SPS Commerce (NASDAQ:SPSC) is a supply-chain management software company. As per its 10-K, SPSC is a "leading provider of cloud-based supply chain management solutions, providing network-proven fulfillment, sourcing and item assortment management solutions, along with comprehensive retail performance analytics to thousands of customers worldwide." At its fiscal year-end, it had about 26,000 customers. Refreshingly, its sales are distributed well over its customer base, with even its biggest customer making up less than 1% of its revenues.

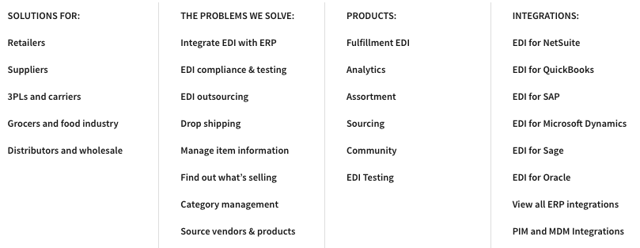

As per its website, it offers the following solutions and integrations:

Source: Company Website

I like a few things about it: its balance sheet isn't laden with goodwill; it announced a share buyback program; as a tech company providing cloud solutions, it has the potential to scale its operations. Nevertheless, I don't think it's worth the risk as of yet, for the following reasons: despite growing revenue over 500% since its IPO, net income is in the red; COGS is increasing at a rate greater than sales; margins are thin; its earnings yield - used to assess its rate of return - is actually negative. And, despite all these issues, execs are being rewarded handsomely.

Let's get into it.

Earnings

If SPSC can't grow its revenue in a way that will benefit investors' bottom line, then it may as well not grow at all, because growth becomes harder as companies increase in size (according to the Law of Large Numbers). While SPSC is still small, its growth so far has only served to hinder its bottom line.

As we can see, its sales and earnings are barely correlated (0.143), and worse, its sales and expenses are almost perfectly correlated (0.999). To that end, its COGS growth has begun to outstrip its revenue growth (544.9% vs. 515.3%, TTM, respectively). COGS, as we know, is