Taubman Centers (TCO) is one of the best mall REITs in the sector. The company has extremely high sales per square foot. If it weren’t for the stock’s price flying from the $40s to the $60s, I would be advocating the common stock over the preferred shares. With the recent rally in the common stock, I believe investors should take a look at the preferred shares.

With the high quality of Taubman Centers, the preferred shares carry less risk than many peers in my view.

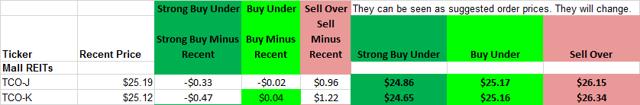

Source: CWMF’s subscriber spreadsheet (subscription required)

These preferred shares have a little more interest rate risk. They don’t go to a floating rate and the stripped yields are 6.49% for J and 6.26% for K. The system assigned the buy for K based on worst-cash-to-call. I manually added it for TCO-J. Similar to the NLY preferred shares, investors would expect a slightly positive total return if they were called very soon. That is the impact of dividend accrual.

In my opinion, TCO-J is the superior choice here, but not by much.

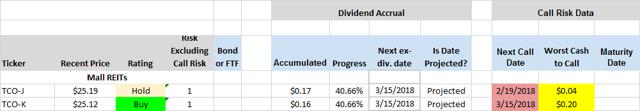

Source: CWMF

In my opinion, TCO-J is the superior choice here despite the system highlighting TCO-K first. I like the extra 23 basis points of yield and think many investors will find TCO-J worth the call risk since the worst-cash-to-call is still positive $0.04. TCO-J also isn’t at too much risk if shares were called right away:

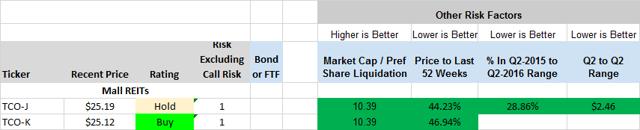

Source: CWMF

Both preferred shares have a positive worst-cash-to-call, though the J series is only positive by around $0.04. When looking at the current price, investors also need to take into account the accumulated dividend. We are nearly half-way to the next ex-dividend date.

While TCO-J has no more call protection on the calendar, TCO-K has a little over a month left. The little bit of extra call protection is why the K series has a worst-cash-to-call of positive $0.20. Therefore, I still believe TCO-J is the better preferred share at current prices.

Risks

Source: CWMF

The market capitalization over preferred share liquidation is 10.39x and in the dark green. I believe anything over 10x for a preferred share is excellent. On top of having an outstanding portfolio, preferred shares do not make up a significant amount of total equity.

I do not think Taubman Centers is likely to call the preferred share. That doesn’t guarantee it won’t happen. However, the company would need to issue another preferred share at a materially lower rate to make it worthwhile. I believe it’s in the company’s best interest to pay down debts (not preferred shares) to lower their leverage. While call risk is the biggest risk to these preferred shares, both have a positive worst-cash-to-call.

Interest rate risk is an issue for preferred shares with a lower coupon rate. Since TCO has lower yielding preferred shares, soaring interest rates could cause an issue. On a positive note, I am not at all concerned about the credit risk given TCO’s high quality portfolio.

Finally, while not a risk for certain investors, investors need to be aware of the poor liquidity.

Who wants TCO’s preferred shares?

I see TCO preferred shares as being better for the buy-and-hold investor. Price volatility is generally very low, and there are better options for traders elsewhere. There are several perks for the buy-and-hold investor. First, the underlying portfolio is strong and the preferred shares carry very little risk outside of call risk. Second, even if shares were to be called, there is a positive worst-cash-to-call. Finally, I haven’t found many options for yields over 6.25% to have a risk rating of “1”.

Join The REIT Forum for the best research on REITs and preferred shares. The REIT Forum offers:

- Spreadsheets of every REIT and preferred share I cover updated in real time and access to a fully functional dividend portfolio tracker.

- Instant actionable SMS alerts.

- Weekly preferred share update of the market for what to buy, sell or hold.

- Rapid fire roundup to quickly go over all the common stocks covered by The REIT Forum.

- Highly knowledgeable and interactive chat room. Highest rated service with perfect 310/310 stars from 62 ratings.