** Most of the companies described herein - except Cronos (CRON) - trade primarily on Canadian exchanges. There are OTC versions listed for most of them, but the Canadian-traded equities will have better liquidity.

Recreational cannabis will be legal in Canada shortly after July 1, 2018 (perhaps in August). This has caused a gold rush of sorts into the industry as companies enter the space, rapidly expand production, and prepare for the beginning of what could be an $8 billion market, according to my own estimate.

"There's no exact date but, if you do the math, you'll see it won't be July 2018," [Canadian Health Minister Ginette] Petitpas Taylor told reporters Thursday. "Cannabis legalization is not about a date, it's about a process ... We want this process done as seamlessly as possible."

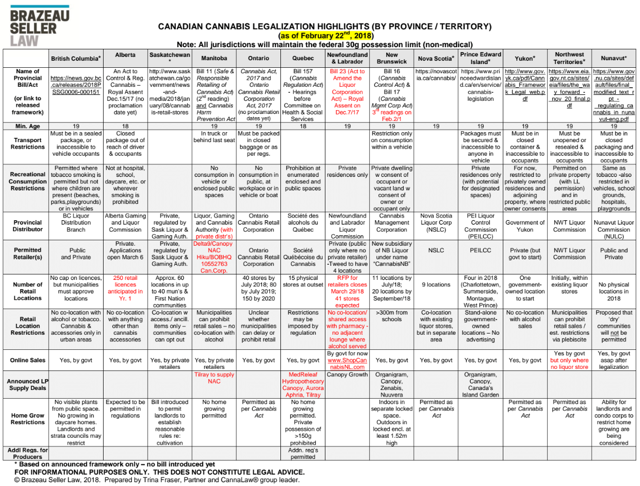

Cannabis will be legal nationally perhaps in August. However, distribution and retail will be handled at the provincial level rather than the national level. In most provinces, cannabis will fall under jurisdictional and distribution rules, similar to the rules currently in place for alcohol. Trina Fraser, a partner at an Ottawa law firm, maintains a very convenient summary chart of the rules in place in each particular province and territory.

Source: Trina Fraser's Twitter (link to PDF)

In four provinces so far, the government organization responsible for cannabis has ordered a large amount of cannabis from a small number of cannabis producers.

| (Orders in kg/year) | NFLD | PEI | NB | QC | Total |

|---|---|---|---|---|---|

| Total Orders | 8,000 | 3,000 | 15,500 | 62,000 | 88,500 |

| Canopy Growth (WEED.TO, OTCPK:TWMJF) | 8,000 | 1,000 | 4,000 | 12,000 | 25,000 |

| Hydropothecary (THCX.TO, OTC:HYYDF) | 20,000 | 20,000 | |||

| Aphria (APH.TO, OTCQB:APHQF) | 12,000 | 12,000 | |||

| MedReleaf (LEAF.TO, OTCPK:MEDFF) | 8,000 | 8,000 | |||

| Organigram (OGI.V, OTCQB:OGRMF) | 1,000 | 5,000 | 6,000 | ||

| Tillray (private) | 5,000 | 5,000 | |||

| Aurora (ACB.TO, OTCQX:ACBFF) | 5,000 | 5,000 | |||

| Zenabis (private) |