A reader asked why ViaSat Inc. (NASDAQ:VSAT) was added to our theoretical short sale model portfolio in our latest model portfolio report, 31 Stocks for September 2017. Quite simply, the stock ranks poorly on four metrics we use to construct our model portfolio strategies:

- Relative Value

- Operating Momentum

- Consensus Estimate Revisions

- Fundamental Quality

Below is a simple review of these four key measures as they relate to ViaSat.

Relative Value

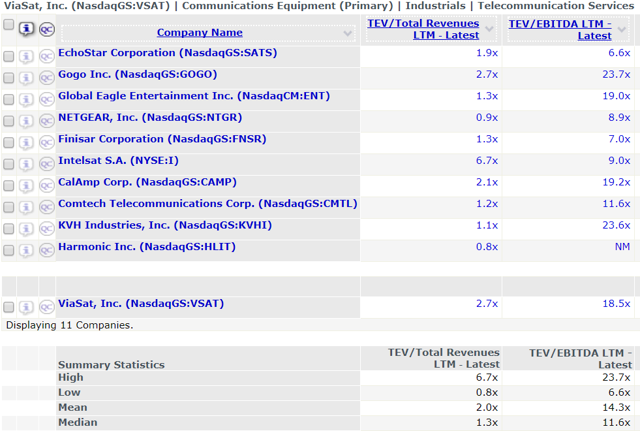

The table below from S&P Capital IQ shows that VSAT trades 2.7x and 18.5x LTM revenue and EBITDA, respectively. This is a premium to the peer average of 2.0x and 14.3x, respectively.

Operating Momentum

As the table from S&P Capital IQ indicates below, various efficiency metrics such as ROA, ROC, and ROE have been declining over the last several quarters. EBITDA and EBIT margins have also been declining. This supports a thesis for multiple contraction.

Consensus Estimate Revisions

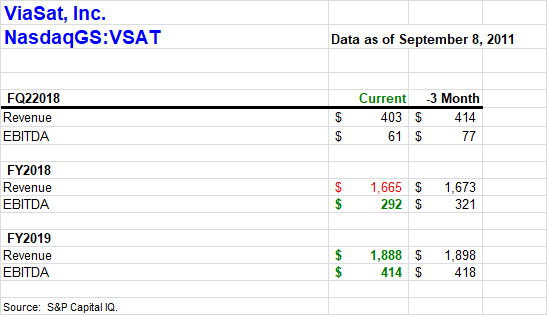

Consensus estimates have also been declining, driving a case for multiple contraction.

Fundamental Quality

ViaSat, Inc. ranks poorly on a number of ratios used to measure fundamental quality. For example, fixed asset turnover has declined from 1.1x last year to 1.0x in the latest quarter, LTM capital spending of $504m is nearly 2x that of LTM cash from operations of$272m.

Is ViaSat a Viable Short Sale Candidate?

Of more than 2000 companies that we rank each month, ViaSat is at the bottom of the list -- the epitome of "low-quality". In addition, the recent downward revisions to consensus estimates lend weight to the thesis that the recent downtrend in various fundamental metrics are likely to persist in the near future.

Does this make ViaSat a viable short sale candidate? Not necessarily. There have plenty of exceptions to applying these simple rules. The 60% surge in Kite Pharma, Inc. (KITE) last month is a good example.

The key elements that support valuation are cash flow growth and return on invested capital. If management or investors can make the seemingly "contrarian" case that ViaSat will grow cash flow in the years to come, and do so more efficiently over time (as measured simply by cash flow / assets), the stock should do well.

In summary, based on the ranking of simple quantitative metrics, VSAT deserves its place in our short-sale theoretical model portfolio composed of low-quality stocks. As a stand-alone short sale candidate, more in depth analysis is required.