El Pollo Loco's (NASDAQ:LOCO) reported 4Q17 earnings late last week, and the results were mildly encouraging. Although I don't think that the fast casual restaurant chain is on its way back to the "good ol' days" of high projected growth and a rich share price, one might rightfully argue that this stock is one of the best values in the sector.

Image credit

First, let's take a quick look at the numbers. Revenues of $95.2 million met the Street's consensus by producing a healthy but unexciting 2.9% YOY top line growth. About half of the increase was driven by mildly positive comps, while the rest was created inorganically.

Gross margins remained flat YOY as costs that moved in opposite directions (lower chicken and supply prices on one side, higher wages on the other) offset each other. If not for higher G&A costs driven by store openings, adjusted EPS of $0.11 that top consensus by a penny would have probably been more robust.

Very importantly, the outlook for 2018 was likely to have pleased investors. Flat comps is usually not something worth much celebration, but an expected restaurant contribution margin of 19.2% at the mid-point of the range appears to point at a resilient pricing and direct cost environment. EPS guidance of $0.68 to $0.73 bracketed current analyst estimates of $0.70.

On the stock

Once upon a time, fast-casual restaurants were all the rage. Now, the industry's boom seems to have been left behind. Because I don't see enough evidence suggesting the tides might turn any time soon, LOCO is far from being the exciting growth play that it was considered by many to be, right around the 2014 IPO date.

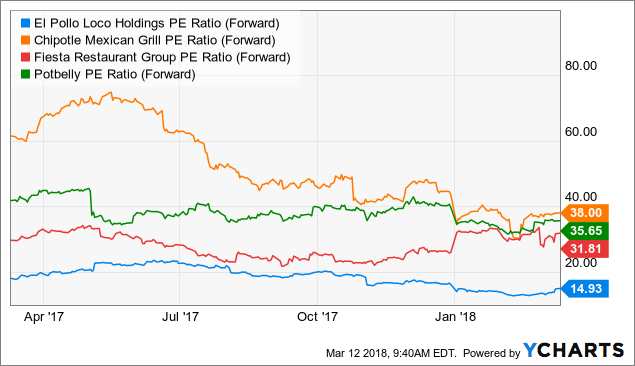

LOCO PE Ratio (Forward) data by YCharts

LOCO PE Ratio (Forward) data by YCharts

| Co./Ticker | Fwd P/E | Fwd PEG | P/Book | FCF Yield |

| Pollo Loco - LOCO | 14.9x | 1.0x | 1.5x | 5.6% |

| Chipotle (CMG) | 38.0x | 2.1x | 6.7x | 2.7% |

| Fiesta Rest. (FRGI) | 31.8x | 2.4x | 2.2x | -1.0% |

| Potbelly (PBPB) | 35.7x | 1.8x | 2.9x | 2.1% |

Yet, as the chart and table above suggest, the Costa Mesa-based restaurant chain is starting to look like a value play worth taking a closer look into. Compared to a few of its direct peers, LOCO is by a long stretch the cheapest stock out there - whether from the perspective of forward P/E, PEG or price/book. Cash generation continues to be robust, with FCF having increased YOY in 2017 by 46% to $17.4 million. And as debt continues to come down, the company's balance sheet also looks increasingly healthy.

All of the above come along with revenue growth projections that, while driven largely by new restaurant locations, should remain above water. Margins should improve in 2018 as fewer store openings will likely have a positive impact on G&A. And while current Street expectations for 15% long-term growth to EPS (according to YCharts) might look a bit too optimistic for my taste, I believe the stock's conservative valuations may have already priced in some risk to these results not materializing.

Although I can't say that I am "going loco" for LOCO, I see the stock as a value play worth further investigation.