with lower risk. I call it the Storm-Resistant Growth portfolio. The early results have exceeded my expectations, as the portfolio is beating the S&P 500 on a risk-adjusted basis despite the raging bull. Take advantage of the 14-day free trial (click here), and get immediate access to all the premium material that I have published so far, including my recent quarter-end report.