Seasoned investors remember the old Anheuser Busch Company as a staple of 70's and 80's growth and income portfolios, a reliable company right there with IBM (NYSE: IBM), General Mills (NYSE: GIS), Procter & Gamble (NYSE: PG) and the other golden oldies. Times change and so did Anheuser Busch, morphing into today's Anheuser Busch InBev SA/NV (BUD) - what a mouthful - a sponsored ADR! The Clydesdales aren't even American anymore!

SOURCE: anheuser-busch.com

How the mighty have…changed.

What is BUD These Days?

Today's BUD is the product of two major beer brewery mergers. On November, 18, 2008, Belgian-Brazilian brewer InBev completed a $52.0 billion hostile acquisition of the Anheuser Busch Company creating the largest beer company in the world. On October 10, 2016, the new Anheuser-Busch InBev acquired SABMiller, the world's second largest brewer, for $107.0 billion.

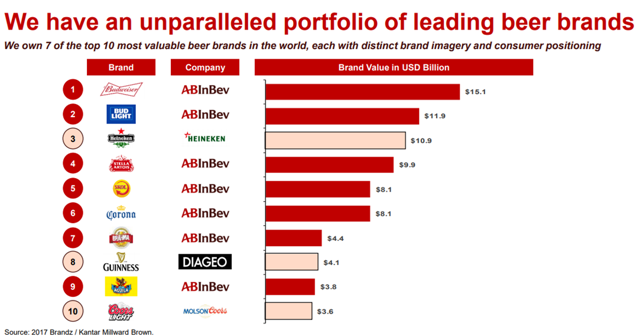

The new BUD is the industry's Clydesdale. With beer production of over 600 million hectoliters (1 hectoliter = 100 liters), BUD accounts for roughly 26% of the worldwide beer market. The company's reach is worldwide, selling more than 500 beer brands in over 150 countries. According to The Drinks Business per data provided by Euromonitor International, BUD owned 5 of the top 10 selling brands in the world in 2016 including Corona, Brahma, Harbin, Budweiser and Bud Light. As noted on the following chart, Kantar Millward Brown's brand equity ranking BrandZ, ranks 7 of BUD's beer brands among the top 10 most valuable in the world.

SOURCE: 2017 AB InBev Annual Report

There has never been a beer company with the global sales, operations and multitude of brands of the current BUD.

The company is headquartered in Leuven, Belgium and employs more than 200,000 in administrative and brewing operations in more than 50 countries. With annual revenue of $56.4 billion and a market cap of $172.4 billion