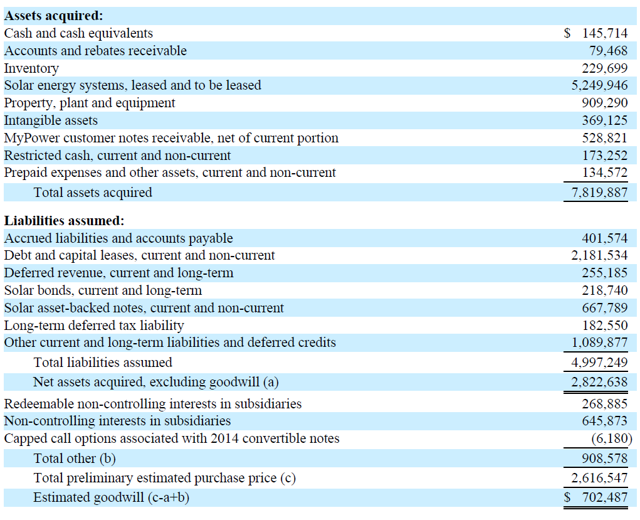

When Tesla (NYSE: NASDAQ:TSLA) proposed to acquire SolarCity in 2016 the prospectus relied on the company's balance sheet to prove the deal was a no-brainer. Indeed, despite ongoing losses and cash deficits the balance sheet actually looked pretty healthy. Tesla was to acquire nearly $8 billion in assets with only $5 billion in corresponding liabilities. With an estimated purchase price of $2.6 billion, Tesla would get good value for its money.

The most important element in SolarCity's assets are obviously the "solar energy systems, leased and to be leased," which, at the time, were valued at $5.2 billion. Debt stood at a little more than $3 billion.

Back then I wrote a few articles about SolarCity arguing that the $5.2 billion in solar energy systems would not necessarily generate $5.2 billion in future cash flows. The number on the balance sheet rather reflected what it had cost the company to build these assets. Not what they were worth, which is how much cash they would generate.

But focused as I was on finding the missing link between the poor financial results and an apparently healthy looking balance sheet, I have to admit I overlooked the most obvious question, which is: how did this company, which had never generated a profit, manage to spend $5.2 billion on building these assets, assuming only $3 billion in debt? Where did the money come from?

Variable Interest Entities

The answer to this question is in the Variable Interest Entities (VIEs) which SolarCity's subsidiaries have created to build out the portfolio. These VIEs are special funds in which outside investors participate. Each VIE owns a specific set of solar installations and the corresponding contracts with lease customers.

The use of Variable Interest Entities is a common practice in the solar leasing business. Their purpose is to