Source: Reuters

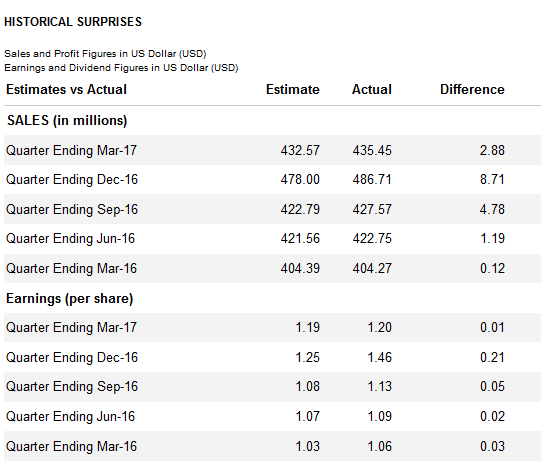

Check Point Software Technologies (NASDAQ:CHKP) reported better-than-expected earnings for the consecutive straight quarter, primarily due to strong subscription sales and introduction of innovative security solutions for the cloud, mobile and advanced threat prevention.

It last posted its earnings for Q12017 on April 27th. The company reported EPS of $1.20 for the quarter, topping Street estimates of $1.19 by $0.01. The company had revenue of $435 million for the quarter compared to the Street estimate of $432 million. During the same quarter in the prior year, the company posted adjusted EPS of $1.06. Currently, analysts expect CHKP to generate revenue of $454 million and EPS of $1.23 in Q22017. CHKP has a 12-month low of $74.34 and a 12-month high of $106.38 (CMP $105). The firm's market cap is $17.55 billion.

"We started off 2017 with a positive trend delivering earning per share and revenues towards the top end of our projections," said Gil Shwed, founder and chief executive officer of Check Point Software Technologies. "We have executed on our vision for consolidating security with the launch of Check Point Infinity, the cyber security platform for the future. The first consolidated security architecture across networks, cloud and mobile, providing the highest level of threat prevention."

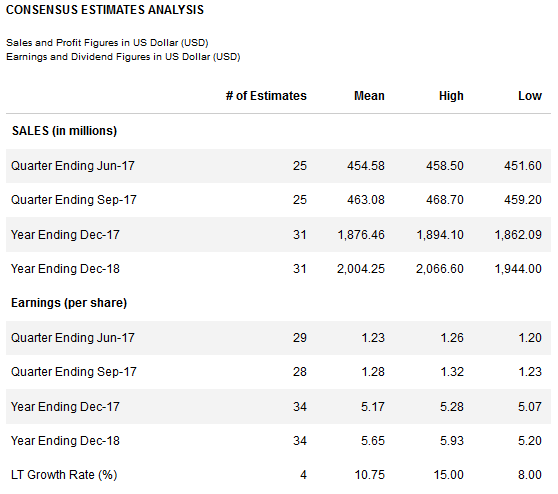

Consensus Estimates Analysis

Source: Reuters

The company had revenue of $1,741 billion for the FY2016 (up 7% YoY). Currently, analysts expect CHKP to generate revenue of $1,876 billion (up 8% YoY) in fiscal 2017 and $2,004 billion (up 7% YoY) in fiscal 2018.

Analysts are expecting CHKP to post EPS of $5.17 in 2017. This implies a 2017 forward P/E for shares at 20.5x and PEG ratio of 1.6. Analysts are currently expecting 2018 EPS of $5.65, which implies a 2018 forward P/E for shares at 18.5x. This is below the S&P 500 forward P/E of 19.7x. In other words, despite the