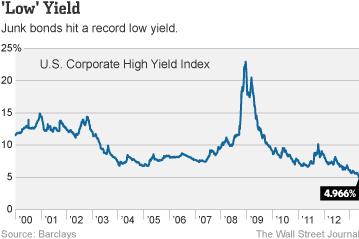

At present, we are seeing interest rates on junk debt (NYSE:JNK) below the long-term historical average risk-free rate of around 5-6%. Companies like Tesla (NASDAQ:TSLA) and Netflix (NASDAQ:NFLX) are happily issuing new junk bonds to finance operations, despite having lagging - or even negative - earnings. Though market-wide debt ratios are not yet at a concerning point, as evidenced in the graphs below, the exuberance of high-growth companies will be reaching a tipping point in the very near-term future. This will be due to rising rates (a primarily psychological phenomenon - markets do just fine under rates up to triple our key 3% level so long as rate hikes are gradual), consumer loan and credit defaults, dishonesty in many industries regarding debt capitalization, and fundamental mispricing as a result relative to the default risk.

Last trading session, rates on the 10-Year T-bill (USD:10YR) was bid up to 2.996%. Again, this in itself carries little to no fundamental risk, and I invest exclusively on strong fundamentals. These fundamentals mean that I don’t care about irrational reactions to risk-free rates increasing by mere basis points, a few swings in volatility (VIX), or the effects of largely empty threats of a trade war on my core holdings of U.S. overweight companies such as Berkshire Hathaway (BRK.A) (NYSE:BRK.B). Though each investment strategy and core thesis should vary between individuals, there’s nothing to gain in the intermediate to long term from panic selling from rates having crossed an arbitrary threshold. That said, it does provide short-term opportunity in those who have the free capital to pounce on the opportunity of a broad market dip. However, junk bonds are trading up almost entirely due to fear of the equities market - CNN’s Fear and Greed index is currently