Bojangles, Inc. (BOJA) can be viewed as a pure value play, as well as a potential acquisition target.

The share price has been suffering from the effects of coming to market at a lofty price and more recently being neglected due to excitement elsewhere in the sector. However, expect this to change soon.

Bojangles operates and franchises limited service restaurants serving fried chicken, buttermilk biscuits and iced tea. Currently the company operates 309 owned and 407 franchised restaurants in the US. Bojangles was founded in 1977 and is headquartered in Charlotte, North Carolina.

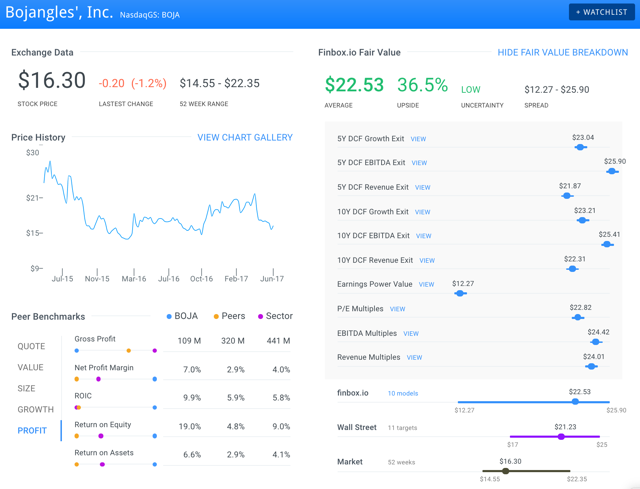

The company initially offered its common stock to the public on May 8th, 2015 at a price of $19 per share. The stock shot up to $27.52 only twenty days later appreciating by over 40%. Jumping forward over two years, BOJA has since dropped below its IPO price and now trades at $16.30 per share.

Now Trading At Attractive Valuation

Applying Wall Street's consensus forecast to finbox.io's ten valuation analyses concludes that the stock is trading at 36.5% discount to its intrinsic value. In fact, only the Earnings Power Value analysis, a highly conservative approach that implies earnings grow at 0% into perpetuity, suggests a fair value below the current trading price. Furthermore, the average 1-year price target from eleven Wall Street analysts of $21.23 implies 30% upside. Shares of Bojangles appear to be heavily oversold as the stock trades near its all time low.

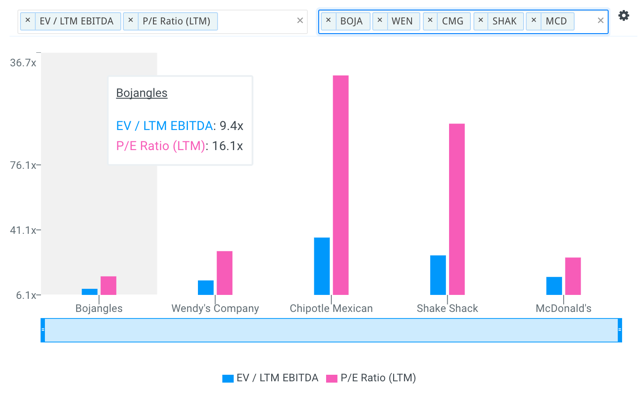

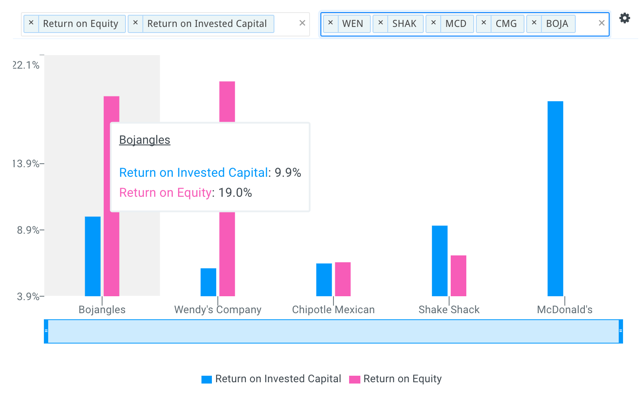

Bojangles is trading at an Enterprise Value to EBITDA ratio of 9.4x while Wendy's (WEN), Chipotle (CMG), Shake Shack (SHAK) and McDonald's (MCD) all trade north of 14.0x. Similarly on a price to earnings basis, Bojangles also looks very attractive as seen on the chart below.

The Market Has Lost Interest

Bojangles came to market in 2015 amidst a lot of excitement and the $27.52 post IPO price was simply too high. For the past two years it has struggled to justify that high of a valuation and investors have lost interest. During this same period, shares of McDonald's have appreciated by a whopping 57% as investors have applauded the fast food giant's franchising transition and its experience of the future.

In addition, investors were also focused on Popeye's Louisiana Kitchen which was acquired by Restaurant Brands International (QSR) in March for $1.8 Billion. That deal valued Popeye's at 20.5x LTM EBITDA and 38.6x LTM earnings. Those multiples are more than double what Bojangles is currently trading at.

Why Should Investors Look At Bojangles Now?

Restaurant Brands International was formed when Burger King acquired Tim Hortons for $14B. With its acquisition of Popeye's, they now own a burger chain, a chain of coffee shops and a chain of chicken restaurants. Comparatively, Yum Brands (YUM) owns KFC, Taco Bell and Pizza Hut.

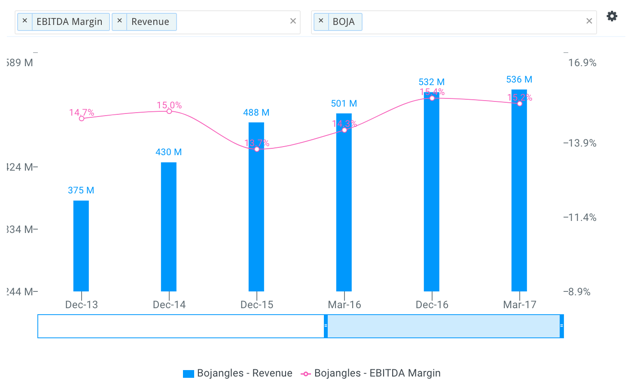

In the midst of a strong M&A market, don't be surprised if one of these restaurant holding companies or private equity group takes a swipe at Bojangles. Private equity professionals typically prefer companies with a record of stable free cash flows and healthy growth. By taking a quick look at the chart below, one can see that Bojangles exhibits these characteristics.

With a market cap of approximately $600 million, plus a premium, this would be a manageable acquisition for many PE funds. Although it's unlikely that a deal would be done at 20.5x times EBITDA, a 12.0x multiples would be reasonable (cheap when compared to peers) which implies a 30%-40% premium.

A Solid Standalone Investment

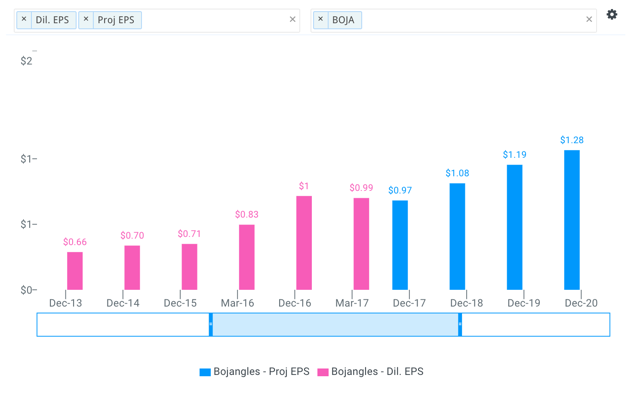

There haven't even been whispers so it's safe to assume that Bojangles isn't currently in any M&A talks (at the moment). Even if Bojangles is not acquired, it still makes for a solid stand alone investment. The restaurant chain has a very loyal customer base and a product that is unlike any other on the market. As per the following chart, we have only seen one quarter of slightly lower earnings, which can hardly be described as a trend. In addition, the consensus forecast from eleven Wall Street analysts only expect slight dip in 2017 earnings followed by strong growth.

Fast food restaurant stocks can be quite a defensive investment as long as they are purchased at reasonable valuations. Bojangles' strong return on equity and return on invested capital of 19% and 9.9%, respectively, is much more attractive than many of its overpriced peers.

Bojangles's current oversold share price presents an opportunity to invest in one of the most attractively priced stocks in the restaurant sector. And don't be surprised if shareholders receive an added bonus in the form of an acquisition at a healthy premium.