WPX Energy (WPX) had a disastrous transition last year and might still be worth avoiding. This year needs to be a lot better to stop all the bleeding. The first quarter improved, but management needs to keep going. This company has a long way to go before results are anywhere near satisfactory.

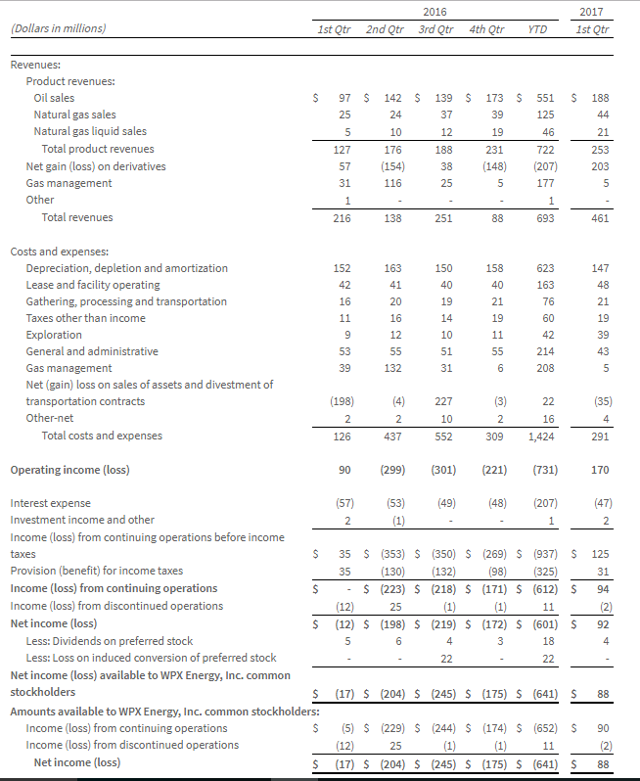

Source: WPX Energy Q1 2017 Earnings Press Release

A stock is probably best avoided anytime the reported loss approaches the revenue. No transition needs to be this costly. Even so, the stock has a couple of things going for it outside of operations, fundamental analysis, and earnings that will help the stock price.

First, Goldman Sachs likes the stock. Investors need to remember that this company has been selling shares like mad and making acquisitions over the last year. Those stock sales helped to fund the loss, purchase properties, and provide lots of business to the brokerage business. Those brokerages will respond with a nice comment or two if they think more business is coming their way. Actually, a purchase recently closed that involved the issuance of more equity in the fourth quarter, so the brokerage firms are inclined to be very helpful.

The company purchased acreage in the Permian and has been pushing that Permian exposure hard. The "Permian Charm" is in full swing with this stock. But sooner or later actual results are going to matter. So far, this company has been in favor with Mr. Market. Management has helped by making periodic announcements about progress that the market approved of. So, for the time being, the stock has held up remarkably well for a company losing this kind of serious money.

Now, with commodity prices declining, this Permian stock has pulled back. So the big future question is: Can the stock come back, or is it doomed to go lower