We just spoke with AMD (NASDAQ:AMD) (click here for our full earnings model). We wanted to share what we came away with after working through the earnings model with the company. Investors are either "love it" or "hate it." We want to put all that on the side, and let's all put our rational level-headed hats on to try to understand what AMD needs to drive the earnings and the stock price.

Earnings Drive Stocks

First, we wanted to preface our work with a short soliloquy on what drives our investment process to want to buy something; earnings. When the potential earnings number in the next 12 months multiplied by a typical historical PE can give us 30-40-50% or more stock upside, we like it. Because we speak to so many companies, a cookie-cutter approach to earnings lets you know when something stands out. We want our assumptions to be reasonable so our process remains consistent and disciplined.

With that, let's jump into AMD.

Let's Cut To The Chase: We Understand The Street's $.31 For 2018

The average Street estimate for EPS for 2018 is $.31. We get about $.40 and we'll show you how. Our EPS is 29% higher than the Street so we're not trying to be conservative.

Again, we are biased by our approach that what really drive stocks are earnings. You always need to ask "what's your earnings number?"

Next, PE: What PE Can We Realistically Use?

AMD's PE has traded all over the map. We like to say that a stock can get to the midpoint of its historical PE. AMD's PE average has been around 40 when it had some earnings.

NVIDIA's (NVDA) PE in contrast has averaged about that, we'd say about 35. We don't mind giving AMD an NVIDIA-type PE, but with lower gross margins, lower growth and more perceived risk, we can't give it more than NVIDIA.

We're using a 35 PE for AMD. We don't think that's conservative.

What Does AMD Need To Show $.40 Next Year?

Let's Go Through Revenues

When doing an earnings model, it's not so complicated. It's a little tedious, but after doing so many of them personally, I find myself in a happy smiley high from all the numbers all starting to make sense. You can definitely do this process of making a model yourself. You don't have to be some top-notch sell-sider to know where the numbers are going (Elazar stop drifting off let's get to the AMD numbers, c'mon what's AMD need to hit nums?).

Computer And Graphics

Ok, let's get to it.

Computer and Graphics (C&G) was the revenue segment that made up a little over half of AMD's revenues last quarter. It's the company's crowned jewel.

|

C&G jumped 51.5% in Q2, which was a pickup from the previous quarters. AMD said it's sold out, and cryptocurrency demand drove nice upside here.

If you are expecting revenue growth this year, you need to see it in this line item. Keep in mind the company is sold out so not sure how much faster this can grow. You have its new Ryzen CPU for PCs in this line item and its new GPU Vega in this line item.

Do you expect growth to continue here? We do.

Here's our model going out.

We use the two-year run rate to guestimate where the one-year year-over-year growth rate can go. The two-year last quarter was 66%; it was huge. We keep that two-year run-rate through the end of 2018 (again, not conservative). We give AMD credit that it'll keep it going. With all its new launches and crypto demand, we think it can continue.

|

Here is the two-year run rate math going out. Keeping the two-year run rate at 66% next quarter would get you one-year revenue growth in Q3 of 55% and 38% in Q4. You can see the growth rates for next year. We don't think our numbers are conservative.

Next revenue line item.

Enterprise, Embedded and Semi-Custom (EE&S)

Here's the run-rate for AMD's other revenue line.

This revenue line has been weaker.

|

This business has been slower, and you can see last year's Q3 jumped, thanks to Xbox and PlayStation sales. The issue is we have to lap that.

Here's how we model it going forward.

|

If you keep the same two-year, the third quarter could be down much more than our -10%. Again we are not being conservative.

In speaking with AMD, the company thinks last year was a peak in the gaming cycle. If so, we may have a tough time growing on last year's numbers for the EE&S business line item shorter term. If you take that comment a step further, even though it's complaining about cryptocurrency stealing GPU supply from gamers, crypto could be saving it if gaming is peaking.

Its EPYC processor for the server market will be in this line item as well. While it's launching, it takes 3-4 quarters to qualify at customers. While we might hear announcement wins for EPYC, we probably don't see it flow into the numbers in a major way for a year or so. In that time there is plenty of competition. So we have EE&G start to grow in the back half of 2018.

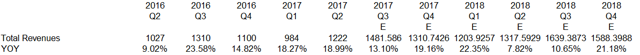

Total Revenues

Let's put it together.

|

The last two quarters revenues grew 18-19%. Next quarter slows because half of its business faces a "monster comp" of 30%. After that, we have 19% and 22% for Q4 and Q1.

Next...

Gross Margins

|

AMD expects gross margins to move up with its Vega GPU. We give the company some credit for that and have Q3 gross margins move up from Q2 (see qtq, which means quarter-to-quarter as opposed to year-over-year).

NVIDIA did say on Wednesday at the Citi Tech conference (Webcast) that it has not seen much in the way of Vega GPUs showing up yet.

Going further out, we don't have a big gross margin ramp. When we spoke with NVIDIA, we heard it is launching a new GPU in early 2018 focusing on AI-inferencing, which is another step in the AI process. NVIDIA is billing this new GPU as a lower-end one. We are a little concerned that this lower-end GPU could compete with AMD at the lower-end price points.

AMD's GPUs will be focused on AI-learning according to the company, but NVIDIA sounds to be a step advanced by seeing demand at the next stage, inferencing.

Whatever the use cases are, we think the bottom line is NVIDIA will be competing at its higher price points but will also have new products at the lower price points. It's a critical factor that can't be ignored for both companies.

Operating Expenditures

Lastly, operating expenditures have grown about 30%. Even though AMD needs more R&D investment to compete in the huge datacenter growth, we have operating expense growth slowing.

Let's Cut To The Chase: EPS

|

In the next 12 months, based on all of our inputs we reviewed with you, we get about 11.6% stock upside from the recent close.

Our numbers assume a much bigger upside surprise versus the Street than what we've seen the last two years. Expecting more upside surprise than we've seen is not being conservative.

Conclusion

Our recommendations range in upside from 30s percent to a triple. We've limited new buys to need 45% 12-month upside. For us, 11% is good, but it doesn't compete with our other ideas for now.

If you think that revenues are going to absolutely blow out or margins are going to pop much further, you have reason to own AMD here.

For now, we love what it's doing, but the numbers don't add up to our needed 45% 12-month upside.

You've seen our inputs and our logic. You've seen our process. You can do it yourself. Let us know what you get.

Nail Tech Earnings

We are speaking to 1-3 major tech companies each day. We build earnings models while speaking to them. We've been doing this over 20 years for big hedge funds. We have stocks that can double or triple in the next 12 months based on the simple math of trends continuing. Q3 is critical for tech going into the holiday season. We think it's going to be huge. Know which stocks we think have the most potential upside. If you care about tech stocks, you can dip your toe in the water with a free trial. Wishing you lots of success!

All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC, and their related parties harmless. Model portfolio trades and positions are hypothetical to be used for directional analysis and ratings purposes.