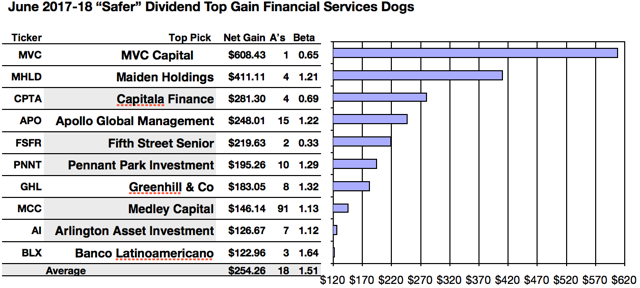

Actionable Conclusions (1-10): Analysts Assert Top Ten "Safer" Financial Services Dogs Could Net 12.3% to 60.8% Gains By June, 2018

Five of the ten top "safer" Financial Services dogs (tinted gray in the chart above) were verified as being among the Top ten by yield for the coming year as well as for gains based on analyst 1 year target prices. Thus the dog strategy for this group as graded by analyst estimates in June proved 50% accurate.

The ten probable profit generating trades illustrated by YCharts analytics for 2018 were:

MVC Capital (MVC) netted $608.43 per price estimates from just one analyst, plus dividends less broker fees. The Beta number showed this estimate subject to volatility 35% less than the market as a whole.

Maiden Holdings (MHLD) netted $411.11 based on median targets from four analysts, plus dividends less broker fees. The Beta number showed this estimate subject to volatility 21% more than the market as a whole.

Capitala Finance (CPTA) netted $281.30 based only on a median target price estimate from ten analysts, plus projected annual dividends, less broker fees. The Beta number showed this estimate subject to volatility 31% less than the market as a whole.

Apollo Global Management (APO) netted $248.01 based on median target price estimates from fifteen analysts, plus dividends alone less broker fees. The Beta number showed this estimate subject to volatility 22% more than the market as a whole.

Fifth Street Senior (FSFR) netted $219.63 based on mean target price estimates from two analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 67% less than the market as a whole.

Pennant Park Investment (PNNT) netted $195.26 based on mean target price estimates from ten analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to volatility