We recently analyzed Hudson's Bay (OTCPK:HBAYF) and investigated whether it was truly an undervalued real estate play. We concluded that while the real estate value was there, Hudson's Bay would have to improve its operating results in order to create a worthy tenant for its spin-offs. How have things progressed since then?

Q3-2017

The company reported Q3-2017 results two days ago and we were struck by the continued deterioration in the top-line.

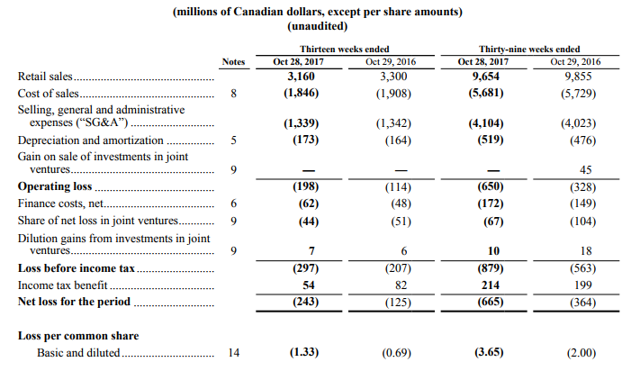

Source: Hudson's Bay Q3-2017 results

Sales were down 4.2% (3.2% adjusted for currency). Cost of sales fell, less than that decreasing gross margins, by 60 basis points. On the surface the gross margins still look fine, but those are 60 basis points that Hudson's Bay cannot afford. The combination of slightly lower sales and lower margins created almost twice the loss per share.

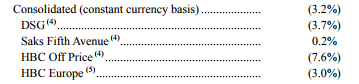

Comparable same store sales

Sales were down across all banners with the exception of Saks, which was able to squeeze out a tiny gain.

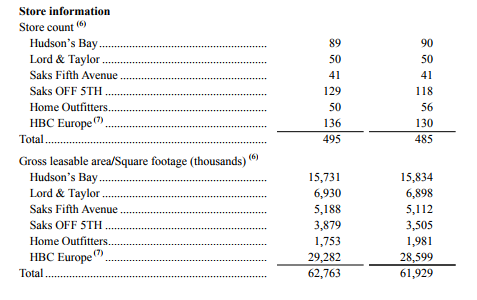

While many other retailers continue to shrink their footprint, Hudson's Bay expanded its in this difficult environment.

While many other retailers continue to shrink their footprint, Hudson's Bay expanded its in this difficult environment.

It is possible that it is seen as the few remaining choices for vacated Target (TGT) Canada and Sears Canada (SRSC) spaces and being offered great terms to move in. Online sales did do OK, increasing on a constant currency basis by 2.1%, but that is off a really low base and in a time where the leading retailers are posting 25% gains in online sales, this should be taken in a positive light. The issue this time was that apparently it cut too much of the work force.

It is possible that it is seen as the few remaining choices for vacated Target (TGT) Canada and Sears Canada (SRSC) spaces and being offered great terms to move in. Online sales did do OK, increasing on a constant currency basis by 2.1%, but that is off a really low base and in a time where the leading retailers are posting 25% gains in online sales, this should be taken in a positive light. The issue this time was that apparently it cut too much of the work force.

Ed Record, HBC's Chief Financial Officer, added, "While Saks Fifth Avenue and Hudson's Bay are performing well, our overall third quarter results did not meet our expectations. The workforce reductions made as part of