In my previous article on International Petroleum (OTCPK:IPCFF), I talked about the company and its potential; I strongly encourage you to read it.

Seems that from some weeks ago Mr. Market started to recognize the real company value, but I think that the current market capitalization, around $504 million, is still far away from the company's real intrinsic value. My valuation is near US$1,600 million in a normalized scenario using the current FCF generated by the company - considering a current enterprise value of $809 million, we got a potential upside of 98%.

Q1 2018: Results analysis

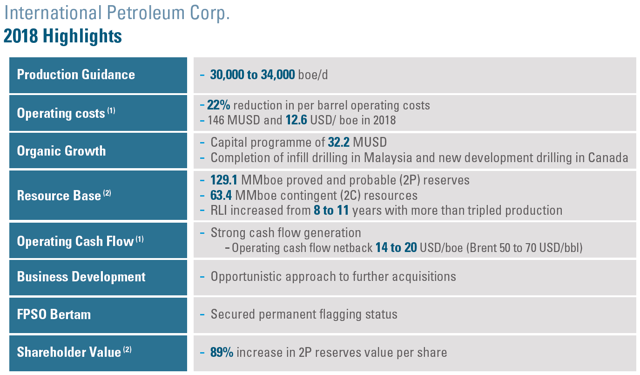

May 15, 2018, the company published its Q1 2018 results, but I would like to highlight the previous guidance provided by the company in February 2018:

Source: Company

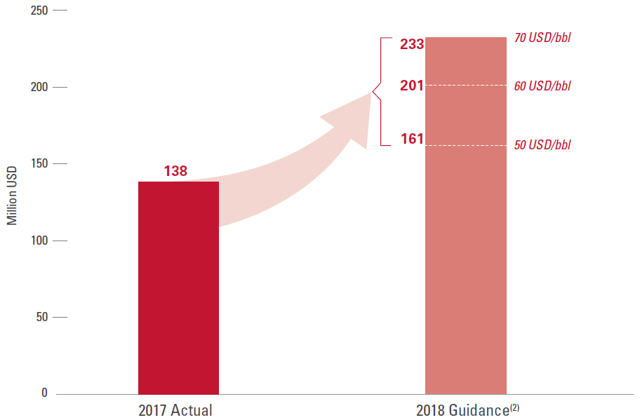

During Q1 2018, the company produced 32,900 boepd with an operating cost of US$12.4/boe, fulfilling and surpassing its own guidance. As I mentioned in my previous article, the management team is prudent and conservative. In February 2018, the company also reported a guidance for cash flow generation:

Source: Company

Please note that the company uses a basic formula for the Operating Cash Flow calculation, as the company discloses on its MD&A:

“Operating cash flow” is calculated as revenue less production costs less current tax.

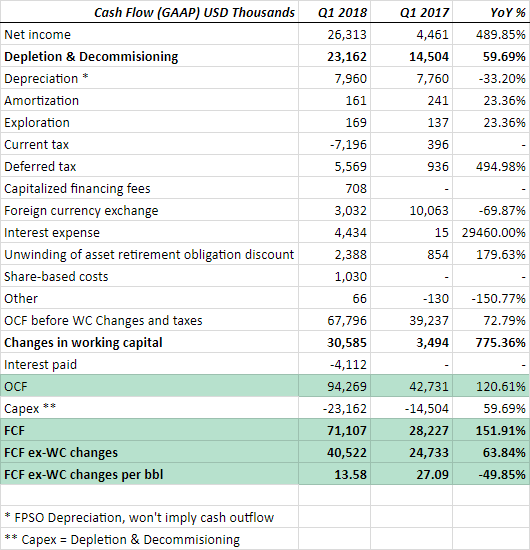

Then, I prefer to use the 'classic" Operating Cash Flow calculation (GAAP), and it exceeded my best-case scenario and even the company's guidance. In my own opinion, this gives a more realistic situation about the company's cash generation:

Source: Author using company filings

All these items are detailed in the last company MD&A for Q1 2018.

The 7.96 million Depreciation corresponds exclusively to the FPSO vessel and won't represent a cash outflow in the near or mid-term. Then I prefer to use as 'Maintenance CapEx' the 'Depletion & Decomissioning' costs, because it represents the extracted reserves and the related