For years, Facebook (FB) has overcome platform questions and concerns over teenagers fleeing the network. The recent confluence of events impacting engagement has a different feeling this time. The ability of the social platform to continue driving ARPU (average revenue per user) higher is a big concern with meeting analyst targets and justifying the current market valuation.

Source: TechCrunch

Source: TechCrunch

One Big Difference

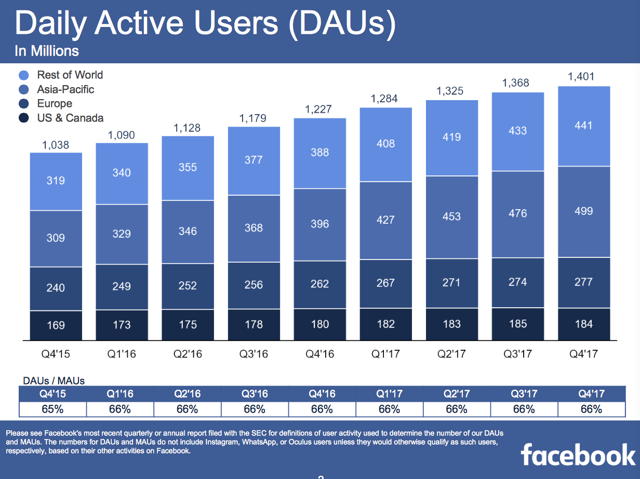

The Q4 results produced one number that clearly signaled a shift in the business. Facebook saw US & Canada DAUs (daily average users) actually decline sequentially for the first time. The company still grew global DAUs an impressive 14% to 1.4 billion, but the most influential and valuable users are in decline.

Source: Facebook Q4'17 presentation

Source: Facebook Q4'17 presentation

Throw in Europe and the platform only grew key DAUs by 2 million over the prior quarter. Fears of slowing user growth have always hit the platform, including the loss of the younger crowd.

Another inflection point that appears to tie in with the DAU hit is the under 25 crowd that is actually leaving Facebook this time. Past studies showed that the social network was no longer appealing to the group, but this time the younger crowd is actually declining and shifting more towards competitor Snap (SNAP) and less to Instagram that Facebook owns.

After a weak 2017, eMarketer actually predicts a decline in the 18-24-year-old crowd for the first time (via recode). In 2016 and 2017, the age group declined, but the declines weren't predicted. The research firm is predicting the following significant declines by age group in 2018:

- Under 12: - 9.3%

- 12-17: -5.6%

- 18-24: -5.8%

Russian Issue

Since Trump won the U.S. Presidential election, Facebook has been under pressure from all sides for allowing the platform to be used by Russians to influence the election. The company has even changed