This weekend, we were asked about Hecla Mining (NYSE:NYSE:HL) by one of our readers and we decided it was time to check back in on the name. Hecla mining was a stock we were recommending under $3.00, and it rocketed higher in 2016-2017. In general, miners have performed well with the recent bounce in silver and gold prices however, Hecla has had some issue of late.

In the present column, we check back in on Hecla Mining, which we have not covered since August 2017 where we listed several concerns. Specifically, we will address production numbers, and highlight the fact that Lucky Friday is masking other weaknesses (and strengths) of the company. We will also provide our thoughts on what the financials in 2017 will reflect when these are reported.

Ongoing strike at Lucky Friday

One of the flagship mines for the company has seen its workers striking for many months. This strike has been ongoing since March 2017 amongst unionized workers who are negotiating for better working conditions and higher wages. Now this does not mean that production has completely ceased, but the lack of unionized miners working at Lucky Friday has weighed on production. As a result, after setting all-time records in 2016, the year 2017 saw production declines.

Production totals

Despite the fact that the ongoing strike at Lucky Friday has weighed on production, 2017 was still the second-best year on record for the company production wise. Total silver production for the year was 12.48 million ounces. This was a 27% decline from last year, and primarily a result of the Lucky Friday strike. However, gold production effectively did not decline from last year, coming in a handful of ounces under last year’s total, hitting 232,685 ounces.

What is taking a hit because of the steep silver production declines is the byproducts being churned out. This is cause for concern. Despite higher prices of metals, the severe production declines will weigh on earnings when they are reported next month. That said, lead production was cut in half, down 47% from last year to 22,734 tons. Zinc also was down 20%, coming in at 55,109 tons versus 68,516 tons.

Mine-specific performance

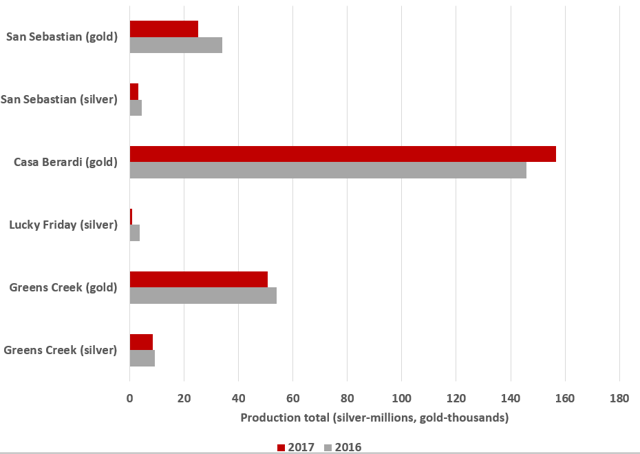

There are four main mines under Hecla Mining’s purview. These include Green’s Creek, Lucky Friday, Casa Berardi, and San Sebastian. Each come with their own strengths and challenges. Still, the story right now for declining production seems to center on Lucky Friday, but we want to be very clear. The declines were across the board, except for a slight increase at Casa Berardi:

Source: SEC filings, visual made by author in excel.

Over at the Lucky Friday mine, 838,657 ounces of silver were produced for the year. This is a whopping 77% decline in production compared to 2016 due to the ongoing strike by unionized employees. As you can see, this strike is weighing heavily, but while this headline grabs the attention of many, it overshadows the other weaknesses (and some strengths) of the company.

At the Greens Creek mine, 8.4 million ounces of silver and 50,855 ounces of gold were produced. These are 10% and 6% lower than last year. Lower silver and gold production, when compared to 2016, was due to lower grades at the mine. While throughput is up compared to years past, it was below previous highs.

At the Casa Berardi mine, 156,653 ounces of gold were produced, including 37,922 ounces from the East Mine Crown Pillar pit, where expansion is underway. This production was in line with expectations, and represented a solid increase of nearly 11,000 ounces compared to 2016. The mill operated at an average of 3,551 tons per day in 2017, 825 more than 2016. This was one very positive piece of news for production.

Finally, at San Sebastian mine, 3.3 million ounces of silver and 25,177 ounces of gold were produced. What is interesting to note here is that this is a decline of 24% and 26% respectively. This hurts, although it was actually above expectations. Still, we hate to see such drastic declines. Part of this had to do with low throughput. The mill operated at an average of 395 tons per day in 2017. With such declines, we expect 2017 earnings will be drastically lower than 2016 when they are reported.

What to look for when the financials are reported

We see that production took a major hit. With the ongoing strike and the company putting out several quarters of year-over-year declines, the Street has bid the stock down in the last 6 months:

Source: Yahoo finance

The production declines will weigh on earnings, but we believe this is priced into the stock now. Regardless of any company-specific woes, the name is a levered play on silver. As silver moves higher, this name will move higher as well, and often at a higher rate than the metal. Of course, the reverse is true as well when silver and gold are under pressure.

While miners have pulled out nearly all the stops to preserve margins, production volumes and control expenses, with metals having rebounded in the last year, having the production volume side of the equation weigh has hurt the stock when most miners are near yearly highs. That said, we will be closely watching several financial metrics as we look ahead.

One of the best metrics to look at to gauge the health of a miner is its cash as well as its cash flows. Upon releasing production numbers, management did note that cash is $20 million higher than a year ago. We think this stems from lack of expenses at Lucky Friday. We will be watching operating cash flow, and are targeting $80 million for the year, and adjusted EBITDA of $200 million. These will be substantial declines from the prior year.

Of course, this all depends on the average selling price of gold and silver. So, we must watch for the average realized silver and gold prices, as well as prices for byproducts. Given the price of metals, we anticipate the prices to be around $16.70 and $1270 an ounce for silver and gold, respectively. Our projections factor in the historical prices of silver and gold in Q4, and weigh in the steep declines we saw for both in December. This could lead to revenues declining around 18-20% for the year, and bringing earnings down with it, perhaps as much as 40%.

Our take

The strike at Lucky Friday certainly weighs on the company but it masks production declines at other locations. The strike also distracts from some positives such as improvements as Casa Berardi and a higher cash position. With declining production and metal prices that have languished a touch in Q4, we expect a drop in revenues of 19-23% for the year, and a hit to earnings. We believe this is more than priced into the stock.

Growth can return once the strike is settled, and as always, will be dependent on metal prices. We think investors who have held on should do so here, but the stock at $3-$3.50 is approaching a bargain for new investment. But not just yet. Let us wait for clarity on the financials before pulling the trigger. We will analyze the numbers and offer our thoughts and projections when they are released.

Note from the author: Quad 7 Capital has been a leading contributor with Seeking Alpha since early 2012. If you like the material and want to see more, scroll to the top of the article and hit "follow." Quad 7 Capital also writes a lot of "breaking" articles, which are time sensitive, actionable investing ideas. If you would like to be among the first to be updated, be sure to check "Get Email alerts" under "Follow."