Bank Stocks Tumble

According to Reuters, Shares in U.S.Banks tumbled on Wednesday with the S&P 500 Bank Index hitting its lowest level since early December after JPMorgan Chase (JPM) and Bank of America Corp (BAC) warned of revenue weakness in the current quarter.

Trading Revenue Decline

Chief Financial Officer, Marianne Lake, reported JPMorgan's Q1 trading revenue has fallen 15%. Similarly, Bank of America CEO, Brian Moynihan, reported that second quarter revenues are weaker than last year. Neither provided a prediction for June or Q2 July 2017.

Recent Share Declines

JPM and BAC are major banks dragging down the S&P 500 Stock Index 2.34%, each falling more than 2% year to year. This compares poorly to 2016 when JPM trading revenue was up 15% and BAC was up 5%.

JPMorgan Chart

After peaking in early March at 93.60 per share, JPM at the time of this writing on June 1 is trading at 82.83. This equals a 12% decline from that close with an oversold Slow Stochastic that was overbought in late April. A very similar chart pattern is noted below for BAC.

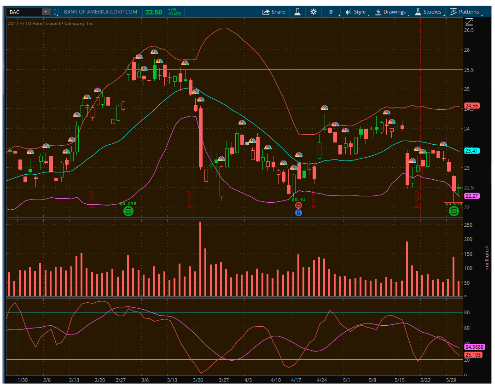

Bank Of America

BAC peaked in early March at 25.50. Currently, it is trading at 22.56, also a decline of 12%. Also note the oversold Slow Stochastic relative to late April's overbought technical.

Goldman Sachs

Goldman Sachs (GS) shares have fallen to their lowest level in six months according to FactSet. After notching their February first record high share price since the 2007- 09 recession, the stock has been drifting lower.

Trading Slump

Executives of the two biggest U.S. banks, JPM and BAC signaled Wednesday that second-quarter trading is weakening, bringing to a halt a string of strong quarters that have previously boosted bank profits.

Effect and Cause

What can the investor or trader glean from financial weakness