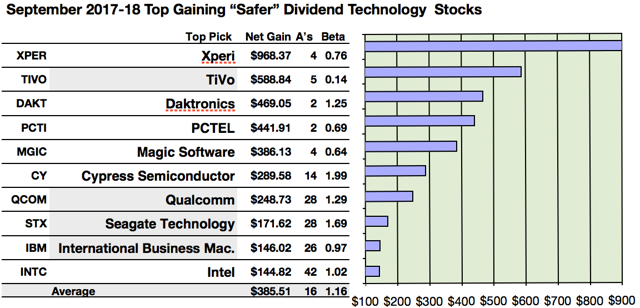

Actionable Conclusion (1-10): Analysts Guessed Top Ten Technology "Safer" Dividend Dog Stocks Could Net 14.5% to 96.8% Gains By September, 2018

Four of the ten top dividend Technology dogs by yield (shaded in the chart above) were verified as being among the Top ten gainers for the coming year based on analyst 1 year target prices. Thus the dog strategy for this Technology group as graded by analyst estimates for July proved 40% accurate.

Ten probable profit generating trades were illustrated by YCharts analytics for 2018:

Xperi (XPER) netted 968.37 based on estimates from four analysts, plus dividends less broker fees. The Beta number showed this estimate subject to volatility 24% less than the market as a whole.

TiVo (TIVO) netted $588.84 based on mean target price estimates from five analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 86% less than the market as a whole.

Daktronics (DAKT) netted $469.05 based on dividends plus a median target price estimate from two analysts less broker fees. The Beta number showed this estimate subject to volatility 25% more than the market as a whole.

PCTEL (PCTI) netted $441.91 based on a median target price estimate from two analysts, plus projected annual dividend less broker fees. The Beta number showed this estimate subject to volatility 31% less than the market as a whole.

Magic Software (MGIC) netted $386.13 based on a median target price set by four analysts plus estimated dividends less broker fees. The Beta number showed this estimate subject to volatility 36% less than the market as a whole.

Cypress Semiconductor (CY) netted $289.58, based on dividend, plus a median target price estimate from fourteen analysts, less broker fees. The Beta number showed this estimate subject to volatility 99% more than the market as a whole.