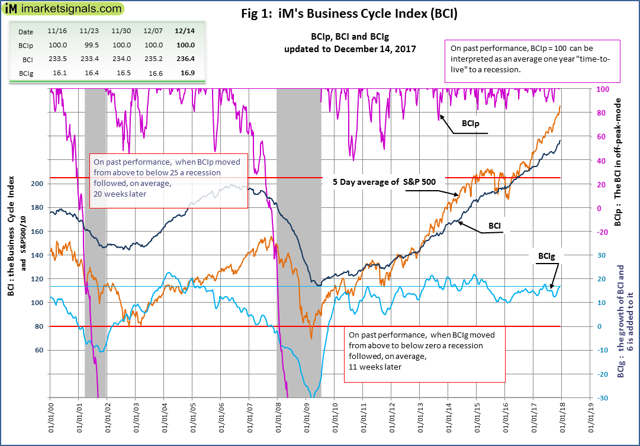

The BCI at 236.4 is above last week's 235.2, and it is at a new high for this business cycle as indicated by the BCIp at 100. Also, the 6-month smoothed annualized growth BCIg is at 16.9, which is above last week's 16.6. No recession is signaled.

Figure 1 plots BCIp, BCI, BCIg and the S&P 500 together with the thresholds (red lines) that need to be crossed to be able to call a recession.

The BCI was designed for a timely signal before the beginning of a recession and could be used as a sell signal for ETFs that track the markets, like SPY, IWV, VTI, etc., and switch into Treasury bond ETFs, like IEF, TIP, BND, etc. (see our article).

The BCI uses the below-listed economic data and combines the components for the index in "real time," i.e., the data is only incorporated into the index at its publication date:

- 10-year Treasury yield (daily)

- Three-month Treasury bill yield (daily)

- S&P 500 (daily)

- Continued Claims Seasonally Adjusted (weekly)

- All Employees: Total Private Industries (monthly)

- New houses for sale (monthly)

- New houses sold (monthly)

The six-month smoothed annualized growth rate of the series is a well-established method to extract an indicator from the series. We use this method to obtain BCIg, i.e., the calculated growth rate with 6.0 added to it, which generates, on past performance, an average 11-week leading recession signal when BCIg falls below zero. Further, the index BCI retreats from its cyclical peak prior to a recession in a well-defined manner, allowing the extraction of the alternate indicator, BCIp (and its variant, BCIw), from which, on average, the 20-week leading recession signal is generated when BCIp falls below 25.

A more detailed explanation/description can be found here. Also, the historical values can be downloaded from iMarketSignals