By Christopher Gannatti

Almost every day, our society is barraged by information about at least one of the FANG (Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google (GOOG) (GOOGL)) firms. Each one has the ability to influence the daily lives of millions-and possibly billions-of people. Not to mention, their equity performance was strong in a year when the S&P 500 Index reached record highs.

Potential Flaw of Market Capitalization-Weighted Indexes

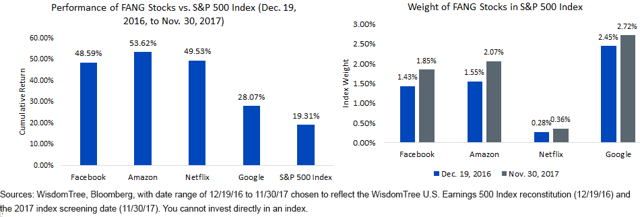

It's no secret that trillions of dollars are benchmarked to the S&P 500 Index-the most widely followed equity index in the world. In that Index, share price x number of shares outstanding = index weight. One of the reasons we're hearing about the FANG stocks is their superior share price performance, and we can quantify how this has connected to increases in index weight.

Strong Performance => Increased S&P 500 Index Weight

Now, so long as these stocks continue their trends of outperformance, we can't say this is a "bad" outcome. In fact, as momentum continued to drive the S&P 500 Index higher in 2017, holding greater and greater weights in these stocks has been positive. But many investors don't believe the S&P 500 Index will simply continue up and up and up-they want to be ready for the correction they think is coming.

How WisdomTree's Earnings Approach Differs from Market Capitalization Weighting

The FANG stocks-with their wide recognition-give us an opportunity to contrast what has happened using a market capitalization-weighted approach with what happens during an earnings-weighted rebalance. These stocks have been constituents in the WisdomTree U.S. Earnings 500 Index, which is where we now turn our focus.

Broadly speaking, the WisdomTree U.S. Earnings 500 Index methodology seeks to delink the level of the share price (and subsequently the size of the firm's market capitalization) from the outcome of the index weighting decision. It