In a recent article I touched on a growth stock that had seen some operational headwinds spark a prolonged valuation contraction. Coffee chain Starbucks Corporation (NYSE: NASDAQ:SBUX) has been a market darling for more than 20 years. Many investors have adopted a "shut up, and just buy it" attitude towards Starbucks, and have come out smiling down the road. With Starbucks having to lean more and more on price increases to drive sales in recent years, the window growth investors have grown to expect may be closing.

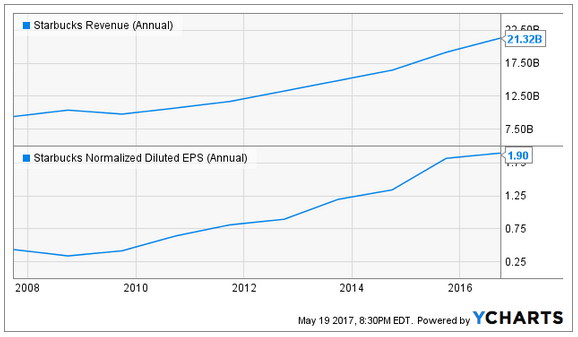

If you bought Starbucks at just about any time in the last couple of decades - regardless of valuation - and simply held on, you have done well for yourself. Over the past 10 years despite a median valuation of 30X earnings, Starbucks has compounded at 16% per annum while the market has returned at less than half that rate. Starbucks has remained on an explosive growth curve, with both top and bottom line numbers rapidly expanding. This has given Starbucks the ability to continuously burn off its lofty valuation, pushing shares higher over time.

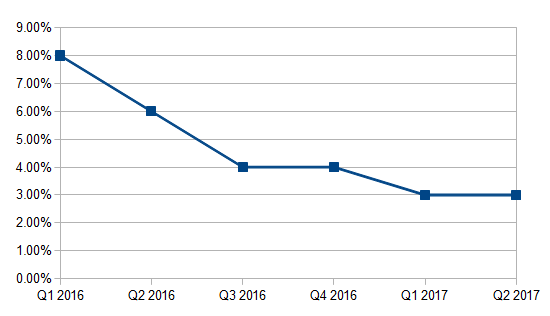

Over the past several quarters, there have been signs creeping up that while Starbucks is still moving at a brisk pace - perhaps the growth curve has climaxed. Starbucks is seeing a slowdown in its comparable store sales.

Global comparable store sales growth rate

graphic source: Justin Pope

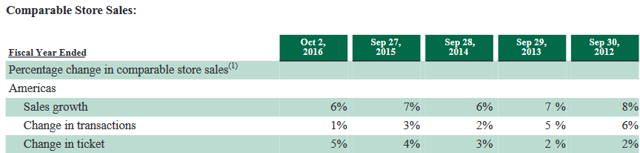

At the heart of this issue is the slowing traffic metrics of its largest market with approximately 50% of its stores - the US. In fact, transaction growth has been struggling for some time.

graphic source: Starbucks

Over time, Starbucks has leaned more and more on pricing increases (change in ticket) in order to counteract the slowing growth in transactions. In 2016 transactions were only +1%, and have been negative through 2017 thus far. What does