Based on prices as of June 2, it is my estimate that Class A mall REITS trade at about a 30% discount to Net Asset Value. The Class B's are selling at an even more extreme 50-70% discounts. The current mentality is that only Class A malls will survive and that too with a lot of difficulty.

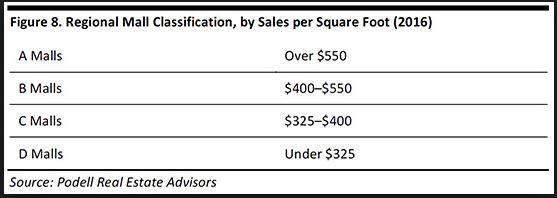

What is a Class A Mall?

According to Podell Real Estate Advisors it is the demarcation above. Sounds simple enough. So where do the Big Retail REITS stand?

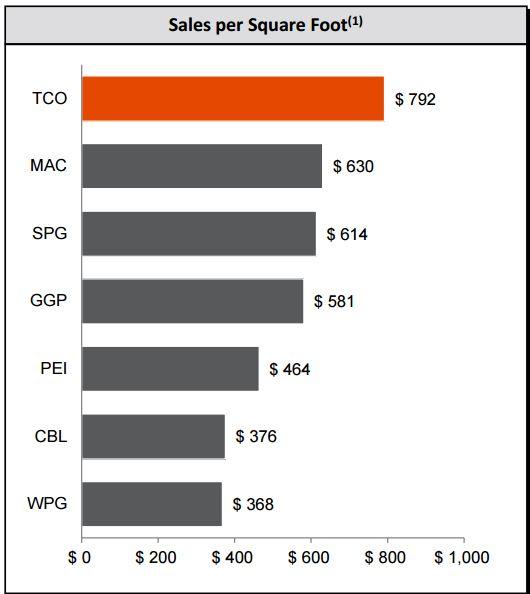

Source: Taubman Presentation

Taubman's (TCO) recent presentation broke down the sales per SqFt. Seems crystal clear. But remember this is the Sales per SqFt of the underlying tenants. What happens if we look at rent per SqFt? Before you look at the next picture, try to imagine how these same malls would look in terms of Rent per SqFt.

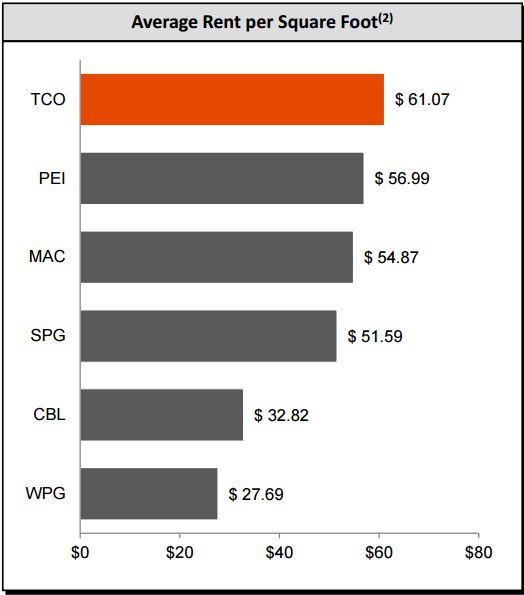

Ready?

Similar. TCO still rules supreme. Yet not identical. One notable standout in the order is Simon Property group (SPG) with sales of $614 a Sq FT, which is 32% above Pennsylvania REIT's (PEI), is struggling to get the same rent per SqFt on its properties. Same for Macerich (MAC) with sales of 36% above PEI. Taubman is getting 10% higher rents than PEI, but it is taking a whopping 72% higher sales to do it.

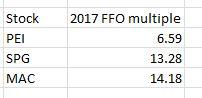

Now let's look at how the market values the funds from operations of these REITS?

Source: Author's estimates & calculations

I think all of them are cheap, but clearly the market is pricing PEI off the sales per SqFt rather than the rent per SqFt. Can you imagine if the entire industry was promoting this metric (rent per SqFt) how the mall REITS would be valued? One could argue that this higher rent is a burden for its tenants or conversely argue that PEI has