In this article, we will examine the current state of WTI price and the benchmark energy ETF, XLE.

This Bloomberg article from January 2018 discusses the substantial net long positioning that has been assumed by Managed Money in the WTI Crude futures complex, noting that total long positioning rests at record high levels. Must be bullish, right? As always, the market generated data reveals the truth. That truth is plain: Managed Money, when positioned in an extreme bullish or bearish state, are almost always on the wrong side of the trade.

Several of our prior SA articles have discussed the nature of the globalized, financialized WTI crude market as a highly interconnected, complex system. These qualities make herding (which arises out of interconnected financialization) that much more significant and potentially severe. Looking at the market through this lens of complexity theory helps explain why the “smart” money gets it wrong repeatedly, why the financial press that follows and “validates” their actions, and perhaps most interestingly, why these conditions will emerge again and again in the future, providing potential asymmetric reward:risk profiles for capital allocation and subsequent risk management.

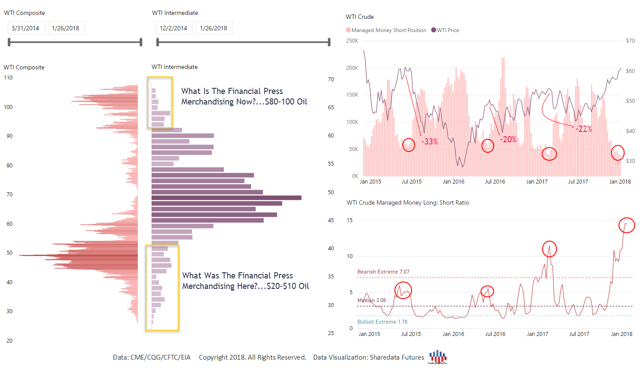

Looking at the market generated data reveals the truth. Since the formation of the current secular low near $26 in January 2016, the WTI market has seen no less than 3 corrections of 20% or greater when the Managed Money posture saw short positioning less than 50k contracts in confluence with elevated Long: Short Ratios (5:1 or greater).

On the equity side, looking at the bullish sentiment on the XLE (of which XOM and CVX comprise approximately 40%), we see bullish extremes slightly ahead of the WTI locations (May-Jun 2015, May-Jun 2016, Jan-Feb 2017, Jan 2018). These three instances of extreme bullish herding resulted in corrections of 27%, 08%, and 21%, respectively. It would appear that extreme bullish/bearish sentiment can alert