Source: DaytonDailyNews.com

Source: DaytonDailyNews.com

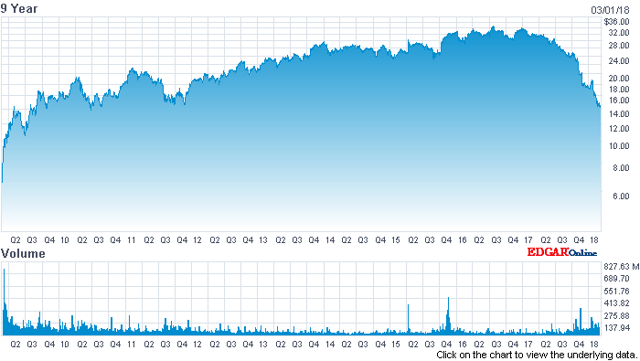

General Electric (NYSE:GE) dipped below $14 this week, seemingly for the first time since 2009/2010, a time when the company was just beginning to climb out of the messy financial crisis. I think it’s noteworthy to mention that back then there was a freeze-up in the financial system that threatened to prevent the flow of liquidity to GE. This scenario would have essentially resulted in a bankruptcy for the company if credit was not made available immediately. Aside from this moment in history, you would have to trace GE’s price back all the way to early 1996 to see the company trading at a comparable price. So, is GE in as dire shape as it was amid the financial collapse? Or is the stock finally trying to put in a bottom as it tests the nearly decade-low $14 level?

Although it is difficult to point to an exact price when the stock may hit a long-term bottom, I am convinced that this point is not far from the current price. GE has extremely valuable businesses, and the current crisis the company is experiencing is one of confidence, perpetuated by years of mismanagement. Much of the negative news is now baked into GE’s share price, and any shift in news flow to a more positive tone should result in a higher share price for the company. Moreover, there is a price point at which prominent investors will begin to recognize significant value in the company, and could begin to acquire substantial stakes in the company. Furthermore, a valuation breakdown of GE suggests the stock is trading at a significant discount to the underlying value of GE’s businesses.

So, How Bad of Shape is GE in?

There is no denying it, GE has seen much brighter days. The company is going through a period of decreased profitability, which has forced GE to cut its sought-after dividend. Moreover, the recent insurance unit debacle had resulted in a massive charge of $6.2 billion, and will require another $15 billion to recapitalize the unit in the upcoming years. If that weren’t bad enough, the company’s pension obligations are underfunded by roughly $31 billion, the greatest shortfall out of any U.S. company. And then there is the recent announcement of the SEC investigation. GE seems to be under a relentless barrage of negative news coverage and the stock is getting hammered perpetually.

However, most of these developments have been known about for months, and are no surprise to investors by now. Thus, the following issues should be largely factored into the ultra-low share price as is. Also, the SEC investigation should have a very limited effect on the company long term. If any irregularities are found and that is a big if, GE is likely to be let off the hook with a slap on the wrist, a relatively benign fine most likely. The pension liabilities are also likely to get resolved over a prolonged period of time, and should have a limited effect on overall future profitability.

As to the question which shoe will GE drop next? Perhaps there are no more shoes to drop. What if these are the last significant skeletons GE has in its closet? There don’t appear to be any fundamental/structural issues at GE. The issues at hand are largely transient in nature, are likely to get resolved over the next few years, and should not significantly impact GE’s performance over the long term. In the meantime, the stock has hit what appear to be generational lows while GE’s businesses still hold significant value.

GE’s Value

It is said that the market is always right, and an argument can be made that this statement is true. However, at certain times, due to significant shifts in sentiment, the market can cause prices to become drastically disconnected from fundamentals. We saw this occur in the dotcom boom, with mortgage-backed securities, and this often occurs at a time of extreme sell-offs. Sometimes panic and extreme pessimism cause stocks to get sold off and become extremely cheap relative to their “true value.” I am not saying that GE is necessarily at this drastically oversold level now, and the stock could slide further, but a breakdown of its businesses does suggest that the company’s “business value” is worth significantly more than the market is currently giving the company credit for.

GE’s Businesses: The Good, The Bad, and The Ugly

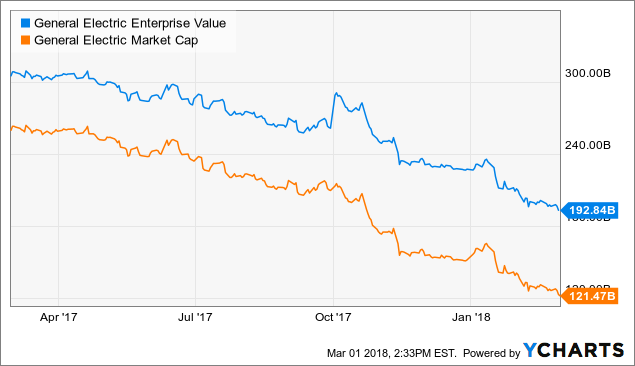

GE’s current enterprise value is roughly $192 billion. However, the value of GE’s businesses appears to be significantly higher if the units are valued independently. For instance, GE’s top enterprises, the Aviation and the Healthcare segment, could be valued at roughly $200 billion alone. If we look at GE’s 2017 full-year financial results we can see that certain segments performed extremely well, but the predominant destructive force, the troubled Capital segment, weighed down the entire company dramatically.

GE Enterprise Value data by YCharts

GE Enterprise Value data by YCharts

The Good

Let’s start with GE’s crown jewel, its coveted Aviation business. This segment generated $27.38 billion in revenues last year, illustrated revenue growth of 4%, a healthy profit margin of 24.3%, and brought in an impressive $6.64 billion in profit. If we apply a relatively modest valuation of 19.5 times trailing earnings we can value this unit at roughly $130 billion. Comparatively, United Technologies (UTX) trades at 23.25 time trailing P/E.

The Healthcare segment, another top performer at GE generated revenues of $19.12 billion last year. The unit showed yoy revenue growth of 5%, demonstrated a very healthy 19.7% profit margin, and brought in $3.45 billion in profits. If we apply a trailing multiple of 22 times earnings, roughly consistent with the industry’s average, we arrive at an approximate value of $75 billion for this segment. Competitors such as Boston Scientific (BSX), Medtronic (MDT), and others have significantly higher trailing P/E ratios upwards of 30.

GE’s Renewable Energy segment may be one of the more underestimated units. It showed significant revenue growth of 14% last year. Moreover, as the world moves towards increased use of renewable forms of energy, this segment is likely to perform extremely well going forward. Renewable Energy brought in revenues of $10.3 billion, showed a profit margin of 7.1%, and delivered a profit of $727 million. Using a valuation of 25 times trailing earnings, we arrive at a value of $18 billion for this unit.

GE’s Oil and Gas segment also appears to be an underestimated property. Oil has increased in value significantly over the past few years and is likely to continue going higher due to increased inflationary pressures and growing demand. Therefore, this segment should continue to do well going forward, and is likely to increase in value significantly down the line. Moreover, despite the volatile oil prices of last year, GE’s oil and gas segment performed relatively well, suggesting that future returns could be much better than many analysts envision.

Last year the oil and gas segment brought in revenues of $17.22 billion, had an impressive revenue growth of 34%, a profit margin of 5.2%, and showed a profit of $900 million. If we apply a trailing earnings multiple of 22 to this segment, the approximate value of this unit comes to $20 billion. Most competitors like Halliburton (HAL), Schlumberger (SLB), and other competitors can’t show P/E ratios for last year due to mounting losses because of wildly fluctuating oil prices, operational difficulties, and other setbacks.

The Bad

Now that we’re done with the good, let’s move on to the bad, GE Power. Although the Power segment’s revenue of $36 billion appears impressive, the rest of the unit’s metrics, not so much. Revenue growth in the Power business was negative, at -2%, profit margin was just 7.7%, profit came in at $2.78 billion in 2017, down by 45% on a yoy basis. The drastic drop in profits is likely a transient phenomenon due to a reshuffle in the company’s power and lighting segments. Therefore, it is not likely the start of a long-term trend. However, given the circumstances, it is difficult to assign a trailing P/E of higher than 12 to this segment, which gives it a value of roughly $34 billion. Nevertheless, I do think that this unit can regain some of its value if GE improves its profitability position. For instance, if we value the unit according to 2016’s earnings, at a 12 multiple the segment would be worth over $60 billion. This could be a low point for EPS in the power segment, therefore the unit’s value could expand going forward.

Another struggling segment, GE’s Transportation unit experienced a revenue drop of 11% to $4.18 billion on a yoy basis. However, the unit is quite profitable with a healthy 19.7% profit margin, and a profit of $824 million. An 11 trailing P/E multiple provides a value of roughly $9 billion for the transportation unit.

GE Lighting showed revenues of $2 billion, but experienced a sharp drop of 60% in revenues last year. A profit margin of just 4.1% appears a bit soft, and the unit brought in a profit of just $93 million. If we put a 10 times trailing P/E multiple on this segment, a value of around $1 billion is derived.

The Ugly

Now the ugly, GE Capital. This unit clocked in a loss of $7.6 billion last year. Moreover, GE is now on the hook to recapitalize the unit’s insurance segment to the tune of $15 billion. Therefore, this segment can be valued at a negative number, - $15 billion. GE Capital is an enormously troubled unit that has apparently been mismanaged worse than any other GE asset. The component is responsible for numerous losses at GE, including a $6.2-billion charge last quarter, and the $15-billion insurance related unfunded liability. The Capital unit is one of the prime sources for trouble at GE.

GE’s Combined Value

- Aviation: $130B

- Healthcare: $75B

- Renewable Energy: $18B

- Oil and Gas: $20B

- Power: $34B

- Transportation: $9B

- Lighting: $1B

- Capital: - $15B

- Total Value: $272B

- Enterprise Value: $192B

- Apparent Disconnect: $80B

GE’s Problem is One of Management

GE’s biggest problem is one of management. However, a turnaround effort appears to be in the works. The days of Jeff Immelt’s double jet travels are over. If there was a time GE’s plundering management could operate in relative opaqueness, that time has probably come to an end. The company’s management is going to be under a microscope for the foreseeable future. Shareholders, newly appointed board members, regulators, pundits, and other market forces are closely observing GE with a few crucial factors in mind. Is the company reforming its culture? Is management effectively cutting costs? Can the company do a better job managing its various businesses? etc., etc. The bottom line is that with so much pressure and scrutiny stacked up against GE, the company’s management may have no choice but to get its house in order.

Source: MalaysiaGlobalBusinessForum.com

Source: MalaysiaGlobalBusinessForum.com

Shift in News Flow

Another element that is likely to play a favorable role going forward is a possible change in news flow. There has been a continuous and overwhelming drumbeat of negative news flow surrounding GE for the better part of a year now. The stock has cratered by more than 50%, as about $150B worth of value has been erased from GE’s market cap in that time. However, at some point the news flow will change to a more positive tone, and it’s likely to occur sooner than later. Some positive developments are already starting to materialize. GE recently appointed three new board members. A shakeup at the board suggests a constructive step towards better governance. Management is continuing to work on spin-off efforts, and news of asset sales should be perceived as a positive element.

Institutional Buyers

Big institutional buyers and activist investors could be warming up to GE at current levels. Even Warren Buffett recently commented that GE has some great businesses that he understands, adding that he would seriously look at GE “at the right price.” Buffett has experience investing in GE at distressed levels, as he became a large shareholder during the days of the financial crisis. Also, Mr. Buffett has about $116B in cash at Berkshire (BRK.A) (BRK.B) to spend, and a great industrial business, with an iconic name like GE, which he understands, could make a lot of sense around these levels.

Technical View

Technically GE is bouncing around $14 support. This level may not hold in the short term, especially if the overall market continues its slide. However, at these already depressed levels, unless the stock market falls through recent correction lows GE’s downside is likely to be very limited here. Moreover, the RSI and CCI are showing that the stock has been in relative oversold territory for about 6 weeks now. A possible reversal in momentum from negative to positive seems likely, especially if some favorable fundamental elements begin to materialize.

Bottom Line

GE’s stock has been battered over the past year, and for good reason. The company’s performance has declined noticeably, the dividend got cut in half, and some alarming skeletons have been exposed. However, things are clearly changing at GE. Management appears to be making some difficult decisions, and the company’s corporate structure is under the scrupulous eye of various market participants pressing for reform. Furthermore, a shift to a more favorable tone in news flow could change investor sentiment, and certain activist and institutional investors may start looking to enter the stock or acquire parts of the company.

Ultimately, it appears that the badly battered GE company is already significantly undervalued. The $80B disconnect between the company’s $192B enterprise value and the $272B assessed value of its businesses suggests that the stock’s fair value is roughly 42% higher from current levels, which would put GE’s share price at around $20. Once the price stabilizes, market participants could bid the stock up aggressively into year’s end, especially once favorable fundamental developments begin to emerge. Therefore, my year-end price target range for GE is $19-21.50.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with risk to loss of principal. Please always conduct your own research and consider your investment decisions very carefully.

To receive real time updates, and get more information about this idea as well as other topics, please visit the Albright Investment Group trading community. Join us and receive access to exclusive content, trade triggers, trading strategies, price action alerts and price targets. These value-adding features are available only to members of our trading community, and are not typically discussed in public articles.