To those of you unfamiliar with spread trading, this article will provide you with an overview of what is meant by the term along with an example of how to analyze and produce these types of trades.

So first, one purpose of a spread trade is that it shouldn't be highly correlated with a long position in the market. Usually, spread trades are either market neutral or they err on being negatively correlated with the market since that is a way to increase portfolio efficiency (having alpha generating positions that have a zero or a negative correlation with your long-only trades significantly increases the overall performance of your portfolio).

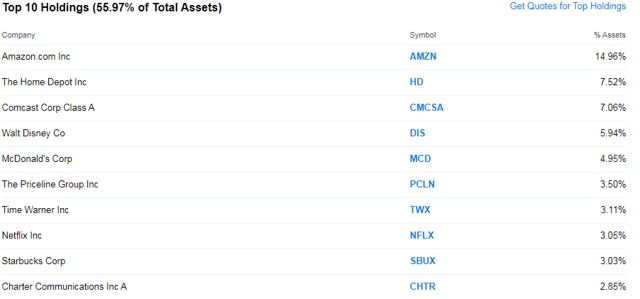

Second, a spread trade is usually formed by examining mean-reverting spreads and implementing the trade when the spread is at one extreme or the other. Let's take the example that we'll examine here, Consumer Discretionary Select Sector SPDR ETF (NYSEARCA:XLY) and Consumer Staples Select Sector SPDR ETF (NYSEARCA:XLP). These are two ETFs that provide exposure to consumer luxury (or discretionary) goods (XLY) and consumer staples (XLP). The majority holdings of XLY are:

Source: Yahoo Finance

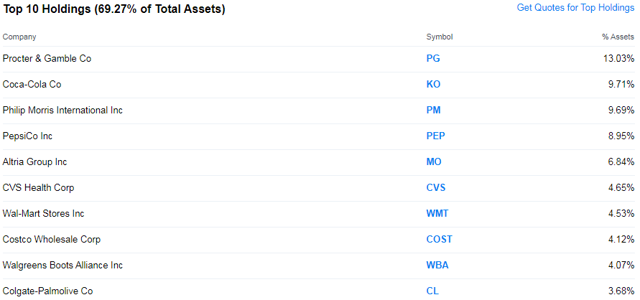

And the majority holdings of XLP are:

Source: Yahoo Finance

As you can see, most of the holdings in XLY (except arguably McDonald's (MCD) and some proportion of Home Depot (HD)) are stocks that consumers utilize more often when they have more discretionary income. On the other hand, the stocks held in XLP are much more geared towards purchases that consumers have to make regardless of how much discretionary income they have (or are goods that are more in demand when discretionary income is below average).

Without looking at the data, we'd expect to see some relationship between these two ETFs that tends to widen and narrow based on how well the economy and market are doing