"Always forgive your enemies; nothing annoys them so much." - Oscar Wilde

![]()

The biotech sector did little on Monday even as the S&P 500 and Nasdaq moved up over one percent on new sanctions against North Korea and less damage from hurricane Irma than expected. There were no notable acquisitions announced on "Merger Monday" within the industry either. Still, the major biotech indices are near two-year highs as the sector has had a very strong summer.

![]()

Marinus Pharmaceuticals (MRNS) shot up by a third in trading on Monday. The company reported encouraging Phase 2 open-label study results in patients with CDKL5 disorder support advancing its primary drug compound ganaxolone into a definitive late-stage clinical trial.

Sage Therapeutics (SAGE) is coming under considerable pressure in trading today. In a Phase 3 trial assessing its lead product candidate SAGE-547 (brexanolone) in patients with super-refractory status epilepticus (SRSE) failed to achieve its primary endpoint. The shares are down approximately a quarter in today's trading.

Beaten down Teva Pharmaceuticals (TEVA) is having its best week in recent memory. On Monday, the shares shot up nearly 20% on the appointment of a well-respected CEO to helm the largest generic drug maker in the world. The company also presented data showing its compound fremanezumab for the prevention of migraine demonstrated its efficacy for all 25 primary and secondary analyses in both monthly and quarterly dosing regimens at the 18th Congress of the International Headache Society in Vancouver, Canada. Today, the company announces it has reached a deal with CooperSurgical to sell PARAGARD (intrauterine copper contraceptive) for $1.1 billion in cash. The deal includes Teva's manufacturing site in Buffalo, NY. PARAGARD does just under $170 million in annual sales. A good step in its strategy to divest non-core assets. The shares are trading nicely up on the news today.

![]()

After presenting positive data from a Phase 1b clinical trial assessing its compound RXDX-105 in a rare subpopulation of non-small cell lung cancer (NSCLC) patients with genetic mutations at the European Society for Medical Oncology (ESMO) on Monday, Cantor Fitzergerald reiterated its Buy rating and $15 price target on oncology concern Ignyta (RXDX) this morning. Cantor's analyst provided the following color within the rating.

RXDX-105 Finds a Patient Population. Readout from the Phase Ib study assessing RXDX-105, targeting RET fusions in NSCLC, suggests a path forward in patients with non-KIF5B-RET fusions versus those whose tumors contain the fusion, with a preliminary ORR of 75% (n=8) compared to a lack of RECIST response for fusion positive tumors (n=14). The overall median duration of response was not reached."

After being dormant for some three months, analyst commentary on Blueprint Medicines (BPMC) has picked up so far in September. Last week, reiterated its Buy rating and $56 price target on BPMC. Yesterday, Canaccord Genuity reissued the same price target. In addition, a five-star rated (TipRanks) at Cowen & Co. also reiterated his Buy rating although no price target was provided.

Cytosorbents (CTSO) sees it first action in a month from the analyst community this morning. Maxim Group assigns a Buy rating and $12 price target on the small cap concern. Maxim calls out a new collaboration deal for its optimism.

CytoSorbents announced its new collaboration with Aferetica srl, an Italian innovative blood purification specialty company, to develop the PerLife ex-vivo organ perfusion system with CytoSorbents' novel adsorption technologies.

![]()

Today we look at another "Busted IPO" in the biotech sector for our Spotlight feature of the day. I occasionally get a question on this name but this is the first time I have taken more than a cursory glance at this concern.

Company Overview

Company Overview

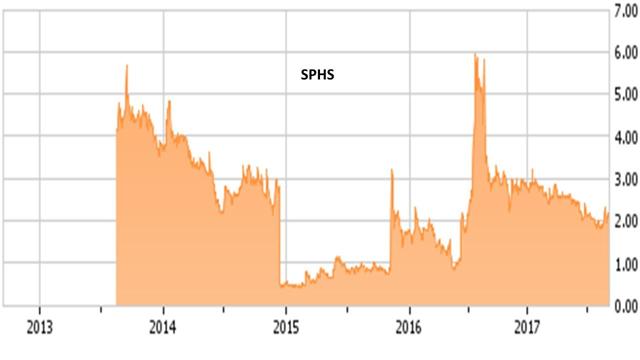

Sophiris Bio (SPHS) is a San Diego based clinical-stage biopharmaceutical company that focuses on the development of products for the treatment of urological diseases. It came public in the second half of 2013. At just over $2.00 a share, the stock trades about half the level of its debut three years ago. It has been a very volatile stock in its time as a public company which can be seen above. Sophiris currently has a market capitalization of approximately $65 million.

Pipeline

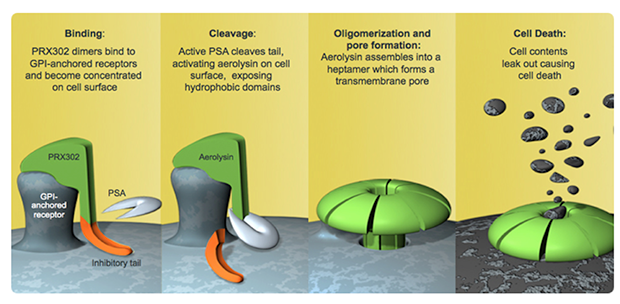

PRX302

This is the company's only late stage developmental asset. This compound is a modified recombinant protein that has been engineered to be selectively activated by an enzyme in the prostate. This will hopefully lead to localized cell death and tissue disruption without damaging neighboring tissue and nerves. According to the company's website:

PRX302 binds to the GPI-anchored receptors on the cell surface of prostate cells. Once activated by PSA, PRX302 combines with other activated PRX302 molecules, forming stable transmembrane pores that induce cell death. The prostate specific activation of PRX302 by enzymatically active PSA thus limits exposure of non-prostate tissues to the drug's activity, contributing to the safety of the therapy.

PRX302 is currently being developed as a treatment for the lower urinary tract symptoms of benign prostatic hyperplasia (BPH or enlarged prostate), and as a treatment for localized low to intermediate risk prostate cancer.

Over a half dozen early stage trials have taken place for PRX302. A recent study showed an ability to ablate tumor cells in over 50 percent six months after treatment in a patient population with pre-identified, clinically significant prostate cancer. The next trial milestone is a top line Phase 2 readout for PRX302 for the treatment of localized low to intermediate risk prostate cancer that should come out in the first quarter of 2018. Full data should be disclosed in the fourth quarter of the same year.

Analyst Commentary and Balance Sheet

The company ended the second quarter with $24 million in cash and marketable securities on the balance sheet. Management has stated this is sufficient to fund operations and development through 2018.

Given its size, it is not surprising the company is sparsely covered by analysts. Piper Jaffray reissued a Buy rating and $5 price target approximately four months ago. Both Maxim Group and H.C. Wainwright reiterated Buy ratings and similar $6 price targets last month

Verdict

I can not recommend SPHS for purchase other than as the most speculative of investments. The company has a 'single shot on goal' and is years away from commercialization. If the key Phase 2 trial goes well next year and probably after the company does a secondary offering or debt deal to provide funding for the next stage of development, we might revisit this name.

"Forgiveness is the fragrance that the violet sheds on the heel that has crushed it." - Mark Twain

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.