It's Bullish…

On Wednesday, the Federal Reserve announced the latest decision by the Federal Open Market Committee with respect to monetary policy. That decision contained two primary components:

No rate hike currently, although, as expected, announcements of further rate hikes in the future, and;

the beginning of the process to cease reinvestment of the Fed's balance sheet.

The announcement was notable for two reasons:

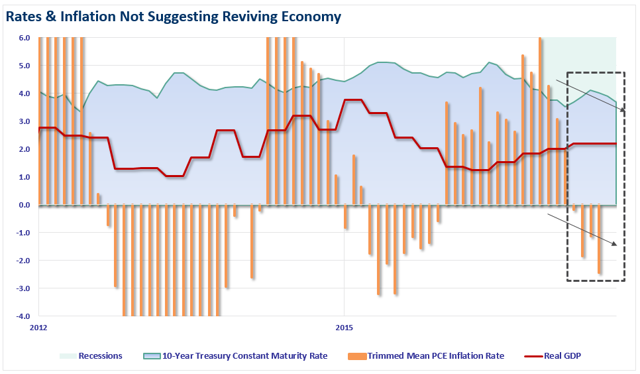

The Fed did NOT hike rates because the underlying economic data and, in particular, the inflation data suggest the economy is too weak to absorb a further increase currently, and;

the unwinding of the balance sheet is generally believed to be bullish for stocks.

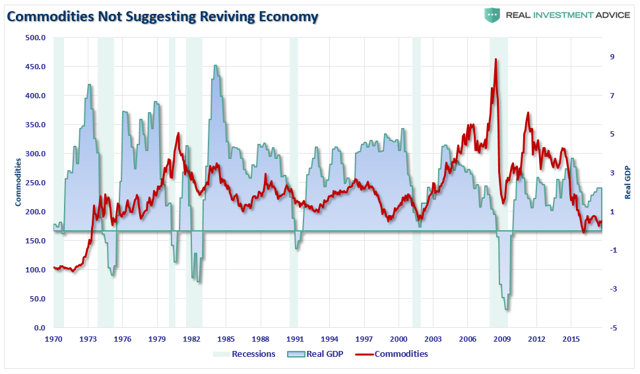

It is specifically the second point I want to address today, although, as shown below, commodities, PCE inflation, and interest rates currently suggest there is downside risk to current economic projections.

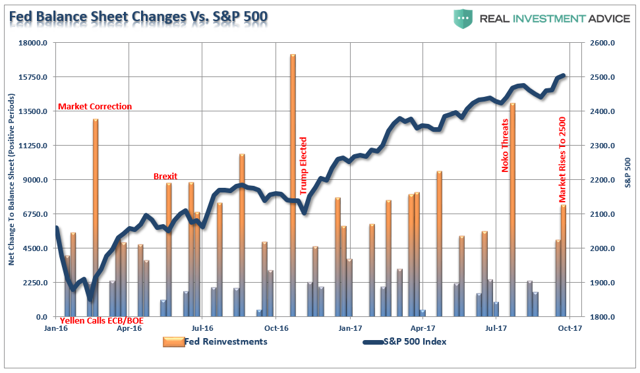

As I discussed on Friday, while the Fed talks a good game about a strengthening economy, improving jobs and rising asset prices, it is interesting to see the "coincident timing" of the Fed's reinvestment of its balance sheet.

With that in mind here is the observation to consider.

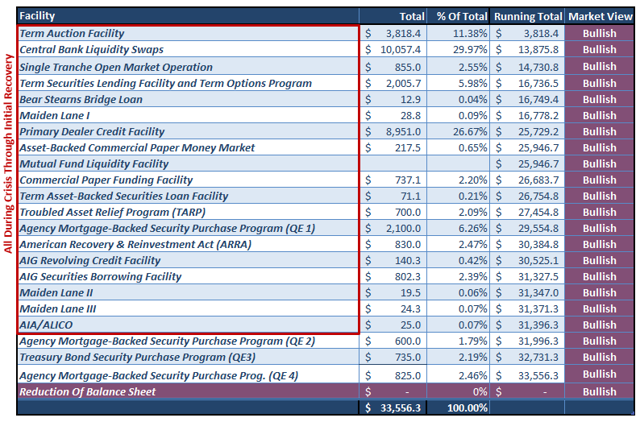

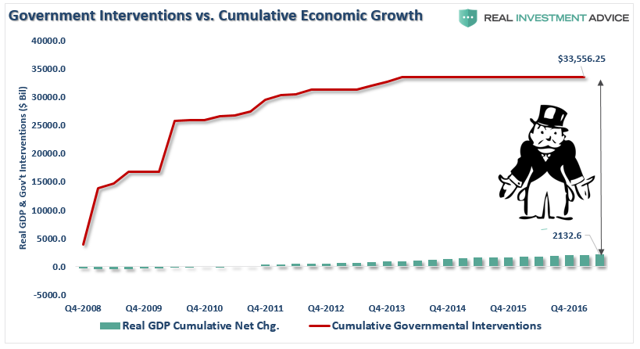

As shown in the table below, since 2009, there has been clear evidence that unbridled Central Bank interventions directly supported the market's advance. All of them considered "bullish" for asset prices.

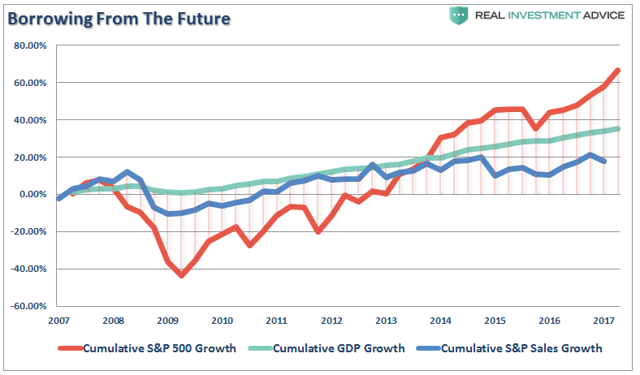

Of course, after $33 trillion in liquidity injections, bailouts, and supports, it should not be surprising that asset prices have been elevated well beyond the underlying growth of the economy or corporate revenue.

Furthermore, the ROI on those investments has been poor at best with each $1 of injections yielding just a $0.063 return economically speaking.

Now, ironically, despite the clear evidence of the support for the markets provided by near zero-interest rate policy and trillions in monetary injection, it