In general you can call me a stock market bear. You can call me a bond market bear. I'm not super optimistic about most industries. There are exceptions. One sector where I like things is shipping. It's one of the select corners of the market where I'm looking for and finding interesting opportunities. Running a beta version of VLCCanalyzer I noticed DHT Holdings (NYSE:DHT), an old favorite, is still quite attractive if not more so compared to the last time I wrote about it:

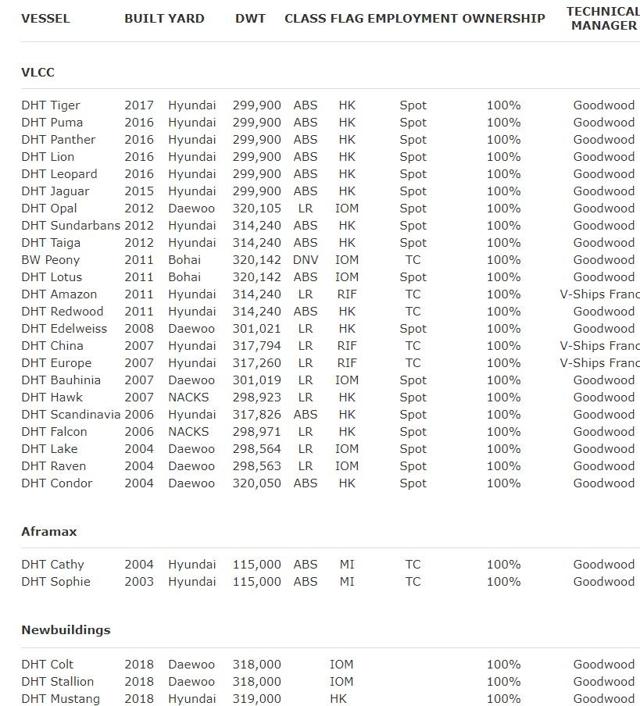

Source: VLCCAnalyzer.com

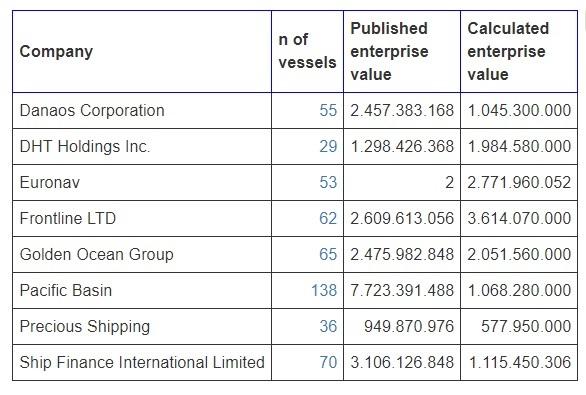

According to VLCCAnalyzer DHT its fleet is relatively valuable compared to its published enterprise value. The ratio is better than for competitors like Euronav (EURN) and Frontline (FRO) for example. It takes into account factors like the age and type of vessels in the fleet.

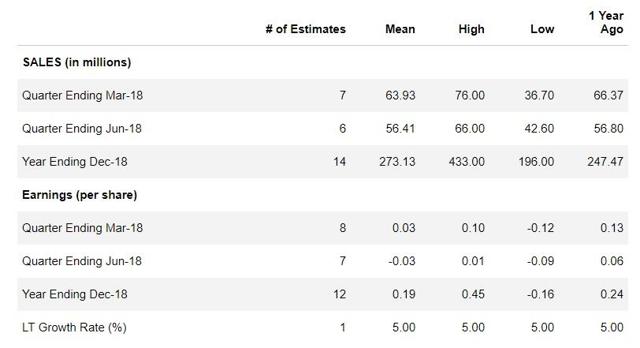

Market expectations

First I looked at the analyst estimates that are out there on DHT Holdings:

Source: Reuters

Source: Reuters

A $0.03 per share estimate for march isn't immediately enticing but shipping rates are notoriously very volatile. With the current low rates earnings are very depressed. For the year ending Dec-18 estimates range from $-0.16 to $0.45.

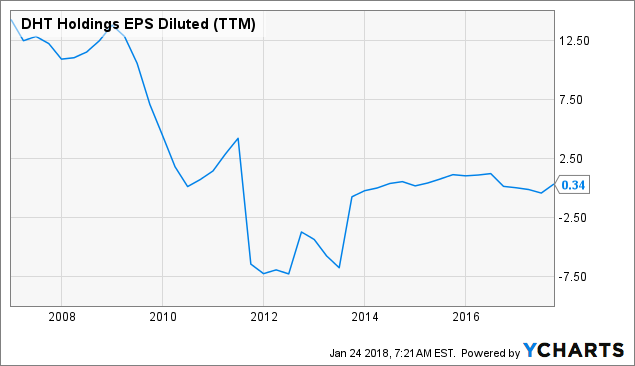

I don't have a better estimate for a year of shipping but the reason I like these kind of companies is that their earnings ceiling is very high as this historical chart shows:

DHT EPS Diluted (TTM) data by YCharts

DHT EPS Diluted (TTM) data by YCharts

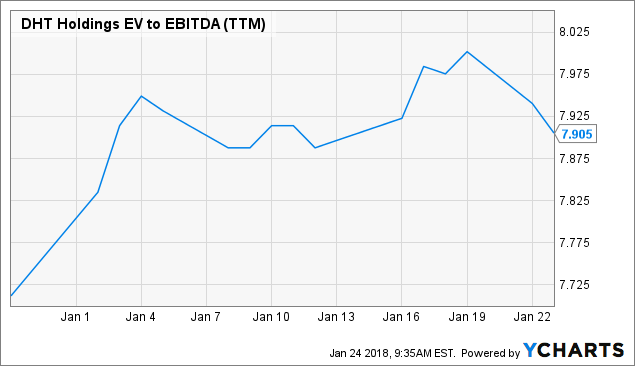

If you can buy in to this sort of company when it is trading at 4x free cash flow or 7.9x EV/EBITDA, that will be very interesting.

DHT EV to EBITDA (TTM) data by YCharts

DHT EV to EBITDA (TTM) data by YCharts

Stay in the game

The trick with shipping is to stay in the game. There are two things important to stay in the game. 1) You need to have ships on spot prices. 2) You need to survive the downturns that invariably come.

DHT its fleet is likely quite valuable by VLCCanalyzer figures because it is relatively young. Most of its ships still have 13+ years to go. There are very few really old ships that are most inefficient. The company also keeps a large number of ships on spot:

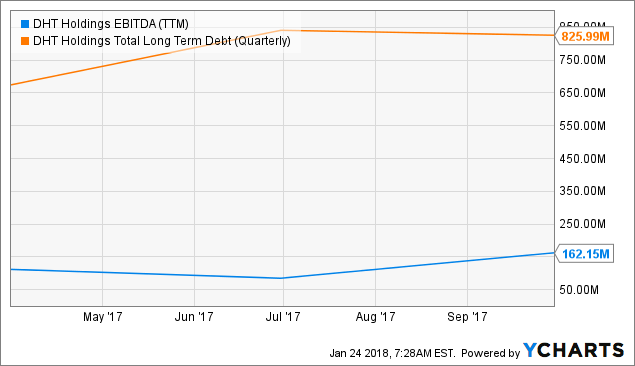

Risk

DHT Holdings looks quite highly leveraged in terms of debt to EBITDA but that's not uncommon with shipping companies. Given where rates are it isn't all that bad.

DHT EBITDA (TTM) data by YCharts

DHT EBITDA (TTM) data by YCharts

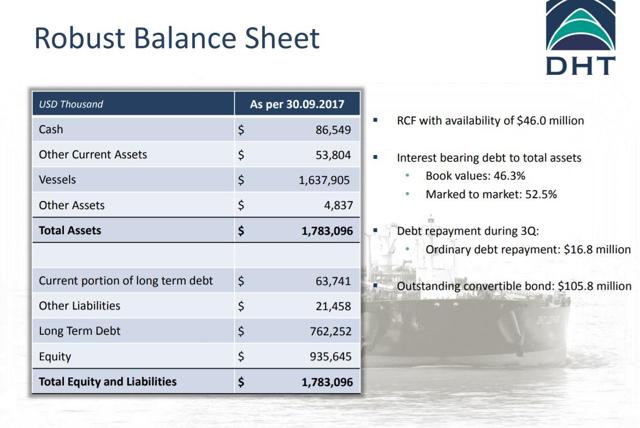

The balance sheet already looks a lot better:

With the company's relatively low break-even rates the company has a good chance of getting through to the next upturn.

With the company's relatively low break-even rates the company has a good chance of getting through to the next upturn.

Catalyst

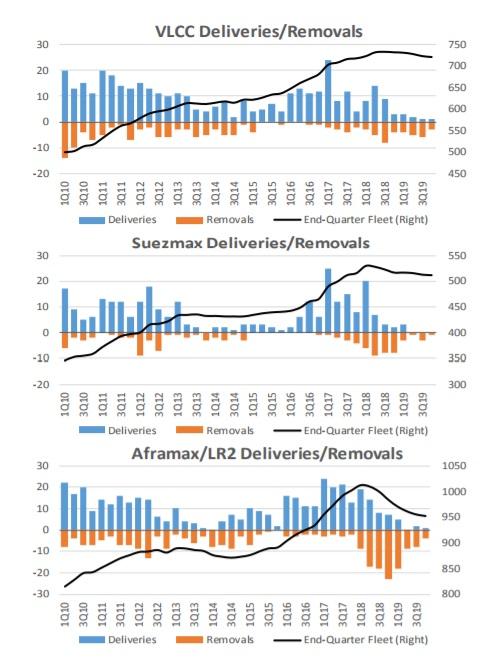

For better shipping rates we need demand for transportation to increase or capacity in the market to decrease. Demand is hard to forecast but capacity is a little bit easier.

Let's look at this recent chart from a recent Hellenic Shipping News:

Tanker fleets look to be shrinking across the board. That's a combination of scrapping and few deliveries. It is certainly possible scrapping will accelerate while it's not as likely to go down substantially.

Tanker fleets look to be shrinking across the board. That's a combination of scrapping and few deliveries. It is certainly possible scrapping will accelerate while it's not as likely to go down substantially.

Conclusion

This seems like a good time to pick up some of your favorite shipping companies. DHT Holdings is certainly a candidate with its attractive fleet, low valuation at 7.9x EV/EBITDA even in a low rate environment, and potential catalysts for rate hikes.