I. The Importance of Being Profitable

The table has now been set for an all-out effort by Tesla (NASDAQ:TSLA) to show a profit during the second half of this year.

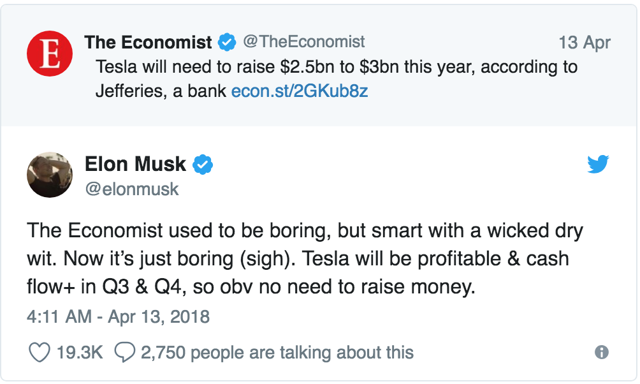

Musk first made the promise on Twitter in April:

Several weeks later, Tesla underlined the idea in a headline to its May 2 Quarterly Update:

Expecting positive GAAP net income and positive cash flow in Q3 and Q4 2018

Musk expanded further during the subsequent conference call:

We need to become a profitable company. That is a good criticism that has been leveled to Tesla, an accurate one, it is high time we became profitable. And the truth is, like you're not a real company until you are, frankly.

It is by now a consensus view that Tesla badly needs another capital raise this year. And, it increasingly appears Tesla hopes that a brilliant result in Q3 – including positive operating cash flow, profitability, and a Model 3 weekly production rate of 5,000 – will be the launch pad.

II. Can Tesla Do It?

Yes, that's the question: Can Tesla do it? Can it be GAAP profitable in Q3 and Q4?

I’ve seen several models from bulls and bears alike. Here’s a narrative explanation from a Tesla enthusiast at CleanTechnica.

Seeking Alpha’s donroband offered a simple spreadsheet model in a recent blog post called How Tesla Becomes Profitable Q3/Q4. As you might guess, that stimulated some useful interchange in the comments.

Meanwhile, over at the TMC forum, a poster calling himself Brian45011 has posted his own detailed spreadsheet, provoking some interesting discussion there.

CoverDrive has seen all these. While he’s still revising his 2018 forecast, he’s skeptical Tesla can achieve either GAAP profitability or the promised weekly production rate (other than for a short “burst”).