Preface

Spotlight Top Pick Palo Alto Networks (NYSE:NASDAQ:PANW) beat earnings last night and raised guidance. The stock is higher today and the promise of an industry leadership position in the massive cyber security thematic has inched one step further.

Story

PANW was added to Top Picks on 18-Jan-16 for $140. As of this writing it is trading at $150.57, up 7.6%. To say the least, this stock has had its ups and downs.

The bullish narrative could use a quick review, so here we go:

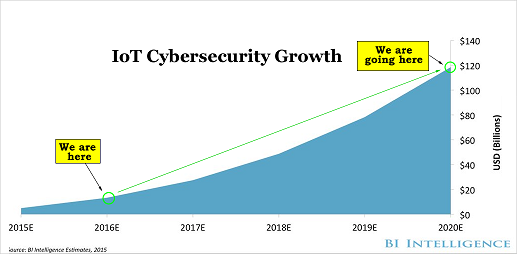

Palo Alto Networks is a cyber security firm sitting in the early stages of a massive boom. As a taste for what we're about to see, this is the forecasted growth in cyber security:

Yes, just the IoT segment is growing from $20 billion to $120 billion in five years. In total cyber security is seen reaching $170 billion by 2020.

There's just no stopping the growth in the need for cyber security and we are right at the beginning. Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening.

Why this is Happening

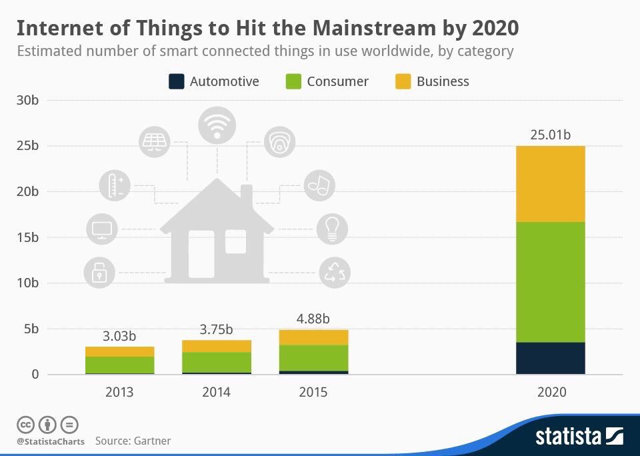

The growth in cyber security comes from the unbelievable growth in the number of interconnected devices the world is about to realize. For convenience, here is the chart for the growth in the number of actual IoT devices, again.

The Internet of Things space will see over 25 billion devices by 2020, and every single one will need security as we integrate our driving, military, phones, contacts, email, mobile payments, fitness, drones and everything else into every device we own.

While there a lot of firms in this space, and there will not be a single winner, we have selected PANW as one of the winners.

Palo Alto's revenue is split between product and services but it focuses on enterprise solutions and its CEO said that is has taken the time down from identifying an unknown threat to a known attack from 28 minutes to 15 minutes by October of 2014, and its only getting better.

While a lot of cyber security focuses on fixing the destruction after an attack, PANW focuses on prevention. The company now serves approximately half of the Forbes Global 2000. This is not a US pure play - this is an international giant.

Progress

There's just no other way to say it, the company is growing market share and beating rivals. Even more impressive is that the company is able to charge more and is getting ever larger contracts.

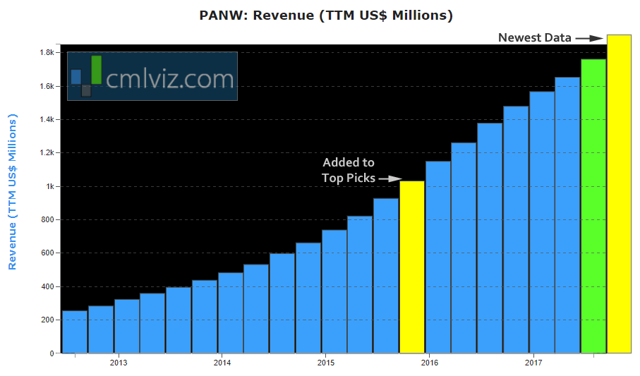

Here are a few financial charts, and then we will get to the earnings results and earnings call. We start with revenue (TTM).

Revenue rose 27% to $505.5 million in the quarter, topping consensus estimates.

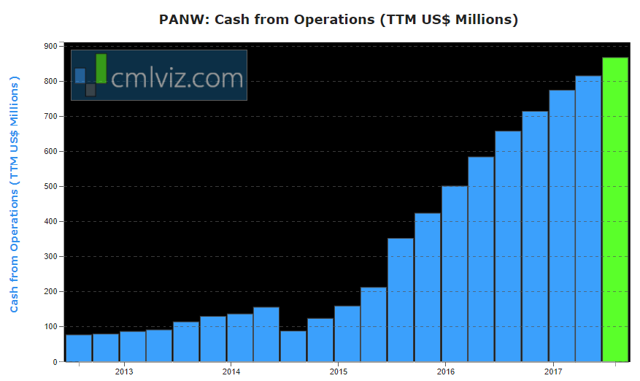

While Palo Alto Networks does not make money on a GAAP basis, the most important financial metric of them all is cash from operations - after all, a stock price is simply the present value of all future free cash flows.

While we don't have updated data from the most recent quarter, we do have the trend from one quarter ago and through history:

As of last quarter, Cash from Operations (TTM) for PANW was $869 million. Last year it was $659 million, which is a 31.9% one‑year change.

For everyone on Wall Street that says Palo Alto Networks is in a vortex of losses, perhaps some facts will help: The company reported cash, cash equivalents and investments of $2.3 billion with $524 million in debt.

Now, onto the earnings results and the earnings call.

Earnings

* Revenue: $505.M vs. consensus estimates of $489M (rising 27% year-over-year).

* Adjusted EPS: $0.74 vs. consensus estimates of $0.69 (rising 34% year-over-year).

* Guidance: EPS of $0.79 vs. consensus estimates of $0.77 and revenue of $523M (up 24%) vs. estimates of $520 million.

This was a beat, and a raise.

Earnings Call

CEO Mark McLaughlin is a bullish CEO, much like many of the technology world, but he does temper his enthusiasm. In fact, it was four quarters ago when he dropped a little bit of a bomb on Wall Street, and the stock price, with his tempered enthusiasm with respect to the disorganization of the sales team.

Here are our highlights from the call.

* On a year-over-year basis Q1 revenue was $505 million up 27%. Billings were $596 million up 15% and non-GAAP earnings per share were $0.74 up 35%.

* In the quarter, we saw a healthy demand environment in all theaters as well as strong customer interest in all the extended capabilities of our next generation security platform from network, endpoint and cloud.

* In the quarter, we added over 2500 new customers and are now privileged to serve over 45,000 customers globally.

* Our top 25 customers each spent a minimum of $23.2 million in lifetime value in Q1 which is a 53% increase over the $15.2 million in Q1 of fiscal '17.

* Specific examples of customer wins and competitive displacements in the quarter included a seven-figure competitive win against Cisco in a virtualized data center deal with the U.S. military organization.

* There are three Hallmarks to our platform that are increasingly well understood by customers and prospects.

- our ability to provide increased prevention through automation and orchestration- our ability to deliver these security outcomes consistently across on-premise, endpoint, cloud in hybrid environments

- our demonstrated ability to continually push the boundaries to simplify consumption models at a time when organizations are struggling to balance security needs with limited operational manpower and budgets.

* [W]e continue to drive disruptive evolutions in the market

* We also enhanced our support for Office 365 and Google applications to include cloud based email services and G3 marketplace applications.

And then from the CFO, Steffan Tomlinson:

* Q1 SaaS based subscription revenue of $169.3 million increased 40%.

* Support revenue of $149.7 million increased 32%.

* In total subscription and support revenue of $319 million increased 36% and accounted for 63% share of total revenue which was a 420 basis point increase compared to last year.

* Q1 operating expenses were $292.4 million or 57.8% of revenue which is a 360 basis point improvement year-over-year.

* We finished October with cash, cash equivalents and investments of $2.3 billion.

* Q1 cash flow from operations of $274.1 million increased 35%

Conclusion

We re-iterate our Spotlight Top Pick status on Palo Alto Networks as the bullish thesis continues to progress as we had hoped.

Recurring revenue is growing, cash is growing, revenue is growing, operating margins are improving, customer count is rising and competitive wins continue.

Thanks for reading, friends.

The author is long shares of Palo Alto Networks in his personal account.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.