Mission: Look good

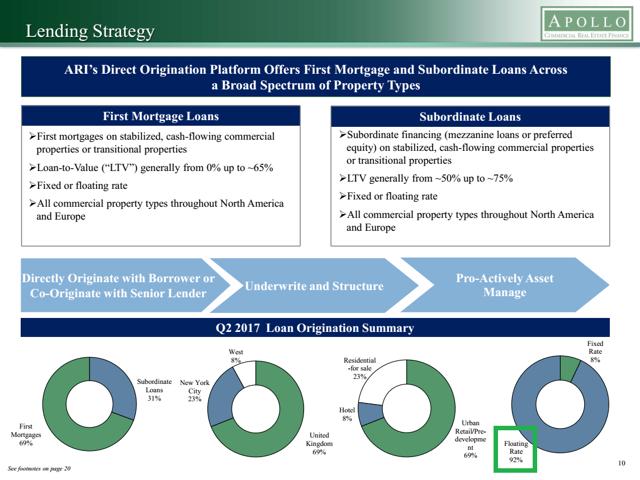

Apollo Commercial Real Estate Finance (NYSE:ARI) has looked good for years. ARI is heavily invested in commercial real estate. Most of ARI’s loans are floating rate:

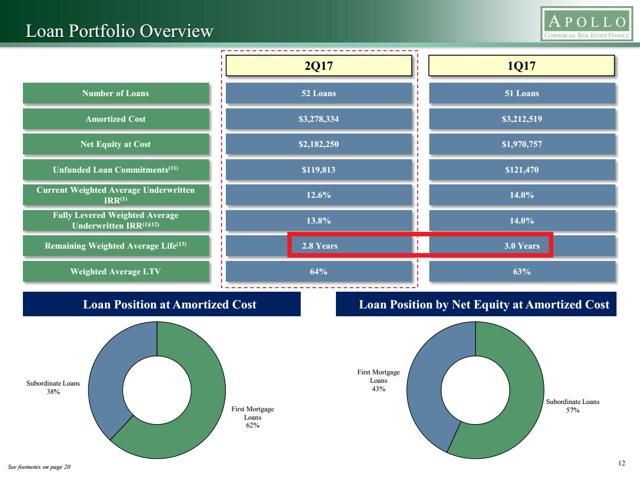

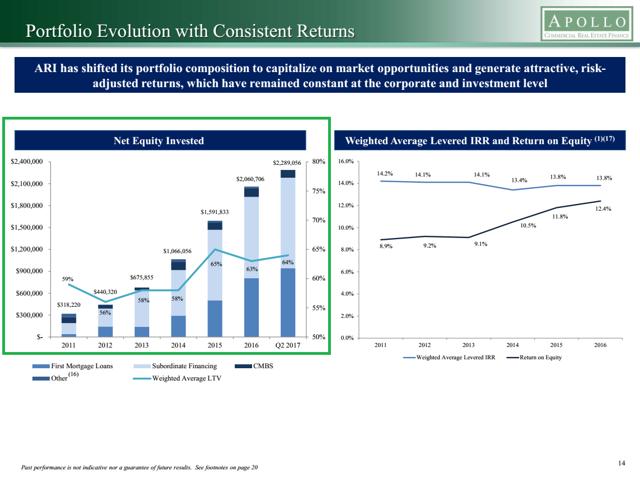

The floating rate is a hedge against rising interest rates. The recent rise in rates has benefited ARI. The company has also decreased their remaining weighted average life of loans:

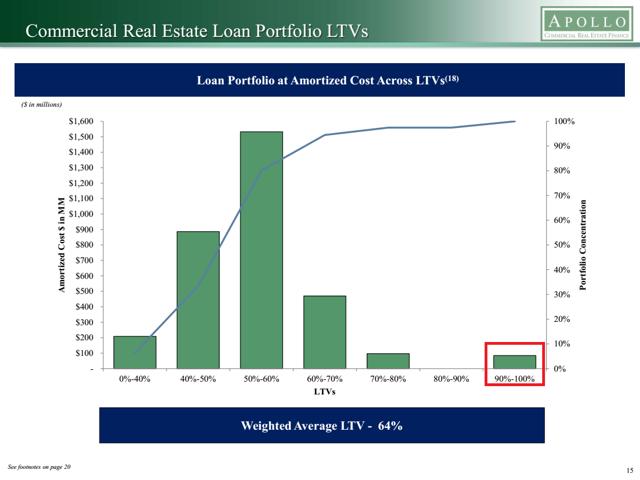

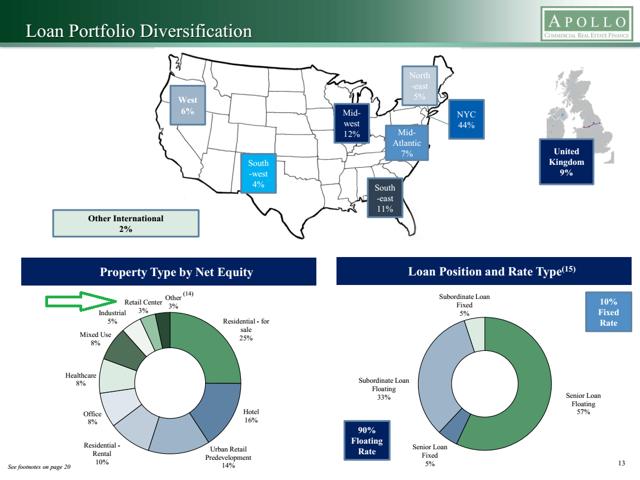

The lower duration can be good if rates increase. With the shorter duration, the company would be able to reinvest sooner. However, 90% of the portfolio is floating rate. Therefore, ARI is already positioned to take advantage of any hike in short-term rates. The weighted average LTV is 64% which is decent. I consider 50% to be great and 80% to be horrible. There’s not many high LTV loans:

Retail has been having a difficult time recently. Retail is only a small portion of ARI’s portfolio:

Portfolio and equity

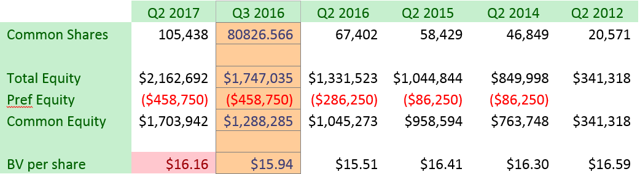

Here’s where things start to get interesting:

Notice how fast equity is growing compared to other mREITs. ARI has done a terrific job issuing new shares while trading above book value. Let’s take a look at book value over the last several years:

First, take a look at the positive. ARI is really good at raising total equity. This is largely in part because of trading at a material premium to book value. ARI is doing exactly what they’re supposed to: issue new equity when trading at a premium.

Take a look at the orange and the red…

There’s a couple things to notice here. One is Q3 2016, which I have highlighted in orange. This significant jump from $15.51 to $15.94 BV per share was due to acquiring Apollo Residential Mortgage (AMTG) at a massive discount to book.

Now, notice the cell highlighted in red. ARI, seemingly, has been doing everything right. However, BV per share has dropped from $16.59 in Q2 2012 to $16.16 in Q2 2017. BV per share can drop for a multitude of reasons.

Three reasons

I can give you three reasons why BV hasn’t been going up.

Reason one

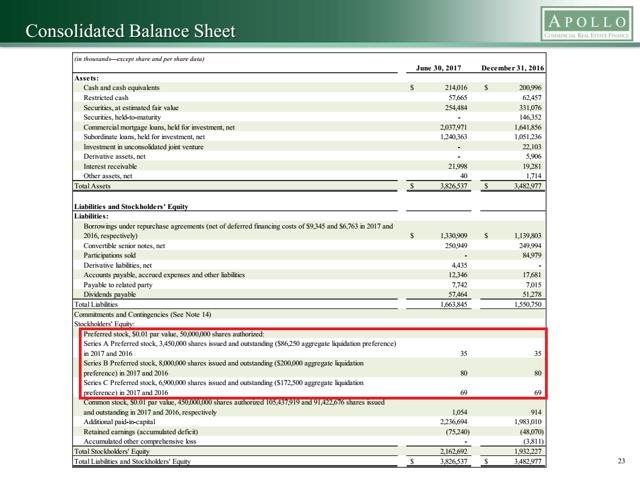

ARI is externally managed. All else held constant, being internally managed is drastically better than externally. External managers are usually going to take 1.5% of equity. Equity. This isn’t just common equity but also includes preferred shares. Common shareholders need to take into account the 8% coupon rate and the 1.5% paid to management annually. Here are the preferred shares:

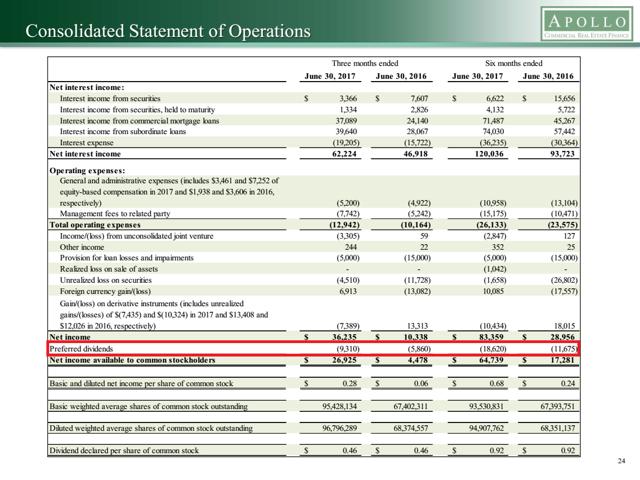

The preferred shares make up a material amount of the total equity. Prior to ARI-A being called, the total liquidation value of preferred equity was over $458 million. Are you wondering what the impact is on net income? Here it is:

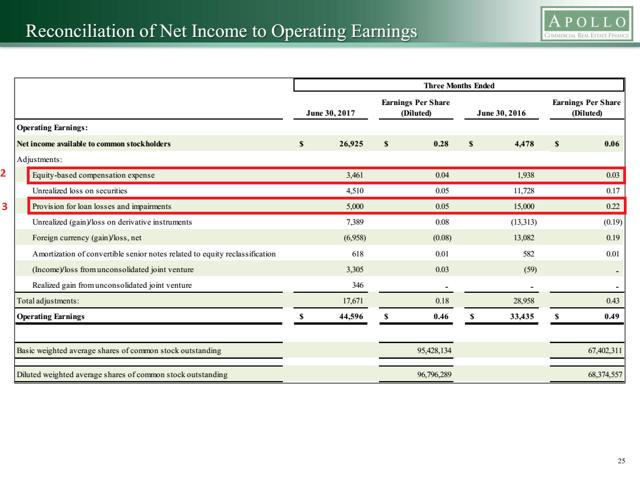

The preferred dividends cut into net income quite a bit. You’ll notice the $0.28 “Basic and diluted net income per share of common stock” doesn’t cover the declared dividend of $0.46.

Obviously, right? We need to add back some adjustments!

Let me bring you to reason 2 and 3:

Reason two

Equity-based compensation expense should not be added back in. In short, operating earnings just went from $0.46 to $0.42. Remember, the dividend was $0.46.

Why shouldn’t this metric be added back in?

Here’s a very simple example of what’s going on:

A company has 100 shares. You purchase all 100 shares of the company. You now own 100% of the company. Equity-based compensation is handing shares to managements. This is how it works:

- Equity: 100 shares

- Equity-based compensation: 100 shares

- Total shares: 200

Congratulations! You just went from owning 100% of the company to owning 50% of the company. Hence, this metric shouldn’t be added back in. This is an extreme example.

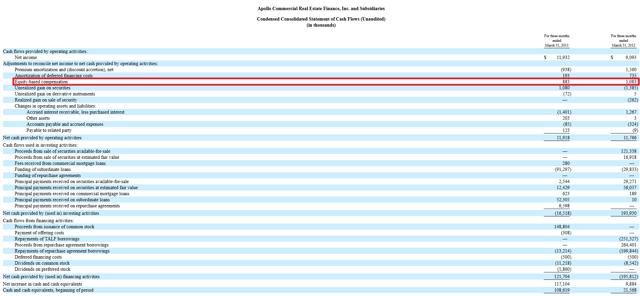

Further, this isn’t anything new for ARI. Here’s a 10-Q from the SEC website for Q1 2013:

Common shareholders have been getting diluted out of equity for years. It’s common practice to add this metric back in. However, it’s extremely misleading and routinely trips up analysts. From this metric alone, the dividend is not sustainable.

Where do they get the dividend from? You guessed right: book value.

Reason three

“Provision for loan losses and impairments” is slightly more complicated. I will advocate some of this being added back in. In other words, this cost should be amortized.

Here’s an example of what’s going on with this metric:

- ARI goes to a property owner and asks them to pay up.

- The property owner refuses to pay.

- ARI now takes the loss, but adds it back to get to operating earnings.

Notice the problem? ARI did have an actual loss and it will show up for book value. They took it out of operating earnings so it would look like they could cover the dividend.

Important note: Property owners refusing to pay up will almost certainly happen again. It won’t be the same amount every quarter and some quarters, even years, may see zero costs. However, amortizing property owners refusing to pay over time will give a clearer view of ARI being able to cover the dividend.

Conclusion

ARI has a good management team. They’ve also made strong choices over the last several years. However, the external management takes 1.5% of total equity. If the company was internally managed, it would improve their earnings. As long as ARI is trading over book value, they will be able to issue new equity. Issuing new equity will help ARI to not only pay the dividends, but continue to grow total equity.

My current rating on ARI is a sell. For a similar portfolio at a better valuation, I believe Granite Point Mortgage Trust (GPMT) is a buy.

Click The Mortgage REIT Forum to sign up for:

- Actionable buy and sell target prices

- Best research on preferred shares and REITs

- Best reviews on the site – 269/270 stars

- Stable dividend yields over 7%

- You get instant actionable SMS alerts.

- Sign up before November 1st, 2017 to lock in at $370/year