As the market focuses on the soaring valuations of the tech giants, investors are overlooking natural resource related stocks at depressed values. In addition, the recent transaction that brought U.S. Gold Corp. (NASDAQ:USAU) public leaves the stock as a surprising gold gem undiscovered by the general market.

The main question is whether the small gold exploration stock is worth the risk. Investors have to offset the concerns with the merger that brought the gold exploration firm public with the presence of a prominent gold geologist-explorer that is a potential game changer for somebody wanting a venture-style investment with plenty of upside potential.

Gold Transition

On May 24, Dataram officially became U.S. Gold Corp with the purchase of that company. Dataram remains a fully owned and functional subsidiary focused on enterprise memory solutions.

The company changed the ticker to "USAU" from "DRAM" on June 26 and maintains the option to sell the assets of the Dataram subsidiary that might provide some cash to fund the gold exploration projects.

The main reason for the transition from customized memory solutions to gold exploration was the opportunity to work with geologist Dave Mathewson along with access to the Keystone Gold property located in Nevada. The combination of a district-scale mining opportunity along with a proven explorer is difficult to pass up.

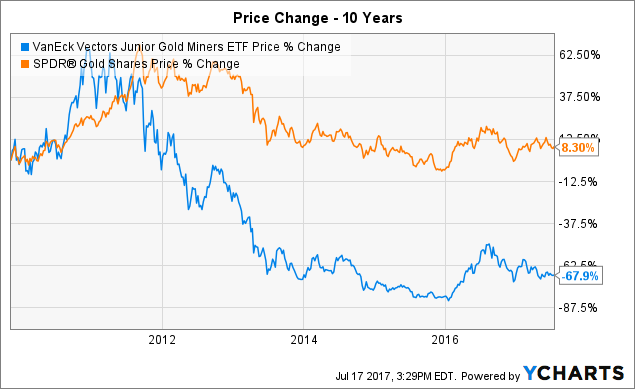

At the same time, junior gold miners aren't the hot subjects like some five years ago. The VanEck Vectors Junior Gold Miners ETF (GDXJ) is down sharply and has actually based over the last couple of years, suggesting the time to invest in the sector might be now.

GDXJ data by YCharts

For these reasons, U.S. Gold provides an interesting time to invest in the sector. As well, the stock provides a small valuation to start an investment during a period when most companies come public at