Source: disney.com

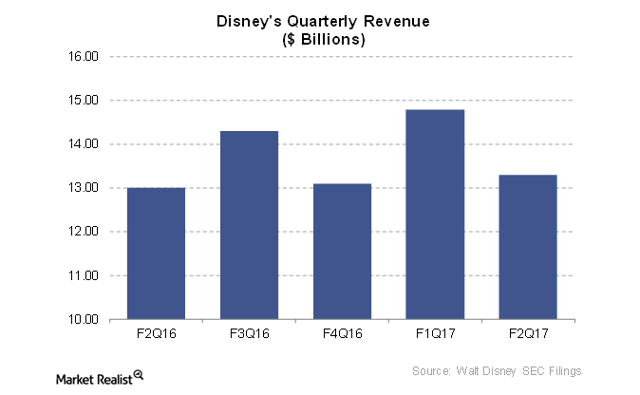

Walt Disney Inc. (NYSE: NYSE:DIS) reported its 2Q17 earnings on May 9. Disney was expected to have a $1.45 Earnings Per Share on $13.48B in revenue, but came in at $1.50 per share on $13.5B. However, they continue to have subscriber issues with ESPN - the cable division's operating profit declined 3% annually to $1.79 billion in fiscal 2Q17.

Disney Company Background and Market

For a recap of short and long-term views on DIS, please see my eariler article. In brief, China should be a great value creator for Disney as it's a huge untapped market. They are following the same successful model that Disney has had in other parts of Asia.

Past Trades and a Look at Technicals

As expected in my last DIS article, there was more volatility priced into the May weekly options than was warranted. The condor trade of a bear call spread of 116/115 and a bull put spread of 110/109, netted me a nice gain over just a few days.

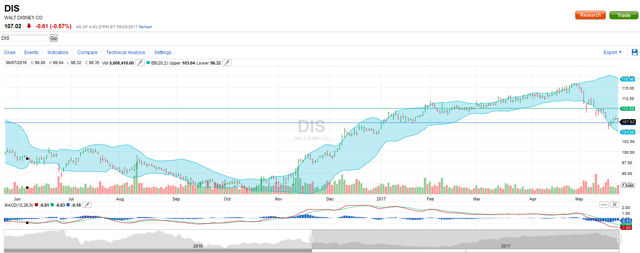

We have seen a fair amount of weakness in DIS since the end of April, even with positive earnings where they beat EPS estimates by $0.09. While it feels like the stock has fallen too far too fast, there appears to be more downside to come.

Source: Yahoo charts

Recognia Alertwire detected that DIS has entered Wave 5 of its Elliott Wave cycle. This bearish signal indicates that the price may fall from the previous close of 107.02 to the next Elliott Wave target price of 101.16 - which would put the stock back to Dec 2016 levels. Wave 5, which is determined using Fibonacci ratios, is the final leg in each of their 1-5 wave formations. Wave 5 generally moves in the direction of the overall market trend (either bullish or bearish).

From other technical points, resistance and short term support are 110.09 and 106.70, respectively. DIS's MACD is turning more bearish and is trading close to the bottom of the Bollinger Band. RSI is trading below 30 (but might just be oversold). DIS is also trading under its 20 and 50 day moving averages. All of these indicators generally point to bearish performance ahead.

As an alternative, if there is an uptick above 109.7, we could see 112.2 as the next upside target. However, I'm looking for a price target of approximately 102.5.

Source: Fidelity Investments

Short and Longer Term Trade Ideas

For a very short term trade which expires May 26, I would look at the 109/108 bear call spread currently trading at 0.20 giving you a max gain of 0.35 and a max loss of 0.80. Net money to you is 0.20 which is your maximum gain per share. Your maximum loss is the difference between the strike prices (109-108) less the premium received of 0.20 equaling 0.80. A ratio of 0.80 / 0.20 or 4 is just within my normal risk/reward ratio. A more aggressive trader could take the 108/107 bear call spread for a max gain of 0.045. I would not take the put side of this trade as theta burns up your premium paid at too quick a rate at the end of the contract term.

Longer term (all the way out to June 16, 2017), I would look at the 109/108 bear call spread currently trading at 0.26 giving you a max gain of 0.26 and a max loss of 0.74. One could also consider buying the June 16, 2017 105 puts at 0.72 which would give you a nice return if DIS speeds towards 102.5.

Additional disclosure: Thank you for your time in reading the above article. I read and write on a wide range of companies on a regular basis. If you would like to stay informed with articles like these, please click the "Follow" button at the top of this report and select "Get email alerts." If you have additional insights on the topic or contrasting views, please kindly share them in the comments section.

This article is intended to provide educational information to readers and in no way constitutes investment advice. Investing in public securities is speculative and involves risk, including possible loss of principle. The reader of this article must determine whether or not any investments mentioned in this article are suitable for their portfolio, risk tolerance and accepts responsibility for their decisions. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer or a recommendation to buy, sell, or dispose of any investment or to provide any investment advice or service. An opinion in this article can change at any time without notice.