All dollar values in USD unless otherwise noted.

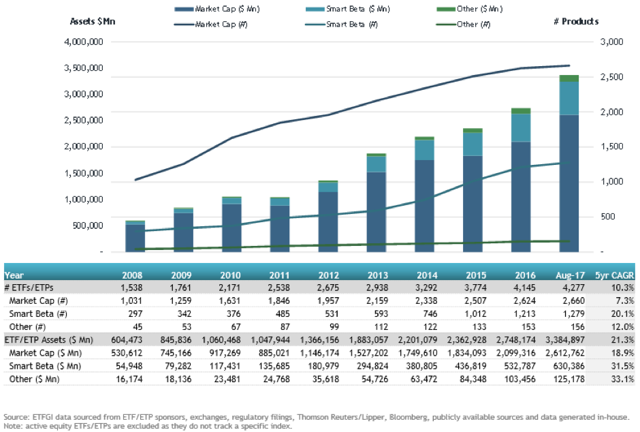

ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in Smart Beta equity ETFs/ETPs listed globally have increased 18.3% in the first 8 months of the year, reaching a new record of $630 Bn at the end of August 2017, according to ETFGI’s August 2017 global smart beta equity ETF and ETP industry insights report, an annual paid research subscription service.

Record levels of assets were reached at the end of August for equity smart beta ETFs/ETPs listed globally with $630.39 Bn, in the United States with $559.41 Bn, in Europe with $46.46 Bn, in Canada with $14.99 Bn and in Asia Pacific (ex-Japan) with $5.72 Bn.

In August 2017, smart beta equity ETFs/ETPs gathered net inflows of $3.23 Bn, marking the 18 consecutive months of net inflows and a level of $48.86 Bn in the year to date net inflows, which is greater than the $33.77 Bn in net inflows at this point last year. Combining market moves and net inflows, smart beta equity ETF/ETP assets have increased by 18.3% from $532.79 Bn to $630.39 Bn, with a 5-year CAGR of 31.5%.

At the end of August 2017, there were 1,279 smart beta equity ETFs/ETPs, with 2,171 listings, assets of $630 Bn from 158 providers on 40 exchanges in 33 countries. According to Deborah Fuhr, the Managing Partner at ETFGI:

August is typically a challenging month for equity markets with the average loss over the past 20 years for the S&P 500 at 1.3%.This year the S&P 500 was up 0.31% in August and 11.93% year to date, MSCI ACW was up 0.44% and 15.48% YTD while MSCI EM was up 2.27% for August and 28.59% YTD (all prices in USD). Storms and political risks remain a focus for