PepsiCo (NASDAQ:PEP) has been the epitome of slow and steady growth for many years. The company's diversified mix of food and beverage has served it much better than Coca-Cola (KO), for instance, and the stock's performance combined with its attractive dividend speak for themselves. But growth has pretty much always been a problem as diversification only works if at least one of your segments grows at a decent pace. The snack business has been picking up the slack in recent years but all PEP has been able to hope for is a couple percentage points of growth each year. However, with the dollar having weakened significantly thus far this year, PEP stands to gain rather meaningfully from its global footprint and I think that has positive implications on the company's growth prospects.

Let's begin with a look at the misery the dollar index has suffered this year as represented by the UUP.

The dollar has been absolutely hammered this year as the selling has been unrelenting. I thought a couple of weeks ago that it had a chance to stabilize in the $24 area on the UUP as the bulls made a stand there. But support broke a few trading days ago and as we can see, it is below multi-year support at this point. That's very bearish and unless the bulls can manage to push it back over that support line very quickly, the dollar seems doomed for more weak action in the back half of the year.

To the bulls' credit, the momentum indicators are leveling out so perhaps, just perhaps, they are gathering steam to arrest the declines. But for now, it looks like there is more weakness to come and that is fantastic news for multinationals like PEP.

Why? Because PEP gets a significant portion of its revenue from outside the US, when it goes to convert that revenue, it either gains or loses dollar value in the process. When the dollar is strong, this is a negative event because it is converting weaker currencies into a stronger dollar. When the dollar is weak, however, as it is now, it is a positive impact and that's what we'll focus on here.

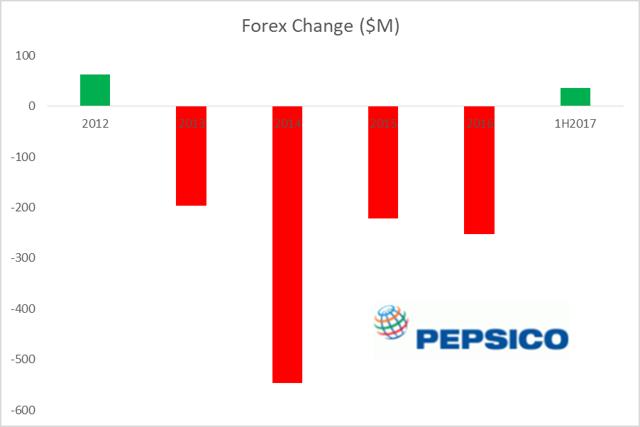

Below I've charted the change from forex for PEP over the past five years and the first half of this year using data from Seeking Alpha.

This chart has some pretty sizable bars on it and it really shows the impact that forex translation can have on this business. PEP is obviously a very global company and that means it stands to gain and lose meaningfully based on the whims of the currency markets.

In the period between 2013 and 2016, PEP lost $1.2B in aggregate due to the stronger dollar. That's meaningful money and while the value changed from year to year, they were all very sizably negative. Last year, for instance, PEP saw a quarter of a billion dollars in losses from currency translation but thus far in 2017, that number is a small gain of $36M.

So what? Well, it isn't that PEP is getting rich from $36M because it isn't, but what is important is that it has stopped seeing such huge declines. And given that the dollar is as weak as it has been all year, the $36M should be much higher than that by the end of the year. It should be at least double based upon the fact that the dollar is at its weakest levels of the year right now and looks to be getting weaker. That should help PEP see close to $100M in gains this year.

On the back of a $250M loss last year, the potential swing of $350M or so is meaningful. It is important to shareholders because a weaker dollar has the chance to make it much easier for PEP to hit and exceed its sales targets. In the same way that the dollar has made it difficult to hit revenue estimates in the past by shaving percentage points off the top, the tailwind of the weaker dollar will now add percentage points to the top. Given PEP is expected to grow revenue at roughly 2% over the long term, any gain is significant and the weaker dollar should be that catalyst.

Keep in mind also that any gains from currency are at 100% margin since there is no incremental cost to the additional revenue. This is purely a conversion so that will help margins as well and while PEP is doing plenty of margin expansion on its own, the extra help is always useful. That, in turn, should help make EPS estimates easier to achieve as well and given that estimates for this year and next year haven't budged anytime recently, that doesn't appear to be priced in. In other words, if you liked PEP last year and earlier this year, the weaker dollar should have you excited. The tailwind of the dollar is exactly what PEP needs to produce higher rates of growth and beat EPS estimates going forward. And given that it is going for 20 times next year's earnings, PEP needs that lift to get over the hump and resume its rally; the currency markets seem happy to assist in that journey.