During this past earnings season, frac sand producers offered extensive discussion of the current market conditions. However, the latest data points provided by Fairmount Santrol (FMSA), the second largest U.S. sand producer, are worth noting.

Pricing Momentum Confirmed

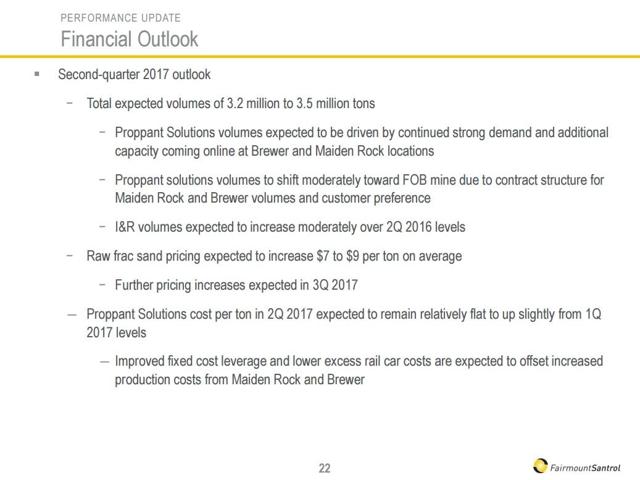

Initiating its Q2 operational guidance, Fairmount Santrol specified the magnitude of the expected price increases expected in second quarter and suggested that Q3 2017 pricing will be sequentially higher.

Source: Fairmount Santrol, May 2017

At mid-point, Fairmount Santrol's guidance implies a sequential volume increase in the Proppant Solutions segment of ~30%, following a ~13% sequential increase during the winter-challenged Q1 2017.

Please note that the company is not expecting a major cost increase in second quarter, despite bringing online some of its higher-cost facilities. Therefore, if one were to assume an average gross margin improvement of $5-9 per ton, one could expect a sequential increase in adjusted EBITDA from the price factor alone of $16-32 million (on the indicated 3.2-3.5 million ton total volume). In addition, Fairmount Santrol will see greater Proppant Solutions segment contribution due to the expected sequential increase in volumes.

As a reminder, for Q1 2017, Fairmount Santrol reported Adjusted EBITDA of ~$22 million. Based on the company's guidance and my assumptions, I expect Q2 2017 Adjusted EBITDA to be in the $45-60 million range.

Further, assuming a sequential 10% volume increase and $3 per ton average price increase in Q3 2017, the company's Adjusted EBITDA could grow to as much $60-75 million in third quarter.

To put these metrics in perspective, Fairmount Santrol's Enterprise Value is ~$1.9 billion (using a $5.61 price per share and $634 million of net debt). At the high end of my Q3 2017 EBITDA estimate, the EV/run-rate EBITDA trading multiple would contract to 6x-7x.

Will Producers' Pricing Power Last?

A strong recovery in frac sand volumes and pricing throughout 2017 has been broadly expected. The key question is whether the meaningful price gains can be sustained.

There is no doubt in my view that the frac sand industry can continue adding brownfield and greenfield capacity at relatively low costs. However, such expansions increasingly require longer lead times and, often, contractual commitments by customers with regard to future volumes. As a result, the pace of capacity additions by the industry, which so far has been fueled primarily by reactivations of idle capacity, will likely slow down significantly by the end of this year.

For producers' pricing power to last, continued growth in demand for frac sand will be required going into 2018, in my opinion. Such a scenario is certainly possible but is obviously contingent on oil prices.

If global oil supply outside U.S. and Canada finally shows signs of contraction, which would increase the call on North American "fast response" volumes, one can certainly see a sustained acceleration in operating activity in U.S. shales. Consistent with this scenario, oil prices would likely climb towards the $60 per barrel for WTI and, possibly, higher. Such a scenario would likely create an anticipation of a "higher-for-longer" upcycle for frac sand, including an expectation that favorable margins would be sustained for some time and be amplified by relentlessly growing volumes. Under such scenario, a case can be made that significant upside to stock prices is certainly possible.

One can also envision more pessimistic scenarios where oil production growth outside the U.S. proves persistent. Under those scenarios, the market would likely expect the pricing peak in frac sand to be less pronounced and less lasting.

This fundamental uncertainty can cause wide fluctuations in prices for frac sand producer stocks, with the oil price sentiment being an omni-important driver.

Strong Free Cash Flow

The frac sand industry has an important attribute: during an upcycle, market leaders generate strong free cash flow, as re-investment requirements for active facilities are typically modest.

During the current phase of the upcycle in frac sand, even after the outlays to re-activate idle capacity, invest into moderate expansions, and meet working capital requirements, industry leaders are well positioned to report significant free cash flow in the second half of this year.

An extended upcycle can make a big difference in terms of an operator's financial condition. Meaningful deleveraging can be accomplished via internally generated cash flow as well as opportunistic equity issuance at valuations far exceeding replacement costs.

Fairmount Santrol: Leverage To The Cycle

Among frac sand operators, Fairmount Santrol stands out in terms of its leverage to the industry cycle. The company's financial leverage is relatively high (although the company's borrowing cost is relatively low).

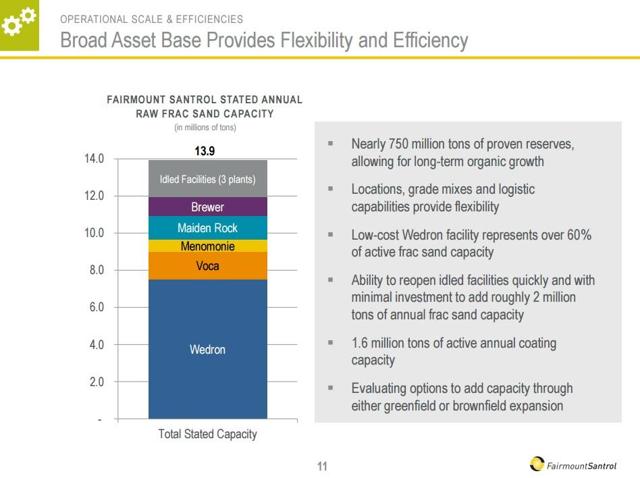

Source: Fairmount Santrol, May 2017

The company can bring additional, albeit relatively higher cost, facilities online at a low cost and quickly, should the market environment continue to improve.

Source: Fairmount Santrol, May 2017

As the second largest producer in North America, Fairmount Santrol has significant scale both on the production and logistics side and should benefit from maximizing the utilization of its available production capacity. At full utilization, fixed costs will be better absorbed whereas operating costs will be optimized.

Source: Emerge Energy Services

Due to the financial leverage and relatively thin public float, the stock is one of the riskiest in this sector. However, for a scenario where operating activity in U.S. oil shales continues to expand, a case can be made that the stock offers significant leverage to the upside.

Disclosure

Fairmount Santrol is currently one of the long positions in OIL ANALYTICS's Macro Portfolio, which is a diversified, energy-only, predominantly long model portfolio. OIL ANALYTICS provides real-time notifications to subscribers with regard to position changes in the portfolio.

About OIL ANALYTICS

OIL ANALYTICS remains one of the most active offerings on Seeking Alpha's Marketplace, with 250+ exclusive materials posted for its members since the beginning of this year alone (a total of over 1,000 non-public materials available to members).

Through our analyses, OIL ANALYTICS accurately anticipated the recent correction in natural gas and recent correction in crude oil, as well as subsequent recoveries.

Our macro and company-specific views are continuously illustrated in our Model Portfolios and Best Stock Ideas modules.

Disclaimer: Opinions expressed by the author in materials included in Zeits OIL ANALYTICS subscription service or posted on Seeking Alpha's public site are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment, tax, legal or any other advisory capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned or commodities and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings, and consult a qualified investment advisor. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.