Former Fed Chair Janet Yellen on several occasions discussed the transitory impact of low oil prices on inflation. She noted in late 2014 and early 2015, that the drop in oil prices had a "major impact" on inflation and would prevent inflation from rising to the Fed's 2% target temporarily.

Former Fed Chair Janet Yellen on several occasions discussed the transitory impact of low oil prices on inflation. She noted in late 2014 and early 2015, that the drop in oil prices had a "major impact" on inflation and would prevent inflation from rising to the Fed's 2% target temporarily.

Today, myself, JPMorgan (JPM), Goldman Sachs (GS) and others are projecting oil prices to rise to around $80 per barrel by summer. What impact would that have on inflation and the economy? The answer is surprisingly little. The impact on the stock market though, could be far more dramatic.

Rising Oil Will Raise Inflation, But Not Much

According to the Fed: "... it seems to make sense that oil prices explain a lot of the variation in inflation because many industries consume oil, often for transportation..."

This is a pretty basic concept. Oil is a shade under 4% of domestic GDP. If the price of oil rises 25%, that theoretically drives about a 1% increase in inflation if there are no offsets elsewhere. Of course, there will be offsets.

Many businesses do not pass on the entire cost of the increase in oil prices, by shrinking their margins. The assumption is that consumers are very price sensitive. While that might or might not be entirely accurate on a business by business analysis, it does impact behavior nonetheless.

Fed studies have shown that with the supposed 25% increase in oil prices that others and I are projecting, the reality is only 20-30 basis points would likely pass through to the CPI (Consumer Price Index). A relatively minor amount.

The converse is also true for oil. If the price of oil falls, as Tony Seba and Raoul Pal suggest to below $40 per barrel again, then we could see inflation decline by 20-30 basis points. Again, important, but not

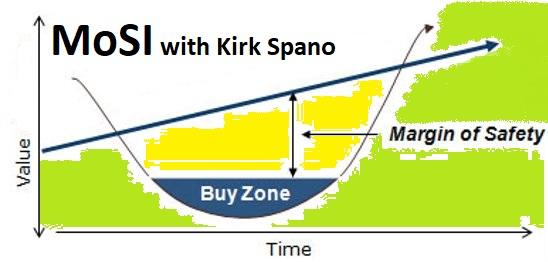

MARCH MADNESS!!! There are fewer and fewer spaces available to Margin of Safety Investing at the $1 per day rate or $365 per year. Try us on a rare "free trial" and see my "Very Short List" of stocks that can lead in the next decade.

The world is about to become very volatile. We are at the intersection of inflation, deflation and stagflation. Missteps can cause the global economy to tumble into recession and for markets to revert to historical valuations which would mean a 30-50% decline. Find out where the safe spots are and how to benefit from global change under any circumstances.