Kinder Morgan’s (NYSE:KMI) earnings call was a very positive one. Unfortunately the market responded appropriately and the stock traded up quickly. Since that time it has pulled back a little bit and it is opportune to pick up or add shares.

The most important news is the $2 billion share buyback program. If you believe a company is undervalued and its shares are worth far in excess of the level they trade at, there are few better ways for a corporation to direct its cash flow.

The most important news is the $2 billion share buyback program. If you believe a company is undervalued and its shares are worth far in excess of the level they trade at, there are few better ways for a corporation to direct its cash flow.

In Kinder Morgan’s case it implies a few things: 1) Management is highly confident it can maintain strong cash flows as it has a slightly conflicting target of reducing its debt to EBITDA ratio and need for expansion capex. 2) It is a sign of “outsider” like thinking, see Thorndike, when management is able to opportunistically shift gears from dividends to buybacks.

The call doesn’t change that Kinder Morgan can grow to $8 billion in EBITDA without diluting shareholders by 2018. It may buy back up to $2 billion worth of shares or approximately 5% of shares outstanding. That means you are looking at a forward market cap of around $40 billion against an EBITDA of $8 billion. Even though EBITDA doesn’t represent durable distributable earnings very well it suffices to sketch how this could be a highly favorable investment.

Especially as the pipeline business is relatively stable. Kinder Morgan takes about ¾ th of its fee based cash flow in take-or-pay contracts close to 90% of its backlog is tied to fee based pipelines and terminals. That means the ups and downs of oil don’t hurt as much as they do at Exxon (XOM), Chevron (CVX), not too mention the small time E&P fish. Pipelines are nice if you like value, don’t believe oil & gas are a dead industry and you have no idea when the oil market will show a broad recovery. Some risk is introduced through the backdoor as the secure cash flow enables leveraging up which is exactly what Kinder Morgan has done.

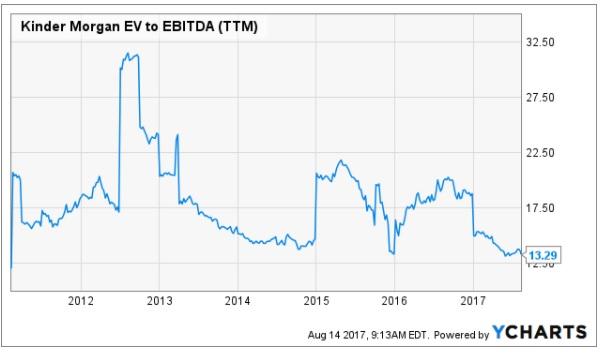

Finally, the company trades at the historically lower end of its EV/EBITDA range. If it traded at a more normalized multiple around 2018 at 15x, while EBITDA increased to $8 billion and 5% of the shares were taken out, it could easily result in a share price of $57. Admittedly, this is somewhat of a bright blue skies scenario and it is more likely a number like that will be realized well beyond 2018.

Conclusion

Kinder Morgan is a great buy sub $20. The company announced a buyback program which is beneficial in and of itself but also has secondary positive implications. The company has a path towards $8 billion in EBITDA by 2018. At a market cap of around $40 billion and a business model that allows for substantial leverage this should unlock a lot of shareholder value at comparatively low levels of risk.