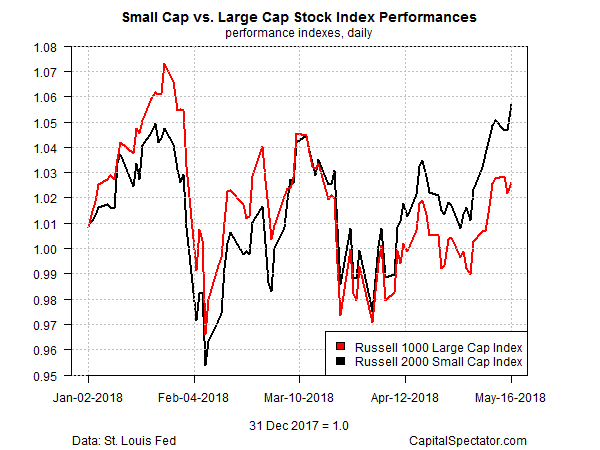

The small-cap equity market so far in 2018 is enjoying a reprieve from its previous underperformance vs. large caps. The Russell 2000 Index, a widely followed gauge of small companies, closed at a record high yesterday. Large caps (Russell 1000) also edged higher in Wednesday's trading, although this slice of the stock market remains well below its peak and is trailing the Russell 2000 year to date.

The small-cap Russell 2000 is up 5.7% so far this year, a solid premium over the large-cap Russell 1000's 2.6% year-to-date performance, based on total returns via FTSE Russell through May 16.

Part of the reason for the firmer run in small caps this year may be related to the lower exposure to offshore business links compared with large caps. In the wake of heightened trade tensions in recent months, investors appear to be discounting prospects for large caps on the assumption that these companies will suffer more vs. smaller firms. Bank of America Merrill Lynch data shows that 21% of revenue for Russell 2000 companies is linked with foreign sources vs. 30% for large-cap S&P 500 stocks, CNBC reports.

The fact that small caps are outperforming larger firms doesn't come as a surprise to Dan Miller, director of equities at GW&K Investment Management. Back in March, he advised that "the protectionist agenda will be better for small-caps relative to large-caps. I would recommend investors buy into small-caps. It's a good time to get into those names."

Ryan Detrick, senior market strategist for LPL Financial, says the healthy trend for the US economy is also a factor that favors small caps. "When the economy is stronger than normal, small caps do better," he said earlier this week. "With a good economy like we've seen happening this year, we fully expect this to keep playing out in the second half of the year."

Despite this year's small-cap rally, the Russell 2000 still lags the Russell 1000 over the longer run. For the trailing five-year window, for instance, big caps are up an annualized 15.2% on a total-return basis through yesterday's close - a sturdy premium over the Russell 2000's 11.9% gain, according to FTSE Russell.

Is this year's rally in small stocks a turning point that gives this corner of the market a sustainable performance edge? Michael Arone, chief investment strategist at State Street Global Advisors, is entertaining the possibility. "Small-caps have the potential to outperform for rest of year," he told the FT on Wednesday. "Fiscal policies put in place will likely result in some better [US] economic growth, which should benefit small-caps more than large-caps."