Exactly one year ago, I published an article comparing Goldman Sachs (NYSE:GS) with JPMorgan (JPM). In that article, I concluded that both stocks were moderately overpriced, but JPM would outperform GS, which it has done ever so slightly. In February, I followed up with another analysis of GS, in which I said that the stock had become even more overpriced and investors would be wise to wait for a much better entry point, closer to book value. Since that article, the stock has fallen about 7%. In this next piece on Goldman Sachs, the analysis will point to continued challenges faced at the Wall Street firm and how investors should play the stock.

2017 has started out well enough that investors would expect great things for the stock going forward. Through the first half of this year, non-interest revenues were up a healthy 16% over the first half of 2016. The firm's principal transactions increased $1.6 billion, primarily due to gains from both public and private equities as the equity markets generally were up over the first half of the year. Investment banking and investment management saw decent increases.

However, the big news out of the second quarter results was the continued challenges in the fixed income, currency, and commodities (FICC) client execution unit. The entire industry is showing weakness in this particular sector; however, GS raised many eyebrows by posting a 40% decline in FICC revenues in the second quarter, compared with an average decline of 11% for the other large banks. GS is now ranked #5 among the large banks in FICC trading. Commodities, in particular, posted the worst quarter on record at the company.

As a result, the company recently announced a bold revenue plan to produce up to $5 billion in new revenues over the next three years. As for the FICC business, the company is expecting to generate $1 billion in new revenues by closing the gap to its peers with increased penetration into the asset managers and banks. It is undoubtedly a bold plan for action; of course, time will tell how successful the company is in meeting this revenue plan. A lot is dependent upon the market conditions. Volatility remains low across all sectors, which reduces the money making opportunities.

Net interest income declined about 20% from 2016 during the first half of the year. Interest expense increased more than interest income. This is an interesting development because the conventional wisdom is that financials will do particularly well as short term interest rates increase. However, the brokers are more reliant upon unsecured borrowings, some of which is floating rate, than the major banks to finance their businesses. At Goldman Sachs, unsecured borrowings represent about 30% of total liabilities compared to just 13% at JPMorgan. Deposits, on the other hand, which carry lower rates of interest, represent just 15% of liabilities at GS, compared to 62% at JPMorgan. Therefore, as interest rates increase, the brokers, like GS, should see greater increases to interest expense, thereby dampening their net interest income.

Company expenses continue to trend favorably. The compensation to net revenues ratio of 41% was the lowest first half accrual in the company's history and 100 basis points lower than 2016. With the major litigation issues in the past, it appears that the company's efforts to reduce overall expenses is paying off.

Net income in the first half of 2017 increased 34% over the first half of 2016. Earnings per share increased 42% in the first half of 2017 to $9.10, compared to $6.39 in the first half of 2016. The average number of outstanding shares declined 6% as the company repurchased about 13 million shares for $3 billion. The company's capital plan was approved by the Federal Reserve, and the company has authorization to repurchase up to 63.8 million additional shares under its current share repurchase plan. In addition, the company increased its quarterly dividend to $0.75 per share.

With exception of the FICC business, Goldman Sachs is performing relatively well. Investment banking, investment management and its newer depository/lending programs seem to be working well. The stock, however, is reflecting a different narrative. A year ago, the stock was trading at $168.08. At a recent price of $225.22, the stock is up 34%. However, the stock closed at a high of $252.89 on March 3, 2017 and is now sitting 11% below that level. For the past six months, the stock has basically been trading between $215 and $230, with occasional breakouts past those points.

Like most financials, the stock shot up in the weeks following Election Day 2016 on the hopes of significant regulatory and tax reform. The House passed a bill earlier this year that would have effectively replaced the 2010 Dodd-Frank Wall Street reform law. However, the Senate has failed to take up the legislation and there really does not seem to be any interest in doing so anytime soon. Tax reform was fairly quiet until recently, and now there is a great deal of discussion about what the administration will propose for tax reform later this month. Tax reform could be a regulatory catalyst that would help the stock to regain its momentum. My personal opinion is that something gets passed in terms of tax cuts, but I would be very surprised if both houses of Congress could pass meaningful tax reform that the country and our corporations so badly need.

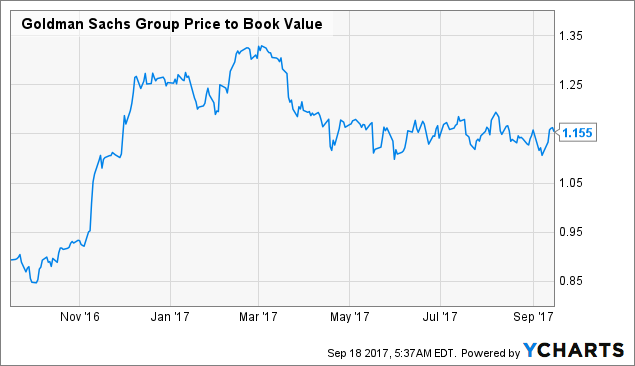

At its recent price of $225.22, the stock is trading at a LTM P/E ratio of 11.8x and a P/B of 1.16x. The P/E ratio is right around its average, while the average P/B ratio is 1.02.

GS Price to Book Value data by YCharts

GS Price to Book Value data by YCharts

I could say the stock is slightly overvalued based on its trading multiples. If we compare GS to Morgan Stanley (MS), GS is slightly cheaper. But given Morgan Stanley's prospects and more consistent results, GS might not be discounted enough. Finally, the present value models all indicate the stock is currently priced at a significant premium to book value.

This is a high beta stock with very little dividend appeal. If the market enters any semblance of a bear market, the stock will get hammered. But for now, the stock is really stuck in a rut. If it can break out above $230, it could then get back toward its 52-week high. The $210 - $215 range represents major support on the stock, with nothing but air below it back to the $180s. However, if it falls below $215, it could then fall back toward book value, which would be a great entry point for long-term investors. It seems that for the first time in a while, Goldman Sachs is directionless and lacking any answers for investors. The broader markets are trading at all-time highs, yet Goldman is struggling. I cannot think of the last time this happened, and this may indicate a changing of the guard on Wall Street.